Stock Market Today: Stocks Resume Slide as Treasury Yields Rise

Signs of strength in the U.S. economy did little to lift investor sentiment on Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Thursday marked another day of choppy trading for stocks as investors considered a round of data that showed the U.S. economy remained resilient even in the face of the Federal Reserve's aggressive rate-hike campaign.

Ahead of this morning's open, data from the Labor Department showed weekly jobless claims fell for a fifth straight week, underscoring strength in the labor market. Additionally, the Commerce Department said retail sales rose 0.3% month-over-month in August, beating economists' expectations for a slight decline in consumer spending.

"This [retail sales] report is not good for the Fed's goals of slower inflation," says José Torres, senior economist at Interactive Brokers. "The Fed would like to see consumers slow down their spending and debt accumulation to slow down inflation. Higher rates provide an incentive to save, not to spend, and that's part of the reason why tighter monetary policy brings down demand and inflation." As such, Torres says the market is not only expecting a 75 basis-point rate hike at next week's Fed meeting, but one at the November meeting too. (A basis point is one-one hundredth of a percentage point.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

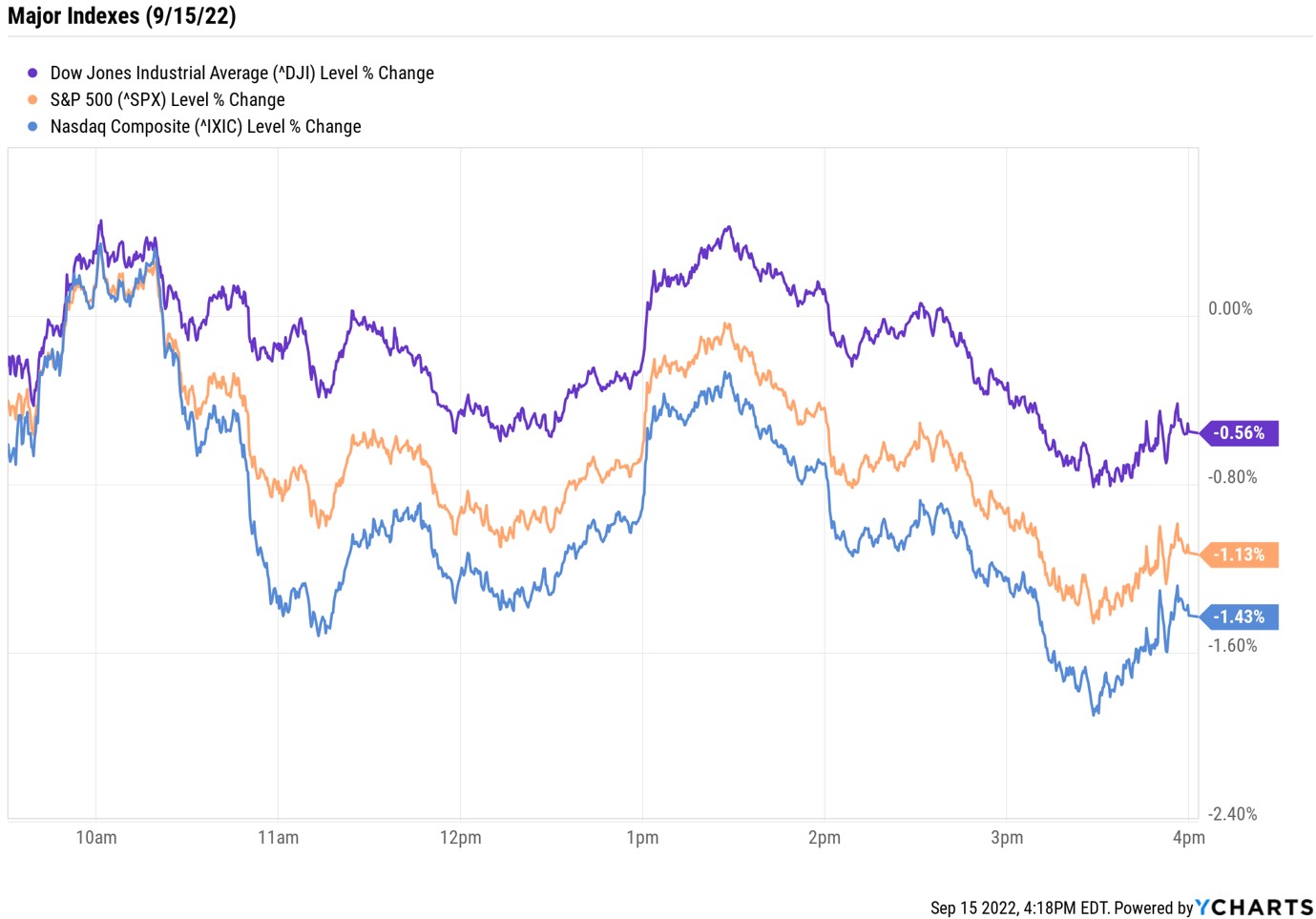

By the close, the market had taken a decisive turn lower as the 10-year Treasury yield jumped 3.5 basis points to 3.447%. The tech-heavy Nasdaq Composite suffered the worst of it, slumping 1.4% to 11,552. However, the S&P 500 Index (-1.1% to 3,901) and the Dow Jones Industrial Average (-0.6% at 30,961) also ended solidly in the red.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.7% to 1,825.

- U.S. crude futures fell 3.8% to settle at $85.10 per barrel.

- Gold futures plummeted 1.9% to $1,677.30 an ounce, their lowest settlement price since April 3, 2020, according to Dow Jones Market Data.

- Bitcoin slipped 0.8% to $19,800.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Elsewhere, Ethereum spiraled 6.3% to $1,499.28 after the Ethereum Merge. "The merge paves the way for the world's second-largest cryptocurrency to become more energy-efficient and to operate on a 'proof-of-stake' network," says Edward Moya, senior market strategist at currency data provider OANDA. "Crypto traders are often used to 'sell the event' reactions in the cryptoverse and this Merge proved to be another example of just that."

- Adobe (ADBE) plunged 16.8% after the Creative Cloud parent said it is buying design software firm Figma in a cash-and-stock deal valued at roughly $20 billion. "This would be by far Adobe's largest-ever acquisition," says Scott Kessler, global sector lead for Technology Media and Telecommunications at Third Bridge. "About four years ago it bought Marketo for around $5 billion. Meanwhile, its closest peer and competitor in some ways, Salesforce.com (CRM), has been far more aggressive with M&A, most recently buying Slack last year in a deal valued at nearly $30 billion." ADBE also reported higher-than-expected fiscal third-quarter earnings of $3.40 per share on inline revenue of $4.4 billion.

- Netflix (NFLX) jumped 5.0% after Evercore ISI analyst Mark Mahaney upgraded the streaming stock to Outperform from Inline, the equivalents of Buy and Hold, respectively. The analyst believes NFLX's ad-supported offering and its clampdown on password sharing create "catalysts that can drive a material reacceleration of revenue growth." Mahaney adds that these catalysts are currently not priced into the stock.

Stocks Making the Most of Supply-Chain Woes

Supply-chain disruptions have been front and center for most of the pandemic and the possibility for another disturbance came back to the forefront this week as a potential railroad strike loomed. While the latest headlines suggest that the strike will be averted as both sides reach a tentative deal, the fragility of the system remains a concern for investors.

"Supply chains were built for efficiency in the past," says Tony DeSpirito, chief investment officer at BlackRock's U.S. Fundamental Active Equities. "And that meant the lowest cost, wherever it was." But COVID "underscored the need for resilience of supply chains," he adds. "And that's what we're starting to see – the trend away from globalization to onshoring or reshoring operations. It's essentially a shift from efficiency to resiliency." This shift is creating a tough short-term environment for investors, DeSpirito adds, but he reminds us that it helps to take a long-term perspective.

And over the long term, companies should benefit from a move to more reliable processes. With that in mind, we've come up with five stocks that stand to win as supply chains falter. Most of the list is made up of industrial stocks, but the tech sector makes an appearance too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.