5 Big Tech Stocks That Are Bargains Now

Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

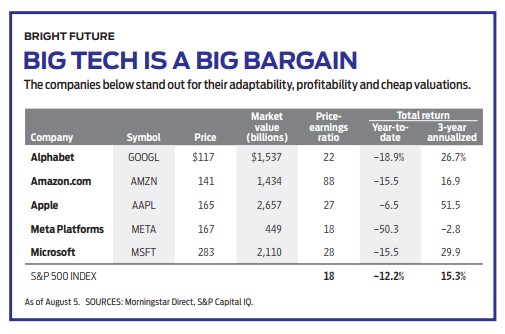

It has been a rough year for the stock market but even more so for mega-cap tech stocks. From the start of 2022 through early August, the four largest technology companies lost an average of 14% of their value, including dividends, compared with a decline of 12% for the benchmark S&P 500 Index. (Prices, returns and other data are as of Aug. 5 unless otherwise noted.)

The four biggest tech firms also happen to be the biggest U.S. companies of any kind, as measured by market capitalization (price times shares outstanding). In order of size, the Mega Four are Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and Amazon.com (AMZN). Over the past five years, their share prices have more than tripled, and each has a market cap of more than a trillion dollars. But investors are bewitched by what behavioral economists call "recency bias," or putting too much emphasis on the latest events, so losses over the previous few months are prominent in investing decisions.

Smart investors take a long view, both forward and backward. They look carefully at a company's progress over the years and then try to forecast a decade out. With this kind of analysis, the 2022 decline is clearly a buying opportunity for three reasons:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Adaptability. Each of the Mega Four started with a single big idea: search-based advertising for Google, personal computing for Apple, online shopping for Amazon and operating-system software for Microsoft. None has abandoned its original business, but all have moved into other sectors. Those transitions have been impressive and nearly unique among corporations. The flexibility that the Mega Four have displayed bodes well for future adaptation to changing markets.

For example, every one of the four is a leader in the supremely profitable business of cloud computing, which lets users store massive amounts of data remotely and securely, accessible anywhere in the world. Three-fourths of Amazon's profits last year came from its cloud-computing unit. For the quarter ending June 30, Microsoft's Intelligent Cloud revenue represented 39% of total sales for the company; Alphabet's cloud revenues jumped 35% in the same quarter.

Even Apple, a manufacturing company, understands the value of cloud computing. Revenues from the company's services division, which in addition to the cloud includes Apple TV+, Apple Music, the Apple Card and the App Store, are growing three times as fast as iPhone sales. Forbes predicts profits from services will reach $50 billion a year, surpassing the profits from iPhone sales, by 2025.

All the companies are using a subscription model, the best example being Amazon Prime, to guarantee a flow of cash. In addition, both Apple and Amazon have made major investments in video production and streaming.

Alphabet's YouTube, even though it is blocked in China, has become a huge global advertising vehicle, with 2.6 billion users. Meanwhile, Microsoft is one of the three largest gaming companies in the world. Alphabet's Google owns Nest thermostats and Verily Life Sciences. Amazon owns the Whole Foods Market chain, with $17 billion in revenues. Alphabet's Gmail service is the largest in the world, accounting for 37% of all email openings last year.

Not all the tech companies' investments (or "other bets," as Alphabet officially calls them) have paid off – Google Fiber, bringing super-high-speed internet connections to about a dozen cities, has been disappointing, for one – but the Mega Four have remarkable acquisition track records and plenty of cash to buy more businesses. Among the three of them, Microsoft, Apple and Alphabet collectively have a total of nearly $300 billion in cash and short-term investments on their balance sheets.

Congress and regulators, of course, may stand in the way of further growth by acquisition. But the big tech companies have also grown organically, with such great businesses as Amazon Web Services, the largest cloud-services organization in the world, generated within their own organizations.

Profitability. The reason the Mega Four have so much cash is that they are absurdly profitable. Take return on equity, which is net income divided by shareholders' equity (a firm's net worth, or what would get turned over to the stockholders if a company were liquidated). According to a Nasdaq primer, return on equity "enables investors to identify companies that diligently deploy cash for higher returns." Apple's current return on equity is 153%. In other words, raising $1 million in equity produces profits of $1.53 million! For comparison, Zack's, an investment research firm, reports that the average for the mini-computer sector is 19%.

A cruder profit measurement is operating margin, or return on sales – that is, profits divided by revenues. For all U.S. industries, the average figure is about 11%, but Microsoft's is nearly 40% over the past 12 months, and Alphabet's is about 30%. Amazon is mainly a retailer, so its margins are lower, but its cloud business has an operating margin of about 30%. There's no need to get bogged down in statistics. It's sufficient to say that these companies are profit machines, even when the economy appears to be slowing down as the Federal Reserve raises interest rates to thwart inflation.

Valuation. Now I get to the best part of the Mega Four story: These stocks are cheap. I can't predict whether they'll get cheaper in the short run, but it's clear that becoming partners in some of the best businesses in the world is a better deal today than it was at the start of the year.

Alphabet, whose shares have dropped from $148 earlier this year to $117, now carries a forward price-to-earnings (P/E) ratio, based on a consensus of analysts' earnings forecasts for the next 12 months, of 22, and Apple's is 27. Despite a recent bounce, Amazon is considerably less expensive than it was two years ago, and Microsoft has lost $59 a share since it traded at $342 in November 2021.

The company that used to be the fifth-largest U.S. stock and now ranks 11th, Meta Platforms (META), the former Facebook, provides a striking contrast to the Mega Four. Some 97% of Meta's total revenue comes from advertising sales, which fell in the most recent quarter because of vulnerability to trends in the overall global economy and increased competition. Meta is trying to make its own shift, "moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology," as its latest earnings report says.

Can Meta's management lead this kind of massive, risky transition? That's uncertain, but when it comes to valuation, Meta is hard to resist. The stock has plunged 50% this year, and its P/E is currently a mere 18. Meta and Johnson & Johnson (JNJ) have the same market cap, but Meta earned about 40% more in the most recent quarter.

Of all the ideas that created America's biggest tech companies, Facebook's was the most simple and revolutionary. It completely changed the way we connect with other people and upended the advertising world. Today, one out of every six ad dollars in the world is spent on Facebook – twice as much as on Google.

The main case for the Mega Four – or Five – is their success. I realize that the market battlefield is littered with giant winners that have become losers, General Electric (GE) being the prime example. There are no guarantees in investing. But when the market sours on companies because of the state of the economy, it's a good time to be buying the best.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. Of the stocks mentioned here, he owns Microsoft and Amazon.com. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. You can reach him at James_Glassman@kiplinger.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.