The 'Yes, And ...' Rule for Retirement

Retirement rarely follows the script, which is why the best retirees learn to improvise.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

There’s an old joke that goes: "Retirement: Twice as much husband on half as much pay."

While retirement is no laughing matter, it does share something with comedy, especially improvisation.

Go to an improv theater, and it can look as if performers are inventing everything on the spot. An audience suggestion becomes a scene, passed from actor to actor in real time.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When it works, it feels effortless. But behind the humor is a guiding principle that keeps the scene moving: the "Yes, and …" rule.

Retirement often works the same way. You might see retirees living a rich, fulfilling life and assume it comes naturally. In reality, many apply a similar mindset — one rooted in openness, adaptability and the ability to build on whatever comes next.

That mindset turns out to be valuable in retirement, when life rarely goes exactly as planned. According to research from Age Wave and Edward Jones, 93% of retirees say preparation, flexibility and a willingness to adapt are essential to thriving in retirement. It’s a recognition that surprises, changes and course corrections are almost inevitable.

In that sense, the "Yes, and …" rule offers a practical framework for navigating retirement’s curveballs: Accept what arrives, adjust your plans. But it also helps make the most of all the opportunities to keep building a meaningful next chapter.

Take it from comedian Tina Fey, who said, "The first rule of improvisation is agree. Always agree and say yes."

How the "Yes, and …" rule works in retirement

Most research and retirement experts agree on two things: you can’t simply wing retirement. But you also can’t expect it to go exactly as planned.

That’s why Kate Feeney, CFP® and wealth adviser at Summit Place Financial Advisors, encourages clients to think in terms of "re-wirement," not retirement.

As she puts it: "Re-wirement works when people expect change, stay connected and remain open to redesigning how they spend their time. That mindset makes it easier to navigate market volatility, health changes and shifting goals while reducing loneliness and regret."

It closely mirrors a core principle from improvisational comedy known as the "Yes, and …" rule, born on stages such as Chicago’s Second City. Performers accept what’s introduced ("yes"), then build on it ("and"), rather than shutting ideas down or trying to control the outcome. Together, they keep the story alive instead of shutting it down.

Applied to retirement, the idea is simple: Accept what happens, then adjust intentionally.

That might look like:

- Saying yes to an unexpected market downturn — and adjusting withdrawals to stay on track

- Saying yes to a new interest, such as pickleball — and building a new social routine around it

- Saying yes to changing energy levels — and reshaping how you spend your time

Instead of clinging to a rigid plan, retirees who embrace the "Yes, and …" rule might treat retirement as something to refine over time, staying open to opportunity while keeping smart financial and lifestyle guardrails in place.

As George Burns once put it: "You can’t help getting older, but you don’t have to get old."

Timing and purpose in a "Yes, and …" retirement

In comedy, timing is everything. The best performers know when to pause, when to act and when to change direction.

Retirement requires a similar sense of timing. For many people, this phase can last 20 to 30 years. The challenge is figuring out how to replace the time, structure and meaning once provided by work.

Research consistently shows that meaning in life is associated with successful aging, better mental and physical health, greater life satisfaction and improved coping and adjustment to illness.

Traditional retirement planning tends to focus on the numbers — saving enough, investing wisely, managing taxes and controlling risk. But once the finances are "good enough," a different question takes center stage: What do you want to do with your life?

That’s where the "Yes, and …" rule becomes useful. Instead of treating retirement like a fixed destination, you can view it as an evolving scene shaped by curiosity, experimentation and adjustment over time.

As Feeney notes, work often provides built-in purpose and community. When that disappears, even a well-funded retirement can feel disorienting. "The most resilient retirees," she says, intentionally replace those anchors — through social networks, volunteering, faith communities, sports or fun activities."

In many cases, it comes down to how people use their time. Ashley Rittershaus, CFP® and founder of Curious Crow Financial Planning, observes that "how you spend your free time today is often a preview of how you’ll spend it in retirement." She recommends, when possible, taking a "retirement test run," extended time off and living as if retired to better understand preferences, values and likely spending.

Mitchell Kraus, CFP® and founder of Capital Intelligence Associates, echoes that experimentation matters, but with guardrails. "Total openness without structure can be unsettling," he says. "Most people thrive with a framework for their days: anchor points like regular movement, social connection and purpose-driven activities, balanced with open space for spontaneity. Structure provides stability; openness provides growth."

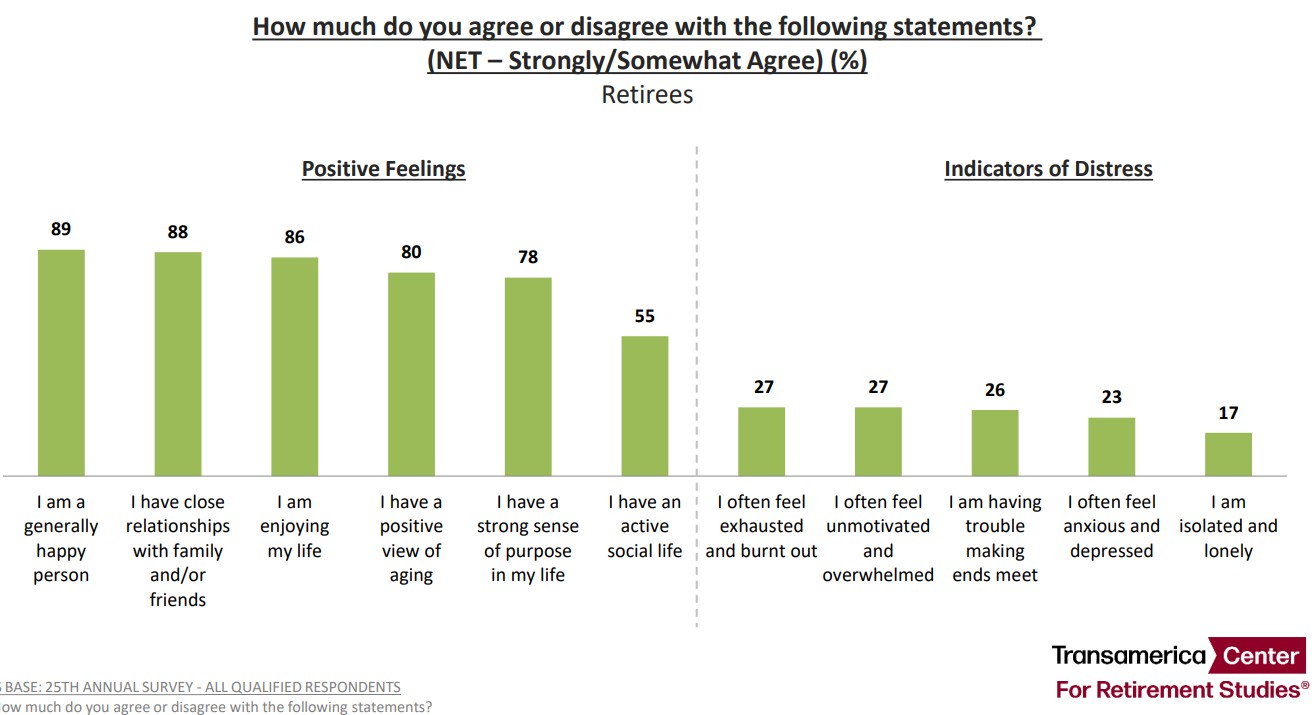

The need for renewal is real. A recent Transamerica study found that more than a quarter of retirees report feeling exhausted or burned out.

In that sense, retirement follows the same logic as improv:

- Yes equals openness. Say yes to curiosity, invitations and new experiences, especially early on.

- And equals intention. Pay attention to what gives you energy and meaning and build more of your life around it.

One research team studying what makes a successful retirement concluded: "The acceptance of retirement, mindfulness, a positive view toward retirement, self-efficacy and a healthy lifestyle are important factors that contribute to adaptation to a successful retirement."

In other words, thriving in retirement is as much about mindset and engagement as it is about planning — a truth that humorists have captured long before researchers put language to it.

As Mark Twain famously warned: "Twenty years from now, you will be more disappointed by the things you didn't do than by the ones that you did do."

The "Yes, and …" rule for your finances

Surveys show that the top fear among retirees is running out of money, driven by uncertainty around market volatility, inflation and potentially high health care costs later in life. It’s an outcome no one wants to imagine, but some disruption is inevitable.

That’s where the financial aspect of the "Yes, and …" rule comes in. Instead of denying uncertainty, retirees can accept that volatility will happen and plan for it.

Experts say this mindset is especially important in the early years of retirement. As Rittershaus explains, "Being open to making small adjustments early on in retirement will help avoid having to make larger adjustments down the line. It’s helpful to understand what adjustments you could make if needed, like which expenses you could reduce or eliminate, or other backup plans like downsizing."

That flexibility also applies to investment strategy. Rittershaus recommends stress-testing retirement plans for a range of scenarios — including lower-than-expected returns, early market downturns, higher spending and long-term care needs — so retirees understand when and how they might need to adjust.

Kraus suggests retirees can benefit from "diversified income sources, conservative early withdrawal rates, and a clear distinction between essential spending and discretionary 'joy' spending." It’s the focus on liquidity and optionality, he says, that allows retirees to adapt as markets, health or priorities change, without panic or regret.

In other words, financial success in retirement doesn’t require predicting every outcome, but rather, preserving options.

Maybe Chris Rock delivers the best punchline: "Wealth is not about having a lot of money; it’s about having a lot of options."

We curate the most important retirement news, tips and lifestyle hacks so you don’t have to. Subscribe to our free, twice-weekly newsletter, Retirement Tips.

Read More Rules for a Happy Retirement

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.When your heart says "yes" but your wallet says "no," there is still a way forward. Here's what financial pros say.

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.

-

I Thought My Retirement Was Set — Until I Answered These 3 Questions

I Thought My Retirement Was Set — Until I Answered These 3 QuestionsI'm a retirement writer. Three deceptively simple questions helped me focus my retirement and life priorities.