This Is What You Really Need to Know About Medicare, From a Financial Expert

Health care costs are a significant retirement expense, and Medicare offers essential but complex coverage that requires careful planning. Here's how to navigate Medicare's various parts, enrollment periods and income-based costs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Don't underestimate health care costs when planning for retirement. It's likely to be one of your largest expenses, especially as life-spans extend.

According to the 2025 Fidelity Retiree Health Care Cost Estimate, the average 65-year-old might need $172,5000 to cover health care expenses in retirement. That number could go even higher, depending on your health and longevity.

Thankfully, Medicare provides essential health insurance coverage and can help limit the cost of care.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But Medicare is notoriously complex, creating its own planning challenges, from choosing supplemental insurance to understanding income-based costs.

Here's what you need to know and how Medicare should factor into your retirement planning.

Kiplinger's Adviser Intel, formerly known as Building Wealth, is a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

What is Medicare?

In a nutshell, Medicare is a federal health insurance program for people age 65 and older or those with a qualifying disability.

Similar to Social Security, you generally need to have worked and paid Medicare taxes for at least 10 years or 40 quarters to be eligible.

Unlike Social Security, however, income doesn't factor into coverage — though it can impact how much you pay in premiums and whether you qualify for assistance programs.

These income-based costs and eligibility nuances can affect your retirement budget, so understanding the basics is a key part of planning for long-term financial security.

What costs does Medicare cover?

Medicare is divided into four parts that cover different aspects of health care, from preventative screenings to end-of-life support.

Knowing what each part covers — and, just as important, what it doesn't — can help you plan for potential out-of-pocket expenses, figure out the nuances of prescription drug coverage and avoid surprises that could disrupt your retirement finances.

Let's dig into the details:

Part A. This segment covers skilled nursing facilities, in-patient hospital stays, hospice care and aspects of home care (though not long-term care, unfortunately).

If you paid payroll taxes as part of your job for the required amount of time, there's no premium, though you'll need to pay co-insurance and a deductible of $1,676 in 2025.

Part B. This part pays for outpatient care, doctor's office visits and other aspects of home care. This part comes with a premium of $185 a month and a $257 deductible.

Once you hit the ceiling, Medicare pays for 80% of your expenses — if you don't have supplemental coverage or Medicare Advantage.

Part C. Also known as Medicare Advantage, these are privately administered (rather than government-run) PPO or HMO health insurance plans. To qualify, you need to be enrolled and paying premiums on Parts A and B.

The advantage of Part C is that it simplifies health care management, offers additional benefits like vision and dental (which aren't covered by Parts A and B), limits out-of-pocket spending, can cover more prescription drugs, even provides wellness programs.

Part D. This is standalone prescription drug and vaccine coverage offered by private insurers. Those with Medicare Advantage likely won't need Part D, though those with regular Medicare should consider it since those programs only have limited prescription coverage.

The deductible is roughly $46 this year with a maximum out-of-pocket cost of $2,000 (though this will rise in the coming years).

Enrolling in Medicare: Miss the window, pay the price

For those aging into Medicare, it's best to enroll within the Initial Enrollment Period (IEP). That's a seven-month period covering the three months before, the month of, and the three months after your 65th birthday.

To have coverage start the month of your birthday, you need to enroll at least a month before.

If avoiding a hefty hospital bill is the carrot to incentivize enrollment during the IEP, financial penalties are the stick.

The cost of late enrollment includes an increase in monthly premiums for Part B (10% of the premium for each 12 months delayed) and Part D coverage (1% of the national base beneficiary for each month delayed).

Based on 2025 premiums, this would translate to almost $23 more every year for the rest of your life, which could add up for those on a tight fixed budget.

There are exceptions, though. If you're still working and have medical coverage through your employer, you don't have to enroll during the IEP.

But there's a catch: Your employer must have at least 20 employees covered under its medical plan for this exemption, so the 16% of Americans who work for employers with fewer than 20 workers should enroll during the IEP.

If you're 65 or older and still working for an organization with at least 20 employees, Medicare doesn't offer primary coverage.

Take note, however, that employers can't terminate employment or coverage to avoid covering Medicare-eligible employees.

Companies also can't offer incentives to enroll in Medicare for primary coverage instead of the employer insurance plan.

How much does Medicare cost?

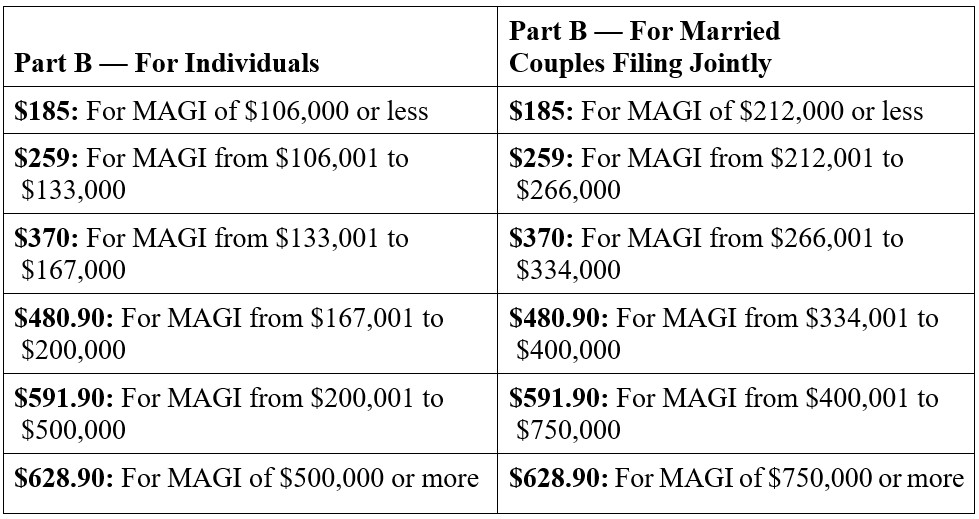

While Medicare isn't directly correlated to income (unlike Social Security), high earners will pay more in premiums due to a surcharge known as the income-related monthly adjustment amount (IRMAA).

Income reflects your modified adjusted gross income (MAGI), which includes wages, Social Security benefits, capital gains and 401(k) distributions, among other sources of income.

This determines what, if any, surcharge you pay for coverage. With Part B, for example, monthly premiums are adjusted via this income scale:

Part D premiums also vary depending on income, although the amounts are much lower, maxing out at just over $1000 annually.

The costs of Medicare Advantage premiums, deductibles and co-insurance will vary alongside coverage, so it's important to work with an adviser to determine which (if any) plan is right for your needs.

What does Medicare mean for my retirement planning?

Because Medicare presents a sizable expense (and can prevent even larger out-of-pocket bills) in retirement, it's important to consider how much coverage you need and how much it will cost, inclusive of premiums, deductibles and co-insurance.

Budgeting with this information in mind can make a big difference when on a fixed income.

With sufficient planning, you can set up tax-exempt income streams that can lower your Medicare bill by lowering your MAGI.

Because withdrawals from Roth IRA accounts, health savings accounts and cash value life insurance contracts* do not count toward MAGI — nor do qualified charitable contributions— using these avenues as income streams or tax reduction strategies** in retirement can lower your accompanying IRMAA surcharge.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth (soon to be called Adviser Intel), our free, twice-weekly newsletter.

A financial adviser can also work with you to determine which Medicare Advantage and supplemental insurance plans align with your fixed income streams and your likely health needs in your golden years.

Because Medicare doesn't cover long-term expenses, for example, an adviser can recommend a supplemental long-term care plan that can fill that coverage gap. Remember, taking action before you need this coverage is an essential part of retirement preparedness.

Your Medicare checklist

As you plan for Medicare in retirement, make sure you've done your homework and consulted experts who can help assess what makes the most sense for you. Start by:

- Spending two to three months reading up on Medicare plans and programs to better understand the program (including Kiplinger's excellent Medicare reporting).

- Consult with an adviser on whether a Medicare Advantage plan makes sense for you and whether your plan should include Part D prescription coverage.

- Set a reminder to enroll within your IEP, if needed.

* It is important to keep in mind that the primary purpose of cash value life insurance is death benefit protection for your beneficiaries. Loans and withdrawals reduce the life insurance policy's cash value and death benefit and increase the chance that the policy may lapse. If the policy lapses, matures, is surrendered or becomes a modified endowment, the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distributions of policy cash values.

** Equitable Advisors and its associates and affiliates do not provide tax, accounting, or legal advice. You should consult with your own qualified tax and legal professionals before proceeding with any course of action.

This article, which has been written by an outside source and is provided as a courtesy by Stephen B. Dunbar III, JD, CLU (AR Insurance Lic. #15714673), Executive Vice President of the Georgia Alabama Gulf Coast Branch of Equitable Advisors LLC, does not offer or constitute, and should not be relied upon, as financial, tax, accounting, or legal advice. Equitable Advisors LLC and its affiliates do not make any representations as to the accuracy, completeness or appropriateness of any part of any content hyperlinked to from this article. Your unique needs, goals and circumstances require the individualized attention of your own tax, legal, and financial professionals whose advice and services will prevail over any information provided in this article. Stephen B. Dunbar III offers securities through Equitable Advisors LLC (NY, NY 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN), offers investment advisory products and services through Equitable Advisors LLC, an SEC-registered investment adviser, and offers annuity and insurance products through Equitable Network LLC (Equitable Network Insurance Agency of California LLC). Financial professionals may transact business and/or respond to inquiries only in state(s) in which they are properly qualified. AGE-8249926.1(08/25)(exp.08/29)

Related Content

- Medicare or Medicare Advantage: Which Is Right for You?

- Your Guide to Open Enrollment and Health Insurance for 2025

- Don't Fall For These Five Costly Medicare Myths

- Social Security Pop Quiz: Are You Among the 89% of Americans Who'd Fail?

- Early 401(k) Withdrawals: Benefits, Risks and Alternatives

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Stephen Dunbar, Executive Vice President of Equitable Advisors’ Georgia, Alabama, Gulf Coast Branch, has built a thriving financial services practice where he empowers others to make informed financial decisions and take charge of their future. Dunbar oversees a territory that includes Georgia, Alabama and Florida. He is also committed to the growth and success of more than 70 financial advisers. He is passionate about helping people align their finances with their values, improve financial decision-making and decrease financial stress to build the legacy they want for future generations.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

You Received a Life Insurance Payout. Here's How to Avoid an IRS Audit.

You Received a Life Insurance Payout. Here's How to Avoid an IRS Audit.You received a big check from your loved one's life insurance policy. Will the IRS be expecting a check from you now?

-

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?Tax Law This landmark decision will reshape U.S. trade policy and could define the outer boundaries of presidential economic power for years to come.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

10 Things to Know About Decluttering

10 Things to Know About DeclutteringYou’ve spent a lifetime amassing your stuff. Here’s how to get rid of it.

-

QUIZ: Are You Ready To Retire at 62?

QUIZ: Are You Ready To Retire at 62?Quiz Are you in a good position to retire at 62? Find out with this quick quiz.

-

Divorce Can Feel Amazing. I See the Freedom in My Best Friend’s Late-Life Divorce — Even if He’s Still Finding It.

Divorce Can Feel Amazing. I See the Freedom in My Best Friend’s Late-Life Divorce — Even if He’s Still Finding It.Having gone through a divorce myself, I know it can bring financial and emotional peace in the long run.

-

I'm a Financial Planner: This Is How You Can Legally Divorce the IRS for the Rest of Your Life

I'm a Financial Planner: This Is How You Can Legally Divorce the IRS for the Rest of Your LifeWith some careful planning focused on the standard deduction, retirees who have large sums in tax-deferred accounts can avoid unpleasant tax bills and even part ways with the IRS for good.

-

9 Ways the Wealthy Waste Thousands in Taxes: A Checklist for What Not to Miss

9 Ways the Wealthy Waste Thousands in Taxes: A Checklist for What Not to MissThe tax code contains plenty of legitimate ways for the wealthy and business owners to cut taxes. Use this checklist to minimize taxes and stay compliant.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.