Stock Market Today: Stocks' Momentum Stalls After Shocking Snap Earnings

The Snapchat parent posted its slowest quarterly revenue growth on record and said it plans to cut back on hiring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Nasdaq's impressive multi-day winning streak came to a screeching halt on Friday as a negative earnings reaction for social media stock Snap (SNAP, -39.1%) weighed on the broader tech sector.

The parent company of photo-sharing app Snapchat last night reported its weakest quarter ever for revenue growth (+13% year-over-year to $1.11 billion). SNAP also swung to a per-share loss of 2 cents from earnings of 10 cents per share in Q2 2021, while daily active users were up 18% to 347 million. All three metrics fell short of what Wall Street was expecting. Additionally, the company said it will "substantially" slow hiring in order to cut costs.

Twitter (TWTR, +1.1%) earnings were also in focus today. Ahead of today's open, the social media platform said second-quarter revenue fell 0.8% year-over-year to $1.18 billion – coming up well short of analysts' estimates – with advertising revenue rising just 2% for the three-month period.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The company's revenue was "hurt by a tougher ad landscape, as well as negative implications related to the pending Elon Musk acquisition," says CFRA Research analyst Angelo Zino. "While it is impossible to decipher the exact impact Musk's actions have had on TWTR, we think results do provide additional support that Elon has had a notable detrimental impact on the company's fundamentals." As for "Musk's actions," the analyst is referring to the Tesla (TSLA, -0.2%) CEO terminating his $44 billion buyout of Twitter, which is resulting in a court battle between the two parties.

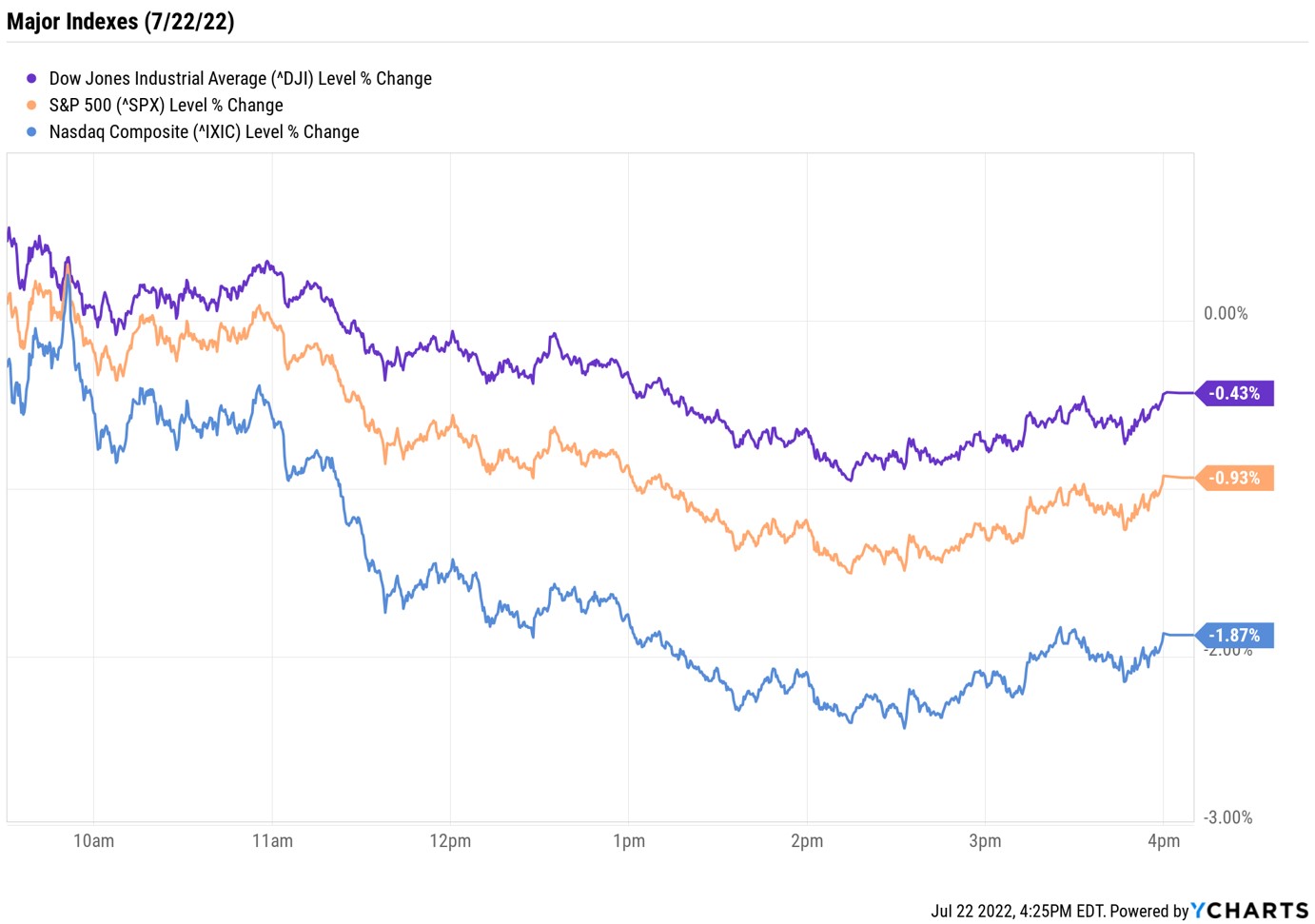

After three straight sessions of solid gains, the tech-heavy Nasdaq Composite slumped 1.9% to end at 11,843. The S&P 500 Index (-0.9% at 3,961) and Dow Jones Industrial Average (-0.4% at 31,899) also snapped their three-day win streaks.

Despite today's negative price action, all three major benchmarks ended higher on a weekly basis.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1.6% to 1,806.

- U.S. crude futures slumped 1.7% to end at $94.70 per barrel.

- Gold futures rose 0.8% to end at $1,727.40 an ounce.

- Bitcoin retreated 2.6% to $22,588.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Verizon Communications (VZ) was the worst Dow Jones stock today, sinking 6.7% after the telecommunications company reported lower-than-expected second-quarter earnings of $1.31 per share and cut its full-year forecast. Q2 revenue of $33.79 billion came in just above the consensus. " We believe VZ is currently between a rock and a hard place," says CFRA Research analyst Keith Snyder (Sell). "On the one side you have AT&T (T), who is being extremely aggressive with promotions, and on the other, you have T-Mobile (TMUS), who has a vastly superior 5G network currently.

- American Express (AXP) gained 2.0% after the credit card company reported earnings. In its second quarter, AXP brought in earnings of $2.57 per share on $13.4 billion in revenue, more than analysts were expecting. The company also boosted its full-year revenue forecast. "We are maintaining our Buy rating on American Express following Q2 earnings, which were helped by a continued strong rebound in billed business, but hurt by a $1 billion swing in credit costs with a $410 million loss provision versus a $606 million credit loss recapture," says Argus Research analyst Stephen Biggar.

Next Week Will Be a Busy (and Potentially Volatile) One

There's plenty on tap next week that could spark further volatility in markets. For starters, we're entering the busiest week of the second-quarter earnings season so far, with several mega-cap tech names – such as Apple (AAPL) and Microsoft (MSFT) – set to report. Wall Street will be watching to "see how margins are holding up in the previous stock-market darlings, and hoping they paint a prettier picture than the underperformance from U.S. banks," says Sophie Lund-Yates, equity analyst at U.K.-based financial firm Hargreaves Lansdown.

In addition, the Federal Reserve will issue its latest policy decision at 2 p.m. Eastern time on Wednesday, July 27, with a press conference from Fed Chair Jerome Powell to follow.

"The market response will likely be closely tied to comments during the press conference and updated summary of economic projections," says Timothy Chubb, chief investment officer at registered investment adviser Girard, a Univest Wealth Division.

The market is currently pricing in a 75 basis-point (a basis point is one-one hundredth of a percentage point) rate hike, and any deviation from this could spark a reaction, Chubb says. He adds that other significant market moves could "be associated with commentary or language that suggests the current rate of tightening policy is either too much or not enough to break the back of inflation."

Investors looking for sturdier ground amid stormier days can find it in some of the more defensive sectors, such as healthcare and real estate investment trusts (REITs), which tend to be able to withstand roller-coaster markets thanks to stable growth and attractive dividend yields. But for more ideas, check out this list of 43 top stocks for a tumultuous market, compiled by strategists at UBS Research Management. The names featured here are the firm's highest-conviction picks to ride out periods of volatility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.