Advanced Micro Devices Stock Sinks as PC Chip Sales Slump

Advanced Micro Devices stock is trading lower Wednesday after the chipmaker's Q1 earnings, but most analysts are still bullish on the name.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

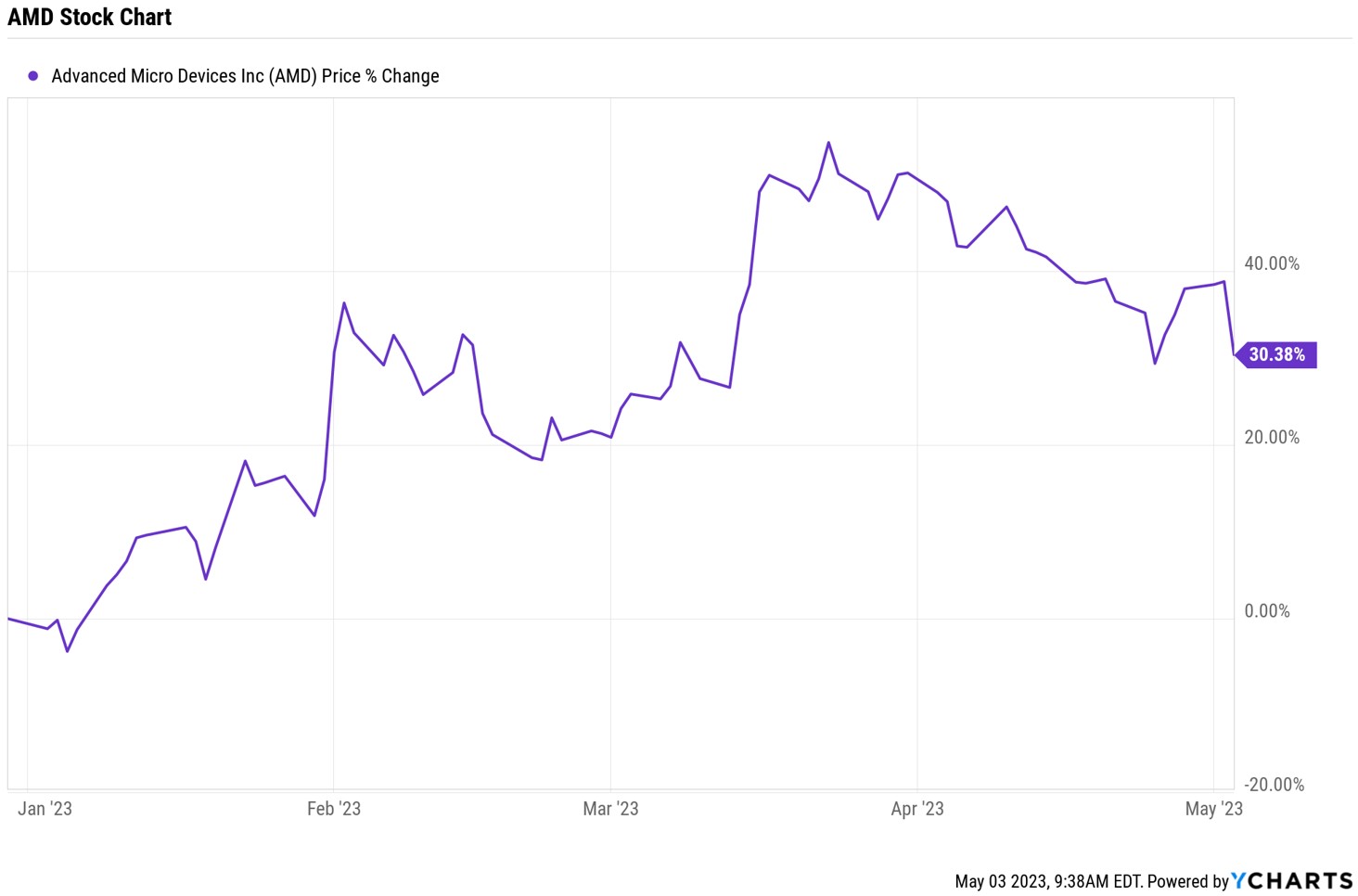

Advanced Micro Devices (AMD, $82.43) stock sold off sharply Wednesday in response to the chipmaker's first-quarter earnings report, which it disclosed after the previous session's closing bell. AMD said adjusted Q1 earnings were down 47% year-over-year to 60 cents per share, while revenue declined 9% to $5.35 billion. Gross margin declined 3 percentage points over the three-month period to 50%, and operating expenses climbed 18%.

AMD's gaming division (32.8%) was the largest contributor to first-quarter revenue, followed by its data center segment (24.2%). The largest year-over-year increase in revenue came from the company's embedded section (+163%), which makes central processing units (CPUs) for high-performance computing systems, automakers and cloud services companies. Meanwhile, its client division, which makes processing units for desktop and notebook personal computers, suffered the biggest year-over-year decline in revenue, down 65.2% over Q1 2022.

"We executed very well in the first quarter as we delivered better than expected revenue and earnings in a mixed demand environment," said Dr. Lisa Su, chair and CEO of Advanced Micro Devices, in the company's Q1 press release.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Looking ahead, though, Su expects uncertainty in the macro environment to continue to cloud the near term outlook. "Based on customer demand signals, we expect second-quarter revenue will be flattish sequentially with growth in our client and data center segments, offset by modest declines in our Gaming and Embedded segments," Su said in AMD's earnings call. On a year-over-year basis, Advanced Micro Devices is guiding to a 19% drop in Q2 revenue to $5.3 billion.

Is AMD a buy, sell or hold?

Analysts were quick to weigh in on AMD stock after the company's earnings report.

"We're not surprised to see shares come under pressure as investors question/focus on AMD's expectation of double-digit data center growth in 2023 (or implying >50% uptick in the second half vs the first half)," says Wells Fargo analyst Aaron Rakers (Overweight, or the equivalent of Buy). The analyst expects the stock to pull back to around the $80 per-share mark, but says this is "an attractive entry point for long-term investors" in growth stocks.

Elsewhere, BofA Securities analyst Vivek Arya cut his recommendation on Advanced Micro Devices stock. "We downgrade AMD to Neutral from Buy, following an inline Q1 but weak Q2 outlook on sluggish market recovery," Arya wrote in a note to clients. "We continue to like AMD's consistent execution and its breadth of product cycles in attractive compute/AI markets. However, in the near/medium-term, we see a range of headwinds."

Such headwinds include an aggressive pricing and promotion campaign from rival chipmaker Intel (INTC), a risky data center growth outlook and a "restrained" cloud spending environment, the analyst says.

Arya does, however, expect "some recovery" as AMD "outlines its AI vision and potential for growth in its unique converged AI (MI300) product."

Arya's downgrade notwithstanding, Wall Street continues to view Advanced Micro Devices as one of the best semiconductor stocks. Of the 42 following analysts issuing recommendations on AMD tracked by S&P Global Market Intelligence, 22 call it a Strong Buy, seven say Buy and 13 have it at Hold. That works out to a consensus recommendation of Buy, with high conviction.

What is the target price for AMD?

The Street also has high expectations for AMD's share price. Analysts' price targets for the chip stock range from a high of $200 to a low of $76. That works out to an average target price of $100.75, which gives shares implied upside of roughly 22% over the next 12 months or so.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.