Can You Retire with a Nest Egg That’s Too Big?

If your retirement plan forecasts a big surplus at the end of your life, your heirs and favorite charities may miss out on thousands – or even millions – when the time comes. To avoid that, maybe you need two different investment strategies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you ever considered that your nest egg may be too big? If so, it is highly likely that you have not invested properly and will be leaving a bunch of money on the table. In other words, you will leave much less to surviving family members, or charity, than you otherwise could.

So, what is the definition of “too big,” and how should you invest if you fall into this category?

We say that your portfolio is “too big” when you accomplish all of your retirement objectives – even after using pessimistic assumptions – and still have money left over at the end of your projected life span.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Right now, that “leftover” money is likely invested somewhere in your portfolio based solely on your age and conservative desires. A wiser choice may be to peel off the leftover money, keep it in your name, but invest it based on your kids’ ages rather than yours to boost the returns.

Essentially, you are creating two strategies in your nest egg:

- A conservative strategy, which will provide you all that you need for your lifetime.

- A second, more aggressive, strategy, which involves investing as if you were, for example, investing one of your kid’s IRA money instead of your own IRA money. This would include a higher degree of risk on a portion of the overall portfolio but also a higher degree of return that will probably pass on even more to your heirs or charity.

Wouldn’t it be nice to leave several hundred thousand or millions more to heirs without changing your current lifestyle? Using this two-pronged approach may allow you to do that. The conservative part of your portfolio will get you to your goals and let you sleep at night, even when markets are volatile.

The second, more aggressive portfolio aims for a much higher rate of return over time, and you could keep this portion of the portfolio in the back of your mind knowing you can tap it if necessary. With this mental accounting, you will be comfortable with the ups and downs of the market it incurs, because it will probably be passed on to your children or charity.

Is this strategy right for you?

Let’s dig deeper and see if this approach will work for you, looking at an example to make our case:

Robert and Cindy Wiseman are both 65 and retired. They have a million-dollar investment portfolio, and receive, after-tax, a $32,000 per year pension and almost $30,000 in Social Security benefits. They have no mortgage on their home. The Wisemans only need $60,000 per year (after-tax) to cover their spending. With a two-strategy portfolio, the Wisemans could probably leave their heirs and favorite charities as much as an extra $399,000 at age 90, or $784,000 at age 100 as you’ll see when you compare the charts below.

To see if the Wisemans should consider a two-strategy approach, we need to first run their retirement projections. Of course, we prefer to use pessimistic assumptions to see if they can reach their goals even if things do not go as planned.

Here are the pessimistic assumptions we have made:

- We assumed that their home equity would NOT be used to cover their retirement expenses, so we left it out of the equation. This is a way to make our analysis more conservative. Of course, home equity is a safety net they could tap if ever needed.

- We assumed that they obtain lower-than-expected rates of return. (We used only 4% per year.)

- We anticipate inflation, of course, so we used 3%. In our projection, we assumed the Wisemans will spend 3% more every year through retirement (while this is usually only the case until people become less mobile and their spending begins to slow).

- We projected a longer-than-average life. We used age 90 for Robert and age 100 for Cindy.

- And finally, we added a five-year nursing home stay starting at age 75, and paid for that expense with withdrawals from the portfolio.

After our pessimistic assumptions, we then asked the question, “Is there still money left over at life expectancy?”

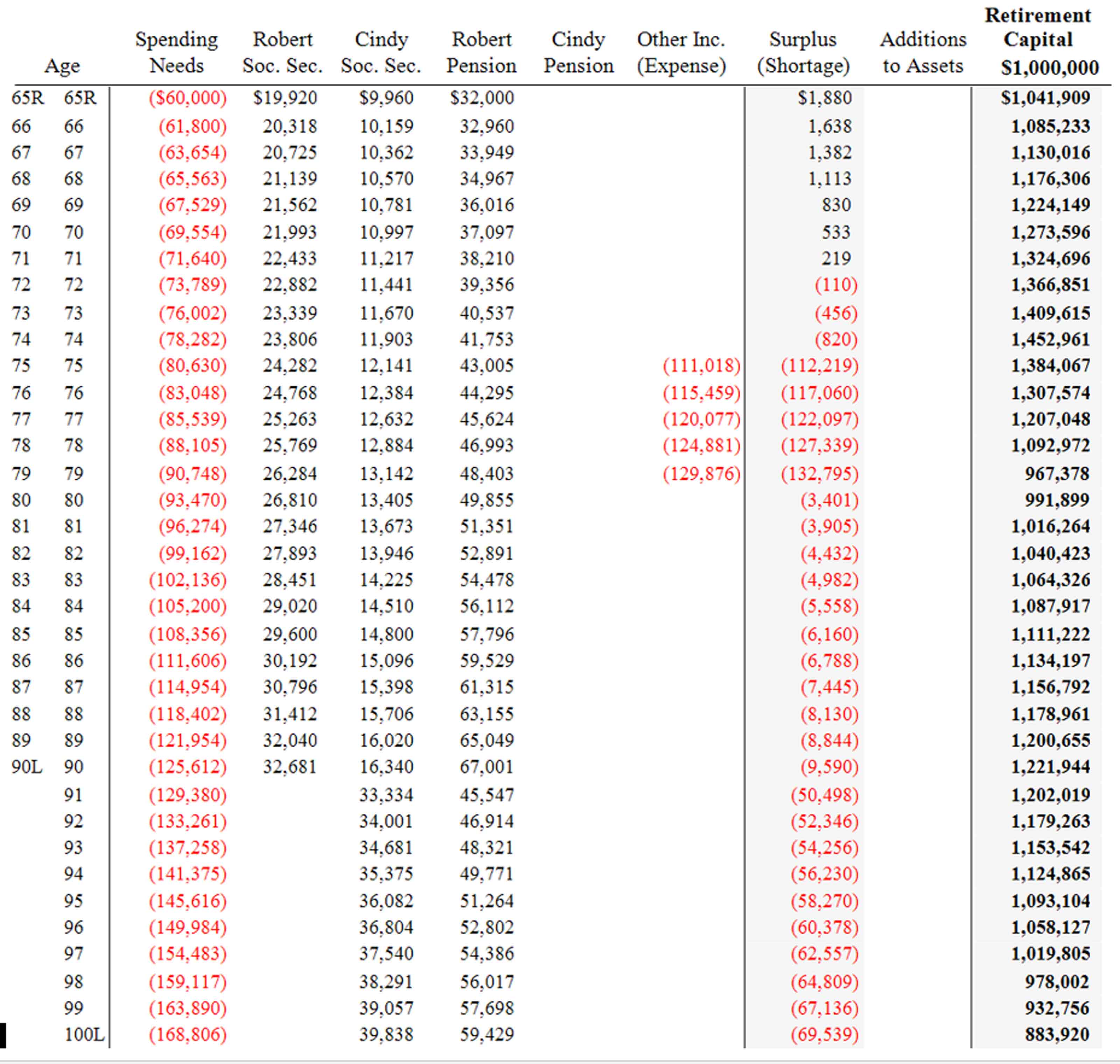

In the case of the Wisemans, our conservative projection indicates that there would be $1,221,944, plus the home equity left over at Cindy Wiseman’s age 90, and $883,920 at age 100. $883,920 at that time ends up being equivalent to $314,130 in today’s dollars, after accounting for inflation (see the chart below). And since the assumptions we used were very conservative, the Wisemans have plenty of cushion for unexpected expenses.

Capital Analysis of Traditional One-Strategy Retirement Savings Method

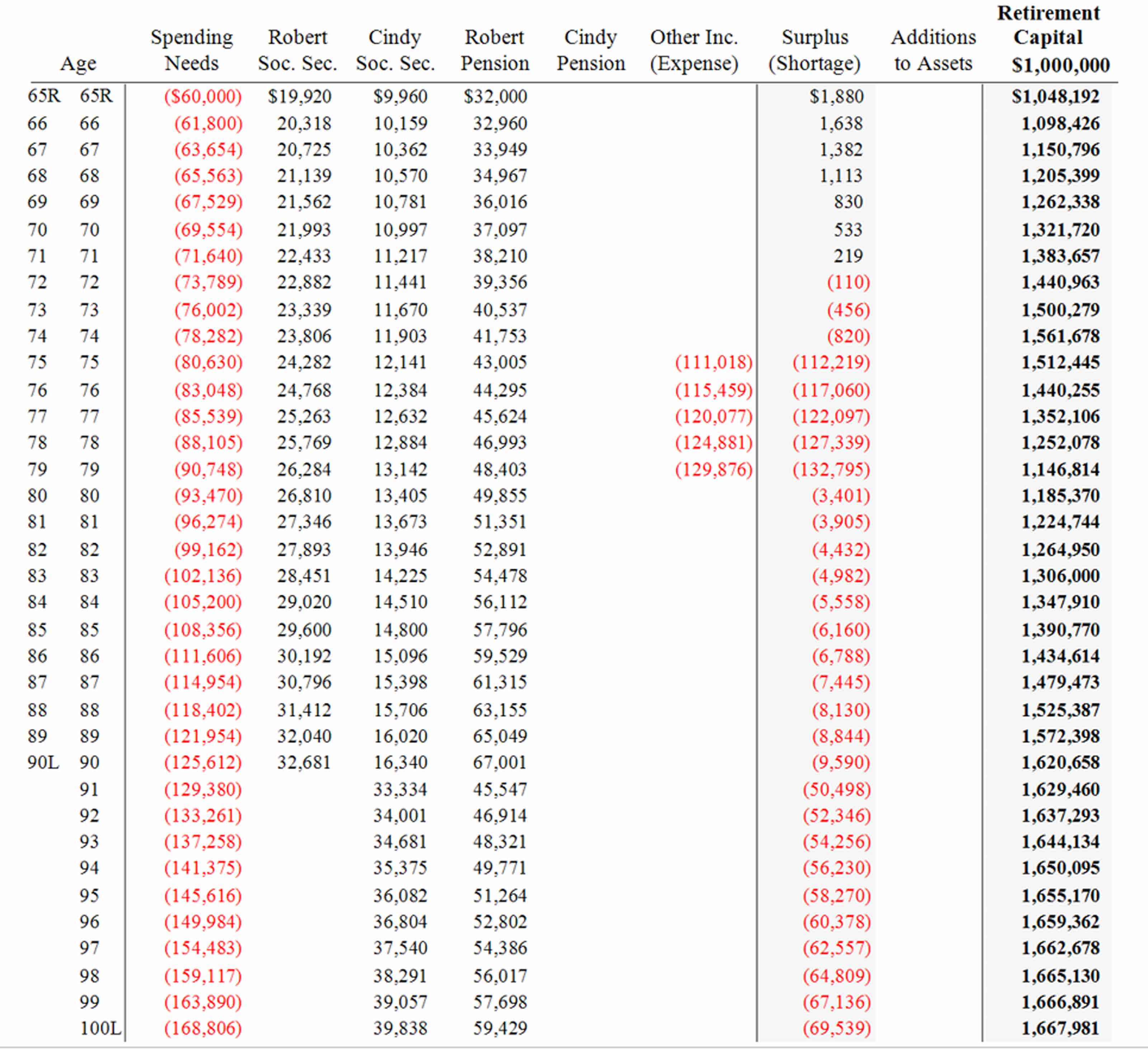

So, this projection shows that the Wisemans could easily peel off $314,130 (equivalent to $883,920 today) from their current $1 million portfolio and invest it a little more aggressively, since it will most likely pass on to their kids or charity. As seen in the chart below, if the $314,130 grows at 6% instead of 4% (our initial pessimistic assumption), they will be able to leave behind $1,620,658 at Cindy’s age 90 and $1,667,981 at her age 100.

This additional inheritance is all because a piece of their portfolio (the more aggressively allocated piece) earned 6%, instead of only 4%.

Capital Analysis of a Two-Strategy Retirement Savings Method

Using this projection, we see that the Wisemans would never lose the ability to tap the $314,130 portfolio throughout retirement (it’s still part of the total nest egg in the far right column).

Stocks vs. bonds: How to divide up your portfolio into 2 parts

The mechanics of the Wisemans setting up this two-strategy method would be to simply move $314,130 into a new account (IRA, annuity, brokerage), keep it in their names, and then invest it slightly more aggressively based upon the ages of the beneficiaries.

One way for you to determine the allocation of the two portfolios would be to use a simple age formula. For example, you could subtract your age from the number 110 to determine how much of strategy No. 1 to invest in stocks. This is a conservative method. Therefore, the Wisemans can take 110 and subtract 65 to determine that they should invest 45% in stocks and 55% in bonds. (This is slightly more conservative than most 65-year-old retirees are.)

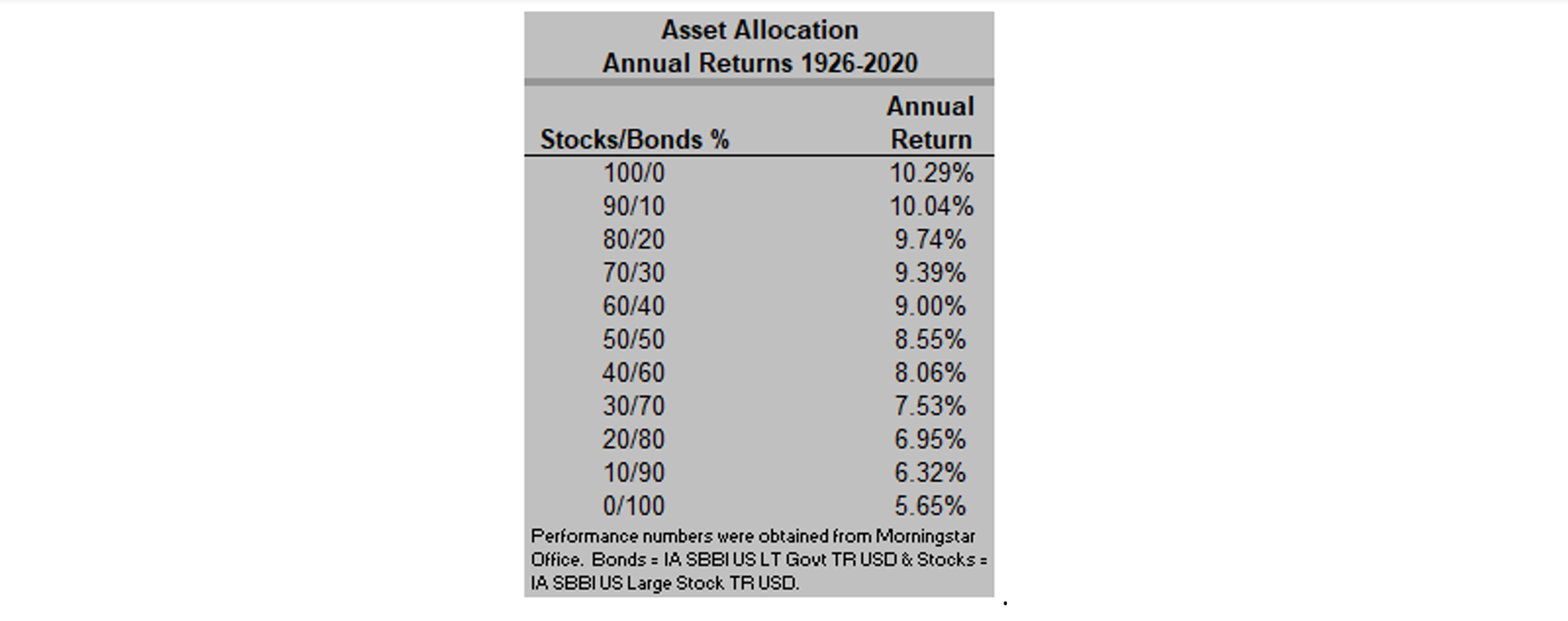

With strategy No. 2, they could take the number 110 and subtract the average of their kids’ ages (let’s say an average of around age 40). With these calculations, their second strategy would be to invest 70% in stocks and 30% in bonds (110-40=70%). The goal with strategy No. 1 is to be conservative and obtain a return that will be adequate for your goals. The objective of strategy No. 2 is to obtain an extra 1% or 2% annual return throughout retirement.

This chart shows the returns of portfolios from 1926 to 2020. As you can see historically, the returns are higher when you invest a greater percentage of your wealth in stocks.

IRAs vs. brokerage accounts: A plan for which accounts to split

If you are in a good position to use a two-strategy approach, the next question becomes, “Which accounts do you split up?” This is largely a function of how the assets you have will pass on to your heirs. For example, if you split your IRA into two IRA accounts, one could be allocated 45% stocks and 55% bonds (45/55), and the second could be allocated 70% stocks and 30% bonds (70/30.)

If you name your spouse as the beneficiary, when you pass away, the two accounts can be transferred to IRAs in her name.

Once the surviving spouse passes away, the money in both accounts would transfer to your heirs, where they will be required to establish inherited IRAs. With current IRS rules, they would have 10 years to withdraw the money and pay income tax on it. The IRA is tax-deferred between now and your death, apart from required distributions, which start at age 72 (roughly 4% of the IRA balance at 72).

If you split up your taxable brokerage account, once you and your spouse pass away, the heirs will receive a step-up in tax basis. This means that when they sell the investments in the inherited account, they will pay capital gains taxes based upon just the difference between the value of the asset(s) at your death and the value at the time that they sell the asset(s).

The brokerage account is taxable each year, meaning that capital gains are assessed on the assets when they are sold, as well as the dividends and interest received throughout the year. (Of course, the capital gains are not taxable if you do not sell an investment during the year; however, dividends and interest received are taxable each year.)

Do you have the right mental outlook to be a good candidate?

This two-strategy approach makes the most sense for a retiree who qualifies based on nest egg size and is good at mental accounting (i.e., this means you need to have the ability to think of the two portfolios differently). For example, if the stock market gets choppy, you will need to be able to remember that the second, more aggressively allocated strategy is for the long-term and you accepted that it would be more volatile from the get-go.

Therefore, the ups and downs don’t matter that much. If a choppy and volatile market causes you to lose sleep at night, then this strategy is probably not for you.

A little help never hurts

Bearing all of these details in mind, if you can reach your retirement goals using only a portion of your nest egg, you may want to consider splitting your portfolio into two strategies in an attempt to boost your return and consequently increase the value of the assets your heirs will eventually receive.

If this all sounds like a daunting task, it’s really not, with the right software and financial adviser. A fee-only CERTIFIED FINANCIAL PLANNER™ (CFP®) will run your retirement projections using many assumptions and scenarios and then help you build two portfolios using no-load (no commission) financial products.

Ray E. LeVitre, CFP, can be reached through www.networthadvice.com or via email at ray@networthadvice.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ray LeVitre is an independent fee-only Certified Financial Adviser with over 20 years of financial services experience. In addition he is the founder of Net Worth Advisory Group and the author of "20 Retirement Decisions You Need to Make Right Now."

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.