How to Keep Your Savings Safe

If you want to keep your savings safe, you may have to open multiple accounts in order to keep your cash FDIC and NCUA insured.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Whether you’ve come into a large financial windfall or you've built wealth through disciplined saving, it’s important to make sure your money is protected from potential failings at your financial institution. Especially in the aftermath of recent bank failures, including both Silicon Valley Bank and Signature Bank's collapse, keeping your savings safe has been at the front of many people's minds.

The Federal Deposit Insurance Corp. (FDIC) insures bank deposits for up to $250,000 per depositor or $500,000 for joint accounts per bank. The National Credit Union Administration (NCUA) — also a federal agency — has a similar program with the same coverage limits that insures deposits in credit unions.

Therefore, if your savings are greater than the $250,000 limit, not all of your cash will be safe. For some, surpassing this $250,000 limit may seem like a pipedream, but you could, for example, find yourself in a position where you've just sold a property and have more than the insured limit in one account. Plus, any yields on savings accounts that take your deposit over $250,000 will not be covered either.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

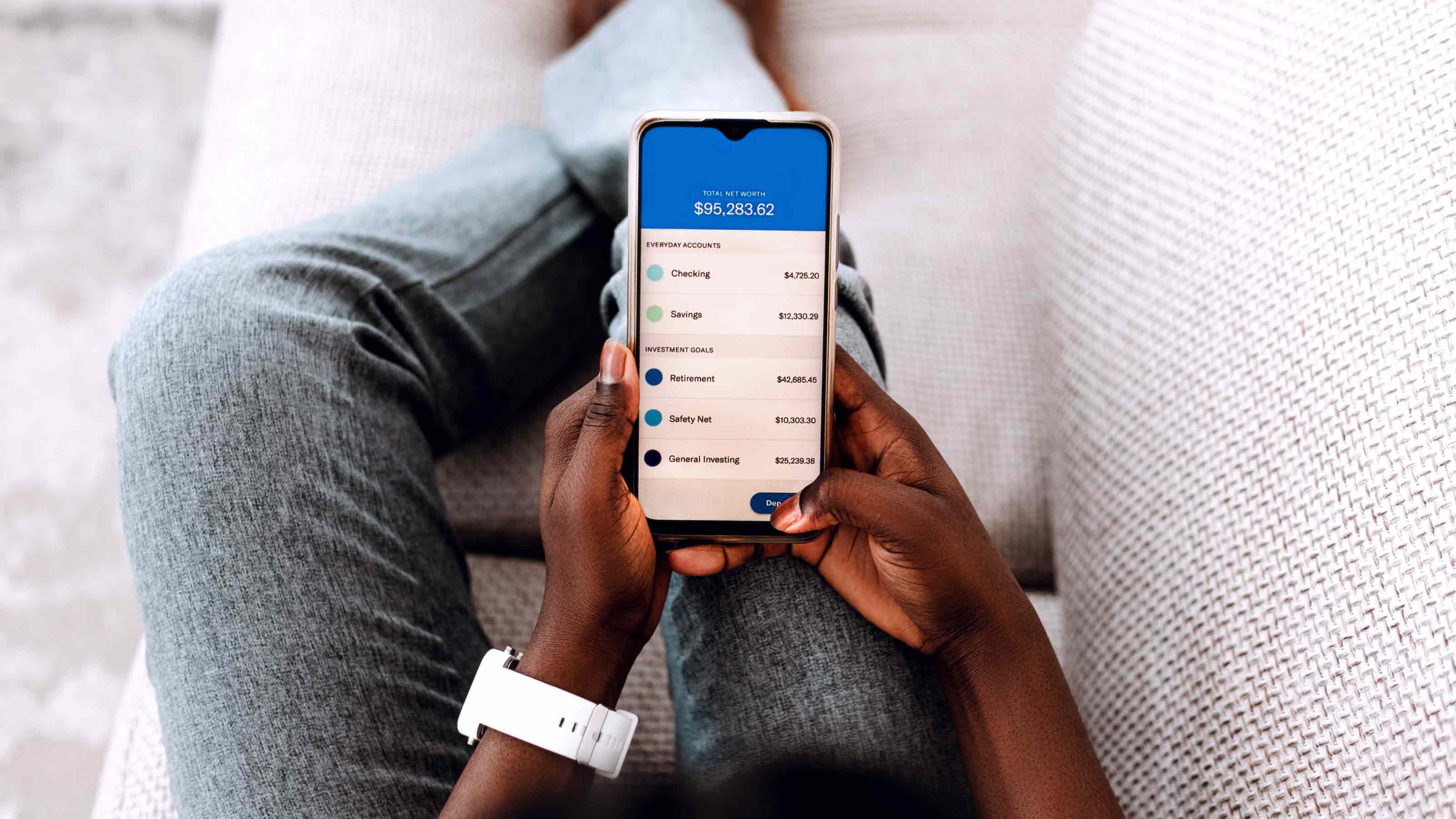

If you're concerned about keeping all of your funds federally insured, one option is to open multiple checking or savings accounts to split your money between.

Even if your first priority is security, you'll also want to get the highest interest rates on your savings — which can sometimes be a challenge. Luckily, in partnership with Bankrate, we have a useful tool below that will help you find the best rates that are also FDIC or NCUA-insured.

MaxMyInterest.com can help you manage your savings, spreading your cash among high-yield savings accounts at insured banks while remaining within FDIC limits. The service charges 0.04% per quarter or $40 per $100,000 held in your savings accounts (subject to a minimum of $20 every 3 months.)

The tool allows direct checking account links from 18 large banks and brokerage firms, including Bank of America, Fidelity, USAA and others. If your bank isn’t supported by a direct link, you can open a Max account and link checking and savings accounts from thousands of banks.

If you’re looking for a new savings account, you can use the Max Common Application. Max partners with eight online banks, including Ally Bank, American Express Bank and Barclays.

Online banks make it easy to open new accounts — which is what you'll appreciate if you have to set up multiple accounts to deposit your cash. Remember though, that while you can earn higher interest at online banks, you likely won’t get the same customer service you’ll find at a brick-and-mortar bank. If you have questions, you may be required to use digital methods — an online chatbot, or an email contact form — depending on the institution.

The same goes for fintech companies that offer high-yield accounts by partnering with banks that hold the deposits. You could be limited to using an e-mail contact form to solve any account issues.

You also want to make sure that your fintech account is FDIC or NCUA-insured. The bank that’s holding your deposit should be listed on the fintech’s website and state whether it is an FDIC member.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rivan joined Kiplinger on Leap Day 2016 as a reporter for Kiplinger's Personal Finance magazine. A Michigan native, she graduated from the University of Michigan in 2014 and from there freelanced as a local copy editor and proofreader, and served as a research assistant to a local Detroit journalist. Her work has been featured in the Ann Arbor Observer and Sage Business Researcher. She is currently assistant editor, personal finance at The Washington Post.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.

-

Will You Get a Trump Tariff Refund in 2026? What to Know Now

Will You Get a Trump Tariff Refund in 2026? What to Know NowTax Law The Supreme Court's tariff ruling has many wondering about refund rights and how tariff refunds would work.

-

2026 Tax Refund Delays: 5 States Where Your Money Is Stuck

2026 Tax Refund Delays: 5 States Where Your Money Is StuckState Tax From New York to Oregon, your state income tax refund could be delayed for weeks. Here's what to know.

-

Bank of America Fined $12M for Reporting False Mortgage Data

Bank of America Fined $12M for Reporting False Mortgage DataBank of America fined over routinely filing false mortgage lending data to the government, the CFPB says.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

How to Open a Savings Account Online

How to Open a Savings Account OnlineYou may be wondering how to open a savings account online. The process is usually simple and straightforward — with just a few steps you’ll be able to start saving your hard-earned cash.

-

Bear Market Strategy for Millennial Investors

Bear Market Strategy for Millennial InvestorsA focused, goal-oriented approach to investing can help millennials navigate a bear market.

-

Bank of America Offering Cardholders Bonus Rewards Points for Shopping on Nov. 5

Bank of America Offering Cardholders Bonus Rewards Points for Shopping on Nov. 5The bank’s first More Rewards Day is designed to play into early holiday shopping demand.