Stock Market Today: Stocks Push Higher Ahead of Powell's Jackson Hole Speech

Today's economic data showed a one-month low in weekly jobless claims and an upward revision to Q2 GDP.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks gained ground Thursday as investors sized up a pair of not-so-bad economic reports ahead of tomorrow's appearance by Fed Chair Jerome Powell at the central bank's annual symposium in Jackson Hole, Wyoming.

This morning, the Labor Department said that weekly jobless claims fell to a one-month low of 243,000 last week, down from the previous week's revised 245,000. A separate report from the Commerce Department showed gross domestic product (GDP) declined 0.6% in the second quarter, an improvement over the 0.9% drop seen in the initial reading that was released last month – a reading that sparked plenty of recession chatter around Wall Street.

But all eyes remain on Jackson Hole. "As we await Chair Powell tomorrow, other officials have started on the media circuit," says Michael Reinking, senior market strategist at the New York Stock Exchange. "The tone of the commentary has been hawkish but has been very much in line with what we've heard post the [July] Federal Open Market Committee meeting. The key themes have centered around remaining committed to taming inflation." Reinking adds that while most central bank officials are holding monetary policy decisions for September's Fed meeting "close to the vest" as they wait for the next round of economic data, they are also hinting that we're not quite at a level where they can stop hiking rates.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

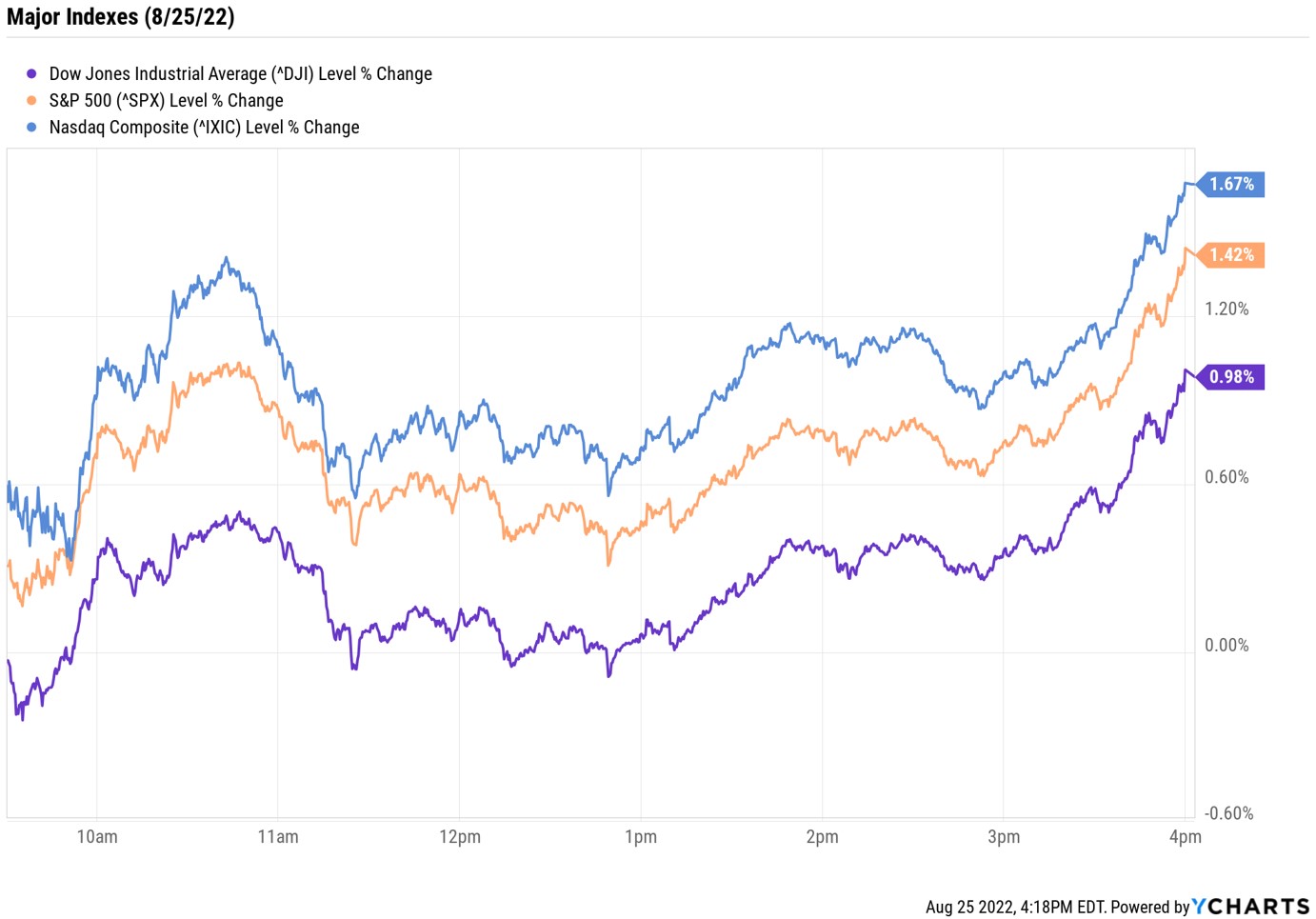

Today's gains were broad-based, with the materials (+2.3%) and the communication services (+2.0%) sectors faring the best. As for the major indexes, the Nasdaq Composite rose 1.7% to 12,639, the S&P 500 Index climbed 1.4% to 4,199, and the Dow Jones Industrial Average tacked on 1.0% to 33,291.

Other news in the stock market today:

- The small-cap Russell 2000 rose 1.5% to 1,964.

- Gold futures rose 0.6% to settle at $1,771.40 an ounce.

- Bitcoin slipped 0.3% to $21,611.45. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Peloton Interactive (PTON) stock plunged 18.3% after the at-home exercise equipment maker reported earnings. In its fiscal fourth quarter, PTON recorded a net loss of $3.68 per share, compared to a loss of $1.05 per share one year ago. Revenue slumped 28% to $678.7 million, falling short of analysts' consensus estimate. It was the company's sixth straight quarter of reporting a loss, though it said it is looking to breakeven on a cash-flow basis in the second half of fiscal 2023. Today's sharp selloff comes one day after PTON stock surged more than 20% after announcing a deal with Amazon.com (AMZN).

- Snowflake (SNOW) surged 23.1% after the cloud data platform reported higher-than-expected second-quarter revenue of $497 million. "July quarter results were exceptional and helped remove fears around a more protracted slowdown in data consumption across key customers following a stretch of mixed quarterly reports," says CFRA Research analyst David Holt. "Second-quarter revenues were $497M (+83% Y/Y), clearing consensus of $467M, as strength in financial services led to the beat." However, Holt kept a Hold rating on SNOW. "Following today's gap higher in shares, we prefer to wait and see if the macro/market environment allows for a continuation of improved trends – we note comparables get progressively harder in the back-half of fiscal 2023 in terms of product revenues and remaining performance obligations (RPOs)."

Is it Time to Buy Energy Stocks?

Oil prices had another miserable day, but energy stocks could still have some fuel left in the tank. U.S. crude futures fell 2.5% today to settle at $92.52 per barrel, and are now down more than 24% from their mid-June highs above $122.

Still, Jeff Buchbinder, chief equity strategist at independent broker-dealer LPL Financial, says there are three conditions currently in place for the energy sector that are creating a "potential attractive opportunity" for investors. Specifically, Buchbinder believes some of the best investment opportunities occur when the following circumstances are unfolding: "1) the market is pricing in a pessimistic outlook in the form of lower valuations, 2) earnings estimates are being revised higher and growth is accelerating, and 3) technical analysis indicators suggest an impending rebound." The strategist sees all three conditions present in energy stocks right now.

If that's not enough to convince you, Buchbinder says to "Follow Warren." By this he means Warren Buffett, whose Berkshire Hathaway (BRK.B) holding company has been big buyers of oil & gas stocks in 2022. With that in mind, take a look at seven energy stocks that could be among the best ideas for investors for the remainder of this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.