Stock Market Today: Markets Steady, But Bed Bath, Cruise Lines Tumble

The calmest market day of 2022 wasn't nearly so pleasant for a few individual stocks, including retailer BBBY and cruise operator CCL.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A slow macroeconomic news day resulted in one of the lowest-volume sessions of 2022, though a few individual equities endured more than their fair share of volatility.

The S&P 500, which finished with a small gain Wednesday, posted the index's smallest intraday range for the year, according to Michael Reinking, senior market strategist for the New York Stock Exchange. "That bit of stability is welcome after the violent reversal seen during yesterday's session, which saw the early 1% gain in the S&P 500 turn into a 2% loss when all was said and done."

Not so for the energy sector (-3.5%), where recent whipsawing continued. U.S. crude oil futures declined 1.8% to $109.78 per barrel as traders waited for news from the Organization of the Petroleum Exporting Countries and their allies (together, OPEC+), which are meeting today and tomorrow. That clipped oil and gas stocks including Devon Energy (DVN, -6.1%) and APA (APA, -6.9%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A few individual stocks hit the mat even harder. Bed Bath & Beyond (BBBY) fell 23.6% after announcing that quarterly revenues had plunged by 25% to a worse-than-expected $1.46 billion, and that same-store sales (revenues earned in stores open at least 12 months) were off by 24%. And worse –the ship just lost its captain, as BBBY said CEO Mark Tritton has left the company.

Another firm in troubled waters is Carnival (CCL, -14.1%), which dragged down the entire cruise line industry Wednesday after a price-target cut from Morgan Stanley. Analyst Jamie Rollo now sees the stock going to $7 per share (-32% from yesterday's closing price), with a worst-case scenario in which a global downturn sends the stock to zero.

"If there is a demand shock that causes trip cancellations or weak bookings … liquidity could quickly shrink," he says.

Industrymates Royal Caribbean (RCL, -10.3%) and Norwegian Cruise Line Holdings (NCLH, -9.3%) swooned in sympathy.

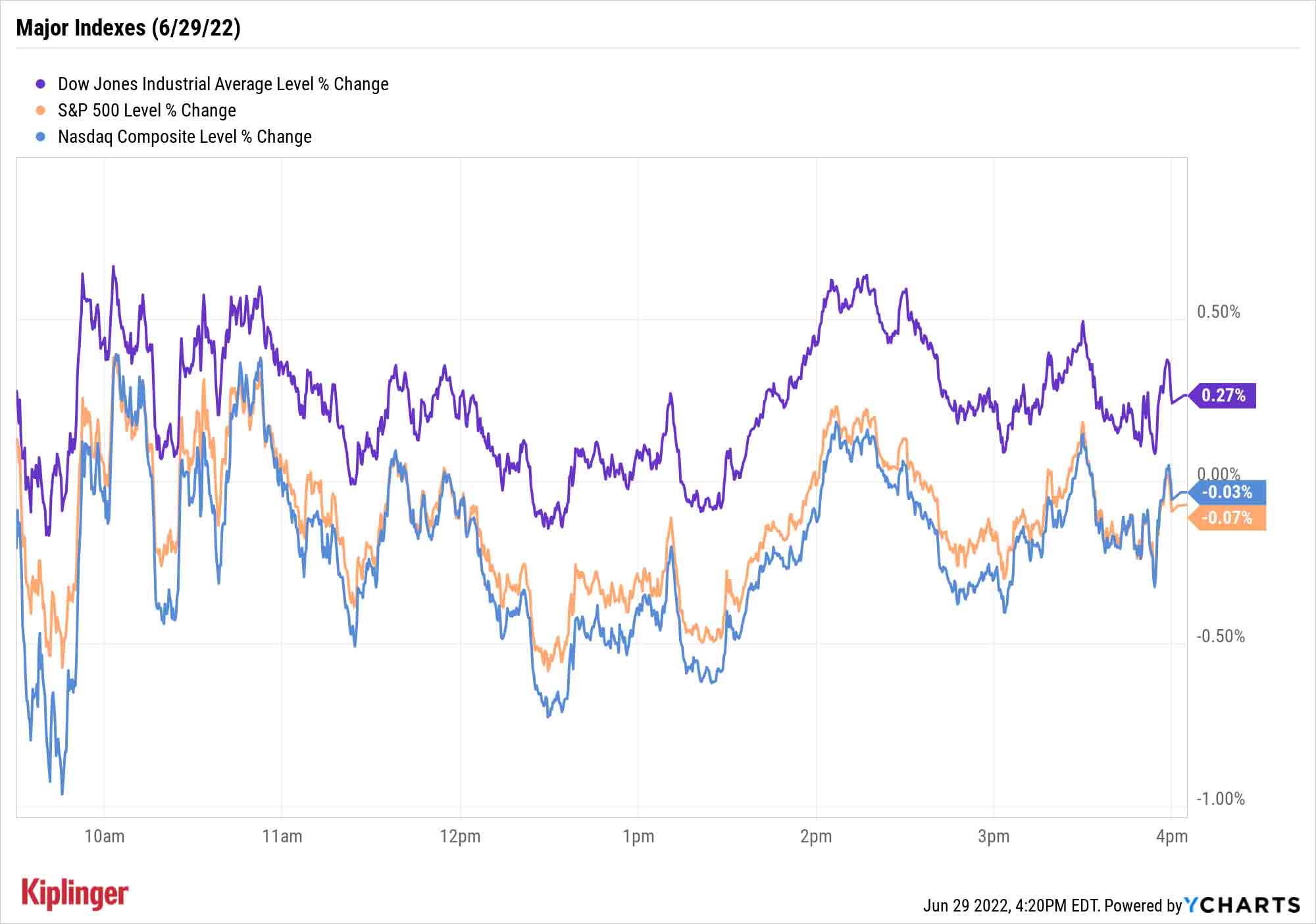

The major indexes didn't move much, however. The Dow Jones Industrial Average improved by 0.3% to 31,029, while the S&P 500 and Nasdaq Composite slipped marginally to 3,818 and 11,177, respectively.

Other news in the stock market today:

- The small-cap Russell 2000 wasn't nearly so calm, dipping 1.1% to 1,719.

- Gold futures gave back 0.2% to end at $1,817.50 an ounce.

- Bitcoin finished marginally higher to $20,255.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Teradyne (TER) slumped 5.2% after BofA Global Research analyst Vivek Arya downgraded the semiconductor equipment manufacturer to Neutral (Hold) from Buy. "We continue to think of Teradyne as a high-quality vendor and leader in the relatively duopoly market of semiconductor testing," Arya says. "However, TER's high exposure to Apple (~10% currently but has been 20-25% in the past) exposes the company to large volatility in iPhone demand and Apple design complexity." He adds that TER's high-growth industrial automation segment is exposed to any downturn in the global industrial economy and competition from Asia.

- It was a volatile session for Nio (NIO), which was down nearly 8% at one point after short seller Grizzly Research issued a report accusing the electric-vehicle maker of an "audacious scheme" to "exaggerate revenue and profitability." Nio replied in a statement, saying the report was "without merit," bringing the shares close to breakeven in late-morning trading, although they still ended the day down 2.2%. CFRA Research analyst Lim Jian Xiong maintained a Buy rating on NIO, saying more disclosures from the company should be expected. "We think NIO's EV portfolio expansion (3 SUV and 2 sedan models in 2022) will sustain its strong revenue momentum, drive an improvement in operating leverage, and support our projected turnaround in NIO's business by Q4 2023," the analyst added.

Trying to Call a Bottom Misses the Point

How low will the market go, and when will it hit its nadir? While there's no crystal ball that has the exact answer to either of these questions, Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, is happy to project a possible bottom, but he stresses that's not the point.

"We still believe the U.S. equity markets are entering the bottoming process of a correction cycle that began well over a year ago," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. "There is still likely more volatility to come, and within such a framework, we continue to believe the 3,100-3,200 range is a distinct possibility for the S&P 500 in the weeks ahead (before a final low is confirmed)."

However, he says the goal here shouldn't be to trade these markets on a short-term basis or try to pinpoint an exact bottom. "Rather, it should be to take advantage of significant multiple compression in valuations relative to the long-term growth prospects for the U.S. When viewed from this lens, we believe those investors with longer-term horizons can start to put some money to work in the current environment." As in, now.

Thus, keep an eye on values. Kiplinger columnist James A. Glassman recently disclosed his own wish list of stocks to buy while they're down. But the general thrust for investors right now is, if it's high-quality and bargain-priced, now might be the time to bite – as long as you're patient. Keep that in mind as you explore these 15 value stocks that seem ripe for a renaissance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.