Value Investing Is Back

Value investing beats growth in the long run, and the best way to participate in value is through funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It looks like value investing is making a comeback. Growth stocks clobbered value for about a decade. In 2020, they beat value by more than 30 percentage points – the widest margin since at least 1927.

Then, in 2022, growth took a sickening dive. A popular exchange-traded fund linked to a major growth-stock index, iShares S&P 500 Growth (IVW), fell 29.5%. The value-stock equivalent, iShares S&P 500 Value (IVE), dropped as well, but just by 5.4%. (Unless otherwise noted, returns are as of February 28; securities I recommend are in bold.)

Value and growth stocks move in cycles. The 1980s were led by value stocks; the 1990s by growth. Value investing beat growth for seven consecutive years starting in 2000; then growth dominated through 2021. Could this be the start of a new surge for value stocks? If you look back far enough, you might conclude that value never really went away.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"There is pervasive historical evidence of value stocks outperforming growth stocks." That is the conclusion of a report last year by Dimensional Fund Advisors, an index-investing specialist with about $600 billion under management. From 1927 to 2021, Dimension calculated, value stocks annually returned 4.1 percentage points more than growth stocks, on average.

That's an enormous difference, but it's no solace to value investors who missed the growth-stock boom, led by giant tech stocks, that followed the last recession. The question is why we should believe that a shift to value is actually at hand.

Why value stocks?

First, understand the difference between value investing and growth. Value stocks are generally out of favor. They are less flashy, and their profits accumulate less quickly. So investors pay fewer dollars for every dollar of a value stock's earnings, revenues and net assets.

Growth stocks are well loved by the market, and growth investors like jumping on fast-moving freight trains. Value stocks are underappreciated by the market while growth tends to be overappreciated.

"Over the last decade, low interest rates and a higher appetite for risk have fueled [the outsize] performance of growth," said Tano Santos, a professor of finance at the Columbia Business School, last October. "Now that both things have changed ... investors are required to look more closely at the underlying quality of the business operations of the firm."

Value stocks surface with scrutiny of a company's balance sheet and its ability to withstand competition. Index providers at S&P Dow Jones Indices choose value using three criteria: a low ratio of a stock's price to its earnings (P/E), book value (or net worth on the balance sheet) and revenues.

FTSE Russell, another large research firm, uses a single criterion, the ratio of price to book value (P/B). Recently, the Russell 1000 Value index, which draws from the 1,000 largest stocks by market capitalization (or price times shares outstanding), had a P/B of 2.5, while the Russell Growth Index had a P/B of 9.6. The average P/E of the Russell Value index was 15.7, compared with 25.9 for the Growth Index.

Value stocks usually carry higher dividend yields. The Russell Value index sports a yield of 2.2%; Growth, 1%.

The reason that value beats growth in the long run is that value stocks are cheaper when you buy them, and growth stocks don't stay hot forever. In fact, growth doesn't stay growth forever. You may be surprised to learn that right now, three of the six most heavily weighted stocks on the S&P Value index are tech giants: Microsoft (MSFT), at number one; Amazon.com (AMZN); and Meta Platforms (META), the former Facebook. (Microsoft and Amazon are both in S&P's Growth index as well; some stocks can have both qualities.)

I like all of these unlikely value stocks. Meta – the only tech giant in the Russell 1000 Value index (which, remember, uses only P/B as a ticket for admission) – now trades at a P/E of just 16, based on profit projections for 2024 by a consensus of analysts.

The difference in performance between value and growth tells us that buying out-of-favor stocks – in whatever sector – pays more in the long run than buying stocks with which investors are infatuated.

This value creed has been the watchword of the greatest investors in history, notably including Warren Buffett, his mentor Benjamin Graham, John Neff, Donald Yacktman and David Dreman.

The torch was passed recently to David Booth, the founder of Dimensional Fund Advisors. Three years ago, I quoted him as saying, "The rationale for investing in value stocks is as strong as ever. The less you pay for a stock, the higher your expected return." That first sentence was belied by the terrible relative performance of value the very next year. (Market timing is impossible.) But the second sentence is absolutely correct.

Value investing strategies

So why do growth and value move in cycles? The best explanation is that investors move in packs. Their enthusiasm is contagious but eventually wears out. In addition, just a few huge growth stocks can pull that style train – at least for a while. Then, momentum works in the opposite direction.

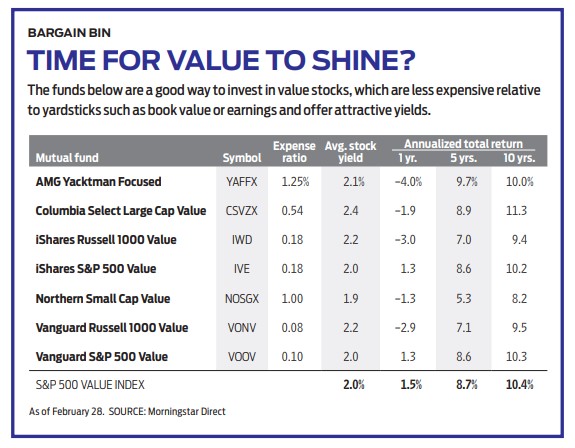

Because stocks travel between style categories, the best way to invest in value is through funds, which regularly rebalance their portfolios to take changes into account. In addition to the iShares S&P 500 Value ETF, which carries an expense ratio of 0.18%, you can choose the Vanguard S&P 500 Value (VOOV), with expenses of just 0.1%, or the iShares Russell 1000 Value (IWD) or the Vanguard Russell 1000 Value (VONV), among others.

Another approach is to let smart stock pickers do the selecting. An obvious choice is Berkshire Hathaway (BRK.B), Buffett's holding company, which owns large stakes in such traditional value stocks as Kraft Heinz (KHC), with a dividend yield of 4%, as well as

Coca-Cola (KO), yielding 3.1%, and Chevron (CVX), paying 3.7%. Berkshire has declined just 5% in the past 12 months, compared with a 16% loss for the S&P 500 Growth Index.

Columbia Select Large Cap Value (CSVZX) has a reasonable expense ratio for a managed mutual fund of 0.54% and an annual average return of 11.3% over the past 10 years, beating the iShares and Russell value index ETFs. The portfolio of 36 stocks includes heavy investments in the insurance giant Cigna Group (CI), yielding 1.7%; Wells Fargo (WFC), 2.6%; and Verizon Communications (VZ), 6.7%.

Another excellent managed fund is AMG Yacktman Focused (YAFFX), run for the past 20 years by Donald's son Stephen. The low-turnover fund owns such value classics as Johnson & Johnson (JNJ), yielding 2.9%; Procter & Gamble (PG), 2.6%; and PepsiCo (PEP), 2.6%. The drawback is a relatively high expense ratio of 1.25%.

Northern Small Cap Value (NOSGX), with an expense ratio of 1%, specializes in stocks that have been the most unloved of all over the past decade or so. The fund, which has a huge portfolio, has returned an annual average of 8.2% for 10 years. Among the top holdings are Tegna (TGNA), the national media company that used to be called Gannett; Commercial Metals (CMC), a steel fabricator with a P/E based on expected earnings of just 10; and Moog (MOG-A), maker of aerospace controls.

What's remarkable about value is that it not only produces higher returns than growth over the long term but also carries less risk. Using beta (which measures movement of an asset relative to the market overall) as a metric, the S&P 500 Value index is 15% less volatile than the Growth index.

Although individual value stocks such as the ones I'm recommending are appealing right now, I like the idea of a portfolio balanced between one or two value funds and several growth funds or stocks. I'm not giving up on great growth companies, but now is the time to return to value.

Time for Value to Shine?

The funds below are a good way to invest in value stocks, which are less expensive relative to yardsticks such as book value or earnings and offer attractive yields.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned here, he owns Microsoft and Amazon. You can reach him at jkglassman@gmail.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.