Stock Market Today: S&P Suffers Worst First Half Since 1970

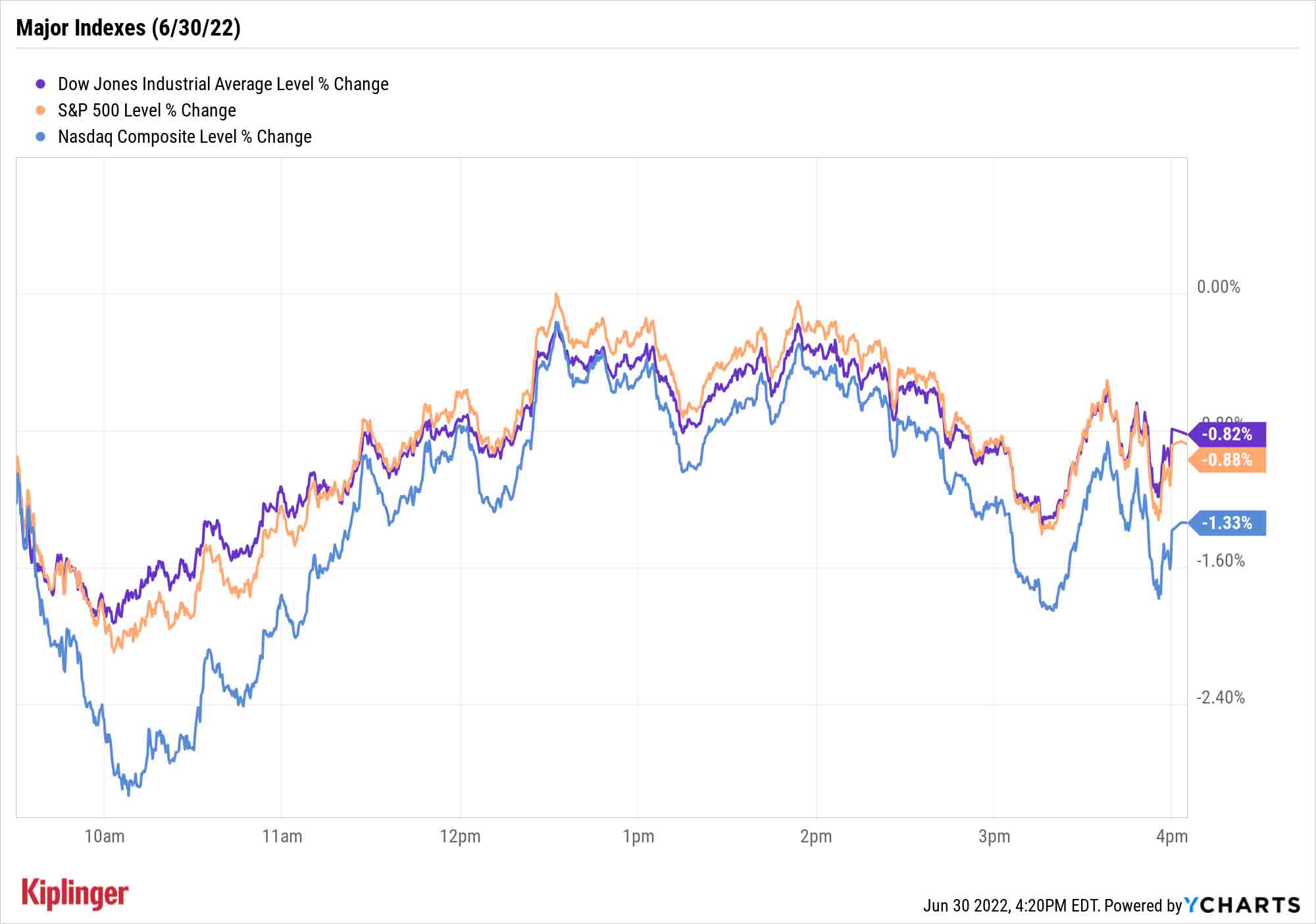

The major indexes produced a familiar result Thursday, finishing in the red to close out a dreary first six months of the year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A broad down day for the major indexes put the cherry on the melted sundae that was the stock market’s first half of trading in 2022.

The S&P 500 declined 0.9% on Thursday to 3,785, securing a 20.6% decline for the year’s first six months – its worst such performance since bombing out by 21% during 1970’s first half.

A glimmer of hope for today's hurting investors: That year, the S&P 500 followed up its implosion with a 26.5% rebound through New Year’s Eve. Whether we get the same remains to be seen, but Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott – who provided us with a potential market-bottom target yesterday – notes that the market is pretty oversold right now, and that we could at least see a short-term bounce.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"If one materializes, continue to watch for initial resistance first toward 4,100-4,200, then closer to the 4,400-4,500 zone [after that]," he says.

But for now, investors are licking their wounds.

"The S&P 500 reached an all-time high on the very first trading day of the year, but then promptly suffered through one of its toughest first-half performances ever, along with a pummeling in most major financial markets," says Douglas Porter, chief economist for BMO Capital Markets. "The challenging environment started and ended with inflation – and the increasingly urgent central bank campaign to control it – further aggravated by the Ukraine invasion in late February."

Now? Energy-driven supply shocks are forcing global growth expectations lower even as inflation remains red-hot.

The market received a potential sign that price gains might moderate, though it wasn’t enough to lift investor spirits. The Bureau of Economic Analysis reported that the personal consumption expenditure (PCE) index for May rose 0.2% month-over-month (MoM), below expectations for 0.4%. Core PCE (which excludes food and energy, and is the Federal Reserve’s preferred measure of inflation) was up 0.3% MoM.

"Most measures of inflation have likely peaked, although tight inventories of oil, gas, and diesel mean risks to energy prices are still to the upside." says Bill Adams, chief economist for Comerica Bank. Still, "Americans are running faster just to stay even," he adds, as rising costs of living absorbed all the increased spending power from added jobs and higher wages in May.

The Dow Jones Industrial Average followed the S&P 500 lower, dipping 0.8% to 30,775 – a 15.3% first-half loss. The Nasdaq Composite’s 1.3% drop to 11,028 locked in a massive 29.5% decline over 2022’s first six months.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.7% to 1,707.

- U.S. crude oil futures dropped by 3.7% to $105.76 per barrel.

- Gold futures edged 0.6% lower to $1,807.30 per ounce.

- Bitcoin bled out by 6.7% to $18,895.16. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Pfizer (PFE, +2.9%) and BioNTech (BNTX, +5.0%) both popped after announcing late Wednesday that they had collectively reached a $3.2 billion deal to provide 105 million COVID-19 vaccine doses to the U.S. government.

Let Data do the Work?

Stock market investors don't exactly have an easy path in the year ahead. Lindsey Bell, chief markets and money strategist for Ally Invest, provides a sobering outlook:

"Pessimism is everywhere you look. Consumers, business leaders, economists and my neighbors are all downbeat about the future of economic growth. Inflation has taken on greater significance in this view as the consumer inches ever closer to a tipping point on higher prices. The Fed's commitment to tame inflation is leading to more confusion and uncertainty for investors. The greatest fear is that the Fed will force a recession by rapidly increasing interest rates."

Obviously, 2022 has been a brutal year for most investors. So why not heed one of the rare strategies to do quite well?

Danelfin, an artificial intelligence (AI)-driven analytics platform, uses AI to analyze more than 900 fundamental, technical and sentiment data points per day for 1,000 U.S.-listed shares and 600 stocks listed in Europe. As we've checked in on it throughout the year, it has done well against the market – and especially well of late. The fintech's top 10 stock picks generated a price return of 2.1% from March 11, which is the last time we looked at Danelfin's picks. The S&P 500? It's down 7.5% during that span.

Read on as we look at what Danelfin AI system says are the top stocks to watch right now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.