Stock Market Today: Stocks Sprint Higher After Fed Minutes

As the broader stock market gained ground, U.S. crude futures fell into bear-market territory.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

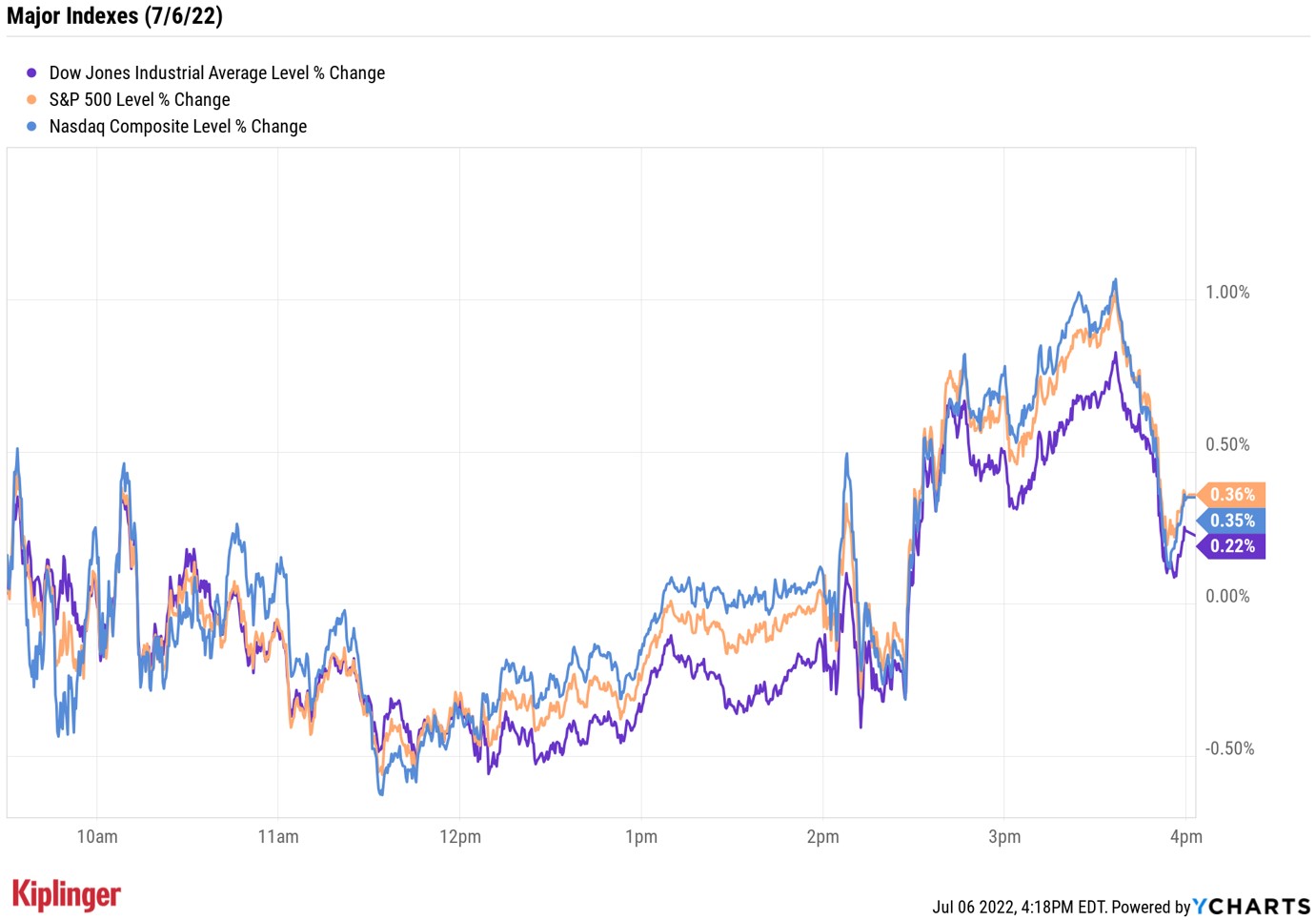

The major indexes spent most of the day bouncing around as investors awaited the mid-afternoon release of the minutes from the Federal Reserve's June policy-setting meeting, where the central bank issued its first 75 basis-point rate hike in nearly three decades. A basis point is one-one hundredth of a percentage point.

The meeting minutes revealed that another hefty rate hike is likely coming when the Fed meets later this month (July 26-27) as the central bank tries to tame red-hot inflation. Specifically, the minutes suggested that "an increase of 50 or 75 basis points would likely be appropriate at the next meeting."

Additionally, the minutes indicated Fed officials believed the current economic outlook "warranted moving to a restrictive stance of policy," while leaving the door open to "an even more restrictive stance" should high levels of inflation persist. Translated: ongoing rate cuts, larger rate cuts, more bond selling or some combination thereof.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Fed minutes' primary message is, by now, what the parade of Fed speakers since the last meeting have emphasized, that 'more restrictive' policy measures will be needed if inflationary pressures do not ease markedly," says Jamie Cox, managing partner for Virginia-based Harris Financial Group. "Markets have received the message loud and clear."

"What got my attention was the reference to a potential pause at year-end," says Cliff Hodge, chief investment officer for North Carolina-based Cornerstone Wealth. "This is new, and extremely important. 'Participants noted that, with the federal funds rate expected to be near or above estimates of its longer-run level later this year, the Committee would then be well positioned to determine the appropriate pace of further policy firming and the extent to which economic developments warranted policy adjustments.' They were already thinking about where the appropriate level is to stop tightening policy in June, before the spate of economic data really deteriorated."

Stocks continued to wobble immediately following the release of the Fed minutes before taking a confident turn higher. By the close, the Nasdaq Composite was up 0.4% at 11,361, the S&P 500 Index was 0.4% higher at 3,845 and the Dow Jones Industrial Average had added 0.2% to end at 31,037.

And as the broader stock market gained ground, U.S. crude futures continued to decline, sinking 1% to settle at $98.53 per barrel. This officially put crude oil futures into bear-market territory, with today's closing price off 20.3% from their March 8 settlement high of $123.70 per barrel.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.8% to end at 1,727.

- Gold futures fell for a seventh straight day, ending down 1.6% at $1,736.50 an ounce – their lowest settlement price since September 2021.

- Bitcoin slipped 0.5% to $20,300.63. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Uber (UBER, -4.5%) and DoorDash (DASH, -7.4%) were two notable decliners today following news that Amazon.com (AMZN, +0.7%) struck a deal with food delivery firm GrubHub. As part of the partnership, AMZN will offer Prime Members a one-year membership to GrubHub that includes $0 delivery fees. Additionally, the e-commerce giant will have the option to take a 2% stake in GrubHub, which is owned by European food company Just Eat Takeaway.com. "We believe the announcement has notable implications for the competitive landscape of the food delivery space, as the transaction essentially creates a more relevant #3 player after years of market share loss by Grubhub," says CFRA Research analyst Angelo Zino. "Grubhub will have the ability to take advantage of Amazon's large Prime base, which should drive upside to volume at a time when pandemic tailwinds are waning." Zino believes DASH will be more impacted by the deal "given its U.S. dominant revenue exposure and share gain benefits in recent years."

- Rocket Companies (RKT) jumped 4.5% after Wells Fargo analyst Donald Fandetti upgraded the fintech stock to Overweight from Equal Weight (the equivalents of Buy and Hold, respectively). "While the residential mortgage market remains extremely challenging, we see RKT as a beneficiary of the dislocation, and interest rate expectations seem to have less upside tail risk," Fandetti says. And following RKT's nearly 40% year-to-date decline, the analyst believes there is a "better risk/reward for the stock in a sector where negative sentiment may have peaked."

Don't Count Out Growth Stocks, But Be Choosy

Could growth stocks finally be ready for their day in the sun? Possibly, suggests Carl Ludwigson, managing director at investment firm Bel Air Investment Advisors.

"Generally, an economic slowdown implies a scarcity of growth and declining inflation as demand decreases," Ludwigson says. "This lower growth and lower inflation environment should favor quality growth stocks that tend to be less cyclical than value stocks."

But not all economic cycles are equal – and even with the recent correction, many large-cap growth stocks remain expensive relative to historical valuations. As such, Ludwigson points to growth at a reasonable price (GARP) as one way for investors to position for a slowdown. GARP stocks are investing's version of having your cake and eating it, too, providing portfolios with both growth prospects and valuations that are attractive.

With that in mind, we've compiled a list of the best GARP stocks to buy now. The names featured here are expected to deliver double-digit earnings growth over the next year and are reasonably priced to boot.

Karee Venema was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.