Smart Investing in a Bear Market

Here's how to make the most of today’s dicey market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The bear that's been lurking on Wall Street all spring finally stepped out of the shadows on June 13, taking hold of what is now officially a bear market. The S&P 500 dropped nearly 4% in a day, erasing $1.28 trillion in a single trading session.

Since its record high on Jan. 3, the broad-market benchmark is down 21.8% – eclipsing the 20% bear-market threshold. That closed the books on the COVID-era bull market that took off in March 2020 and delivered a 114.4% price gain.

The market had tiptoed close to bear territory in May, then mounted a convincing rally. Bear-market rallies are fairly common, with 17 of 26 bear markets since 1929 recording upswings with gains of 10% or more, according to BofA.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But a lack of bullish follow-through points to an increased risk of lower lows, according to technical research strategist Stephen Suttmeier at BofA Securities. The next stop: roughly 3,500 on the S&P 500, he says, a drop of 27% from the record high. And don't be caught off guard by more volatility – in both directions, he adds. "Midterm-election years are very challenging, with big rallies and big declines."

Reading the Stock Market's Signals

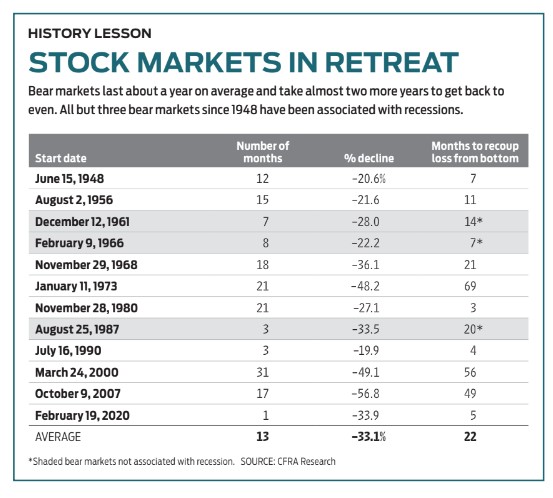

A key question is whether the market's recent malaise is forecasting a recession or not, says Sam Stovall, chief investment strategist at research firm CFRA. Nine of the 12 bear markets since 1948 have been triggered by impending recessions, he says. Those ended up being deeper, on average, than the three not associated with recessions – an average 35% decline versus a 28% drop, respectively. And they lasted longer – 15 months, on average, compared with six months. For now, Kiplinger is in the camp that says the economy will skirt a recession – with the caveat that a few unexpected shocks could tip the scales.

Strategists at investment firm Nuveen believe the economy is headed for either a soft landing (averting a recession) or a mild recession.

In the first case, the Federal Reserve keeps to the moderately aggressive rate-hike schedule that is already priced into financial markets. Inflation moderates, economic growth stays positive, and the job market weakens slightly but remains robust. That scenario favors stocks of companies with businesses that can grow even in an economy that's slowing – the so-called growth stocks that have struggled lately. In a mild recession, the Fed will have succeeded in fighting inflation, but at the expense of economic growth, which turns negative. Then, Nuveen would favor a blend of stocks that are value-oriented and those with growing dividends.

When the mood turns dark on Wall Street, a contrarian view can pay off. A compilation of sentiment surveys shows that optimism about the market across both Main Street and Wall Street was recently lower than about 94% of the time since 1960, notes Jim Paulsen, chief investment strategist at the Leuthold Group. "I get it. We had a virus with an ongoing death count that stuck all of us in our basements and made our major downtowns ghost towns. Add the weirdest monetary and fiscal policies ever, then throw in runaway inflation, shortages of everything and, for good measure, a war."

Many of those conditions are changing for the better, says Paulsen, setting up a promising, counterintuitive strategy. "Historically, when confidence was this low, the bear was close to expiring, and, looking ahead the next 12 months, it typically signifies a uniquely positive occasion for stock investors," he says. Indeed, corporate insiders are betting on better days, according to Leuthold research, having stepped up buying lately.

Pay Attention to Strong Fundamentals

Many stocks have been battered more than their profit outlook warrants, according to an analysis from investment firm Credit Suisse. Stocks whose prices have collapsed even as the outlook for their earnings has improved – drastically lowering their price-earnings ratio – include semiconductor producer Advance Micro Devices (AMD, $106), pharmaceutical research firm Charles River Labs International (CRL, $243), industrial company Generac (GNRC, $269) and luxury goods purveyor Tapestry (TPR, $35). Stock sectors where P/Es have contracted the most include communications services, consumer discretionary and tech.

The caveat, of course, is that earnings expectations could turn out to be overly optimistic.

Bargain hunting is a big part of a bear-market playbook. It's a good idea to keep a list of stocks you'd like to own at the right price so you're prepared to pounce when the market delivers a bargain.

Don't abandon strategies that have served you well in good times. Dollar-cost averaging, for example – the practice of investing a set amount at regular intervals – works even better in volatile markets, allowing you to buy more shares when prices are low and thereby lowering your average cost per share over time. It also helps take emotion out of the decision to buy. You're already dollar-cost averaging if you're a 401(k) investor and your contributions are on autopilot. Now is not the time to turn that off – in fact, it might be a good time for those with a long-term horizon to increase the amount of their regular contributions.

Diversification is another tenet to hold tight to – a challenge lately, considering that both stocks and bonds have been sinking at the same time for much of the year. But especially if we're headed for a recession, diversification can cushion the blow to your portfolio. Wells Fargo Investment Institute found that a portfolio with a wide mix of investments outperformed the S&P 500 (representing a stock-only portfolio) by an average of seven percentage points over the past several recessions.

For investors with taxable accounts, bear markets provide the lemons for lemonade you can make at tax time. Stock losses realized now can be offset against gains to reduce your capital gains tax bill. Or you might consider converting your traditional IRA to a Roth IRA while the value of your portfolio is down, lowering the taxes you'll pay now in exchange for tax-free withdrawals in retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.