Stock Market Today: Stocks Advance as Rate-Hike Fears Subside

The major benchmarks posted broad-based gains amid speculation the central bank will hold rates steady at the next Fed Meeting.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks posted broad-based gains Tuesday, helped by commentary from Federal Reserve officials downplaying the odds of another interest rate hike at the next Fed meeting.

A bullish forecast from a consumer staples bellwether and the kick off of Amazon.com's (AMZN) fall sale for Prime subscribers also helped boost risk sentiment.

In a week packed with speeches and commentary from central bank officials, Atlanta President Raphael Bostic on Tuesday sounded a dovish note toward future interest rate policy. Bostic said that rates are currently high enough to get the economy back to the Fed's 2% inflation target.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The CME FedWatch Tool currently projects an 88% chance that the central bank will hold rates steady at its next meeting, up from 72% last week and 53% one month ago," notes Argus Research.

Rapidly rising global interest rates hampered equities in the earlier part of the month, but stabilizing yields have helped markets post gains for three straight sessions.

"Equity markets have been underpinned by a reprieve in yields and crude oil prices," writes Quincy Krosby, chief global strategist for LPL Financial. "Financial markets are keenly focused on the release of key inflation-related data this week."

As to that last point, note that the September Consumer Price Index is slated for release on Thursday, Oct. 12.

In single-stock news, as mentioned earlier, Amazon kicked off its fall sale for Prime subscribers, and markets approved by adding $13 billion in value to the company's market capitalization. But the real star of Tuesday's show was Pepsico (PEP), which jumped more than 2.4% at one point on an intraday basis.

The soft drinks and snacks maker topped Wall Street's third-quarter earnings and revenue forecasts, and offered a full-year outlook toward the higher end of its outlook. Shares in PEP have been under pressure this year amid concerns over the potential impact of weight loss drugs such as Ozempic and Mounjaro on the company's business.

By the closing bell, the Dow Jones Industrial Average rose 0.4% to 33,739, while the broader S&P 500 added 0.5% to 4,358. The tech-heavy Nasdaq Composite gained 0.6% to end at 13,562.

Seasonality improves from here

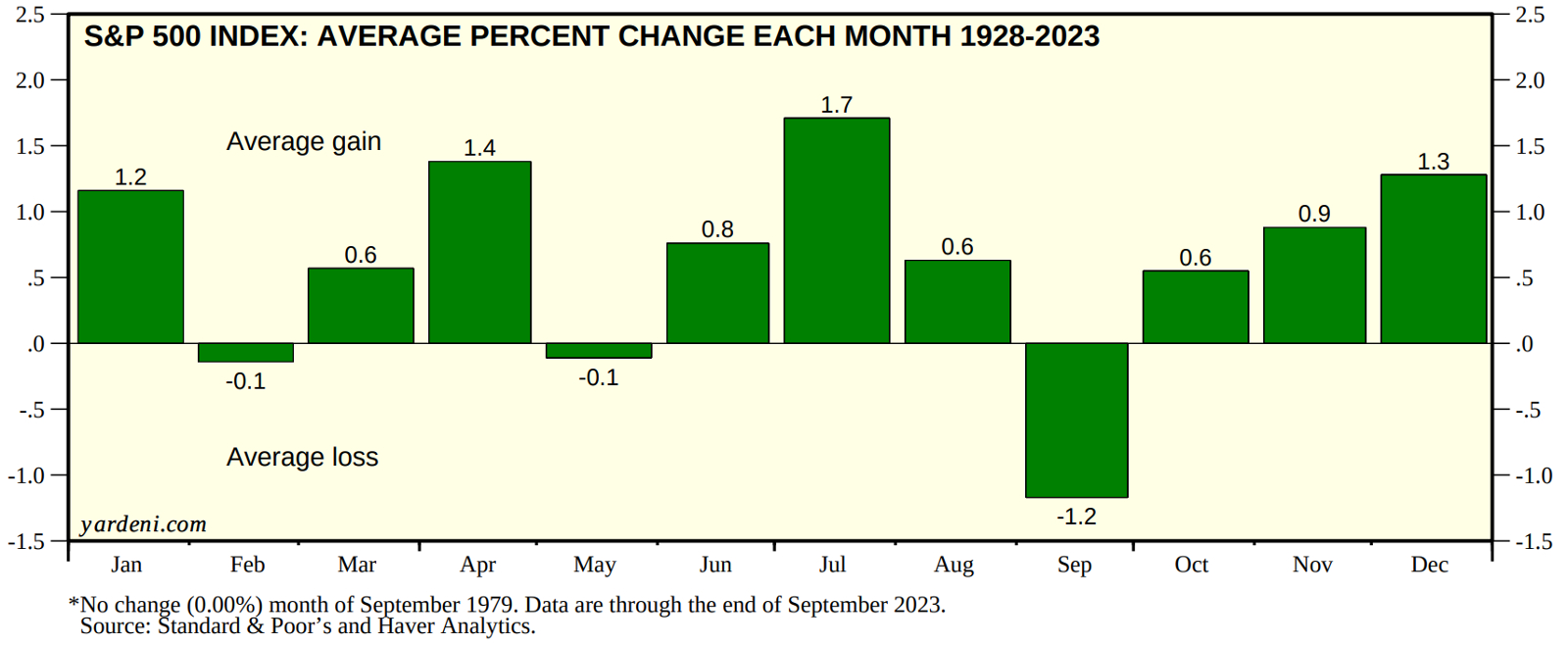

The market's recent strength in face of heightened geopolitical uncertainty and rising oil prices shouldn't be too much of a surprise given that we're exiting the seasonally weakest period for equities, experts say.

"From a market standpoint, we are also entering a better period," writes Brad McMillan, chief investment officer for Commonwealth Financial Network. "While September is historically the weakest month of the year, the fourth quarter has been notably better, which may be a tailwind moving forward. The solid economic foundation and improving seasonal factors may give us better results through the end of the year."

Indeed, investors should be pleased to know that, historically, we're about to enter one of the seasonally strongest periods for equities. Have a look at the above chart, and you'll see that since 1928, the S&P 500 has delivered an average price gain of 0.9% in November, 1.3% in December and 1.2% in January, according to Yardeni Research.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.