Stock Market Today: Stocks Stumble as Inflation Remains Red-Hot

U.S. inflation eased slightly on an annual basis in April, but it wasn't enough to keep stocks in positive territory.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It was a choppy day for stocks as investors unpacked the latest consumer price index (CPI). Data released by the Labor Department this morning showed that prices consumers paid for goods and services in April rose at an annual rate of 8.3% – down from March's 8.5% pace to mark the first drop in inflation in eight months. While encouraging at first glimpse, there were concerning signs deeper inside the report.

For instance, the decline in CPI last month reflected a drop in gas prices, which have since rebounded. Food prices remained elevated, while airfare and restaurant bills increased ahead of the key summer travel season. And core CPI, which excludes the volatile energy and food categories, rose 0.6% on a sequential basis – double what it was in March.

"While this report appears to mark the first that shows some moderation from the ever-rising pace of inflation since September of last year, one data point does not necessarily make a trend; and the rise in core CPI should lead to some consideration that the moderation in inflation will not be quick," says Jason Pride, chief investment officer of private wealth at wealth management firm Glenmede.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

With prices already high, Pride said, it should be harder for the CPI to continue to rise at the same pace, especially with the Federal Reserve also hiking interest rates to combat higher prices. "However, it will likely take multiple reports for such a trend [of moderating inflation] to clearly establish itself," he says.

This sentiment is echoed by Mike Loewengart, managing director of Investment Strategy at E*Trade. "Today's read is a stark reminder that the journey to pre-pandemic levels of inflation will be a long one," Loewengart says. "Although inflation slowed from March, the market's reaction suggests that record high prices continue to weigh heavy on investors psyches. And with inflation persistently hot, the Fed has more fodder for increased rate hikes, which the market doesn't often welcome with open arms."

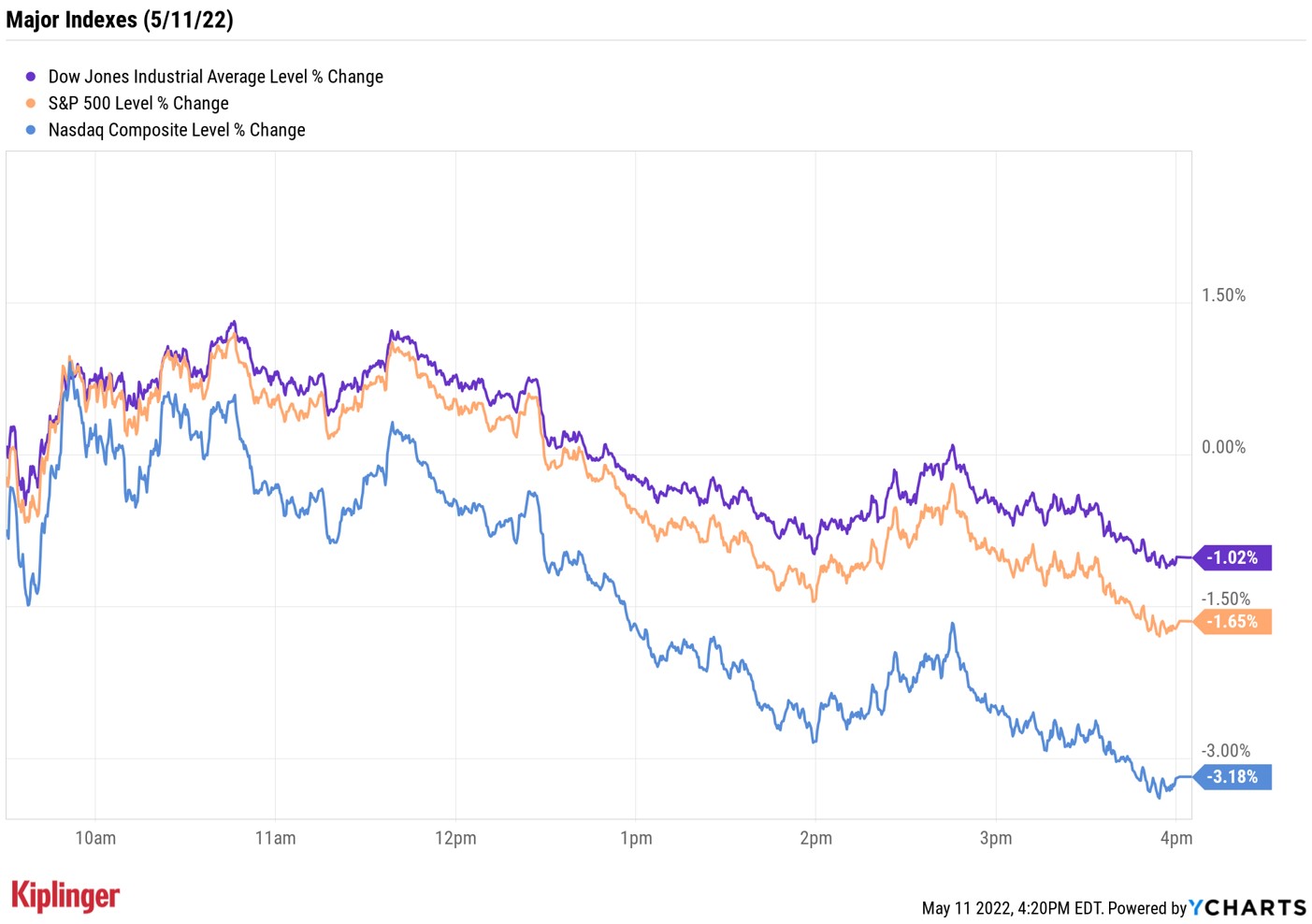

After bouncing between gains and losses in early trading, markets took a decisive turn lower this afternoon. At the close, the Nasdaq Composite was down 3.2% at 11,364, the S&P 500 Index was off 1.7% at 3,935 and the Dow Jones Industrial Average was 1.0% lower at 31,834.

Other news in the stock market today:

- The small-cap Russell 2000 retreated 2.5% to 1,718.

- U.S. crude futures surged 6% to end at $105.71 per barrel.

- Gold futures gained 0.7% to settle at $1,853.70 an ounce.

- Bitcoin slid below the $30,000 for the first time since July 2021, down 5.9% at $29,477.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Roblox (RBLX) was down as much as 10% in after-hours trading Tuesday after the video game developer reported a first-quarter loss of 27 cents per share, wider than the 21 cents per share Wall Street was expecting. The company's revenue of $631.2 million also fell short of the consensus estimate, as did bookings of 54.1 million. Still, the metaverse stock managed to finish today up 3.4% after Chief Financial Officer Michael Guthrie said on the company's earnings call that year-over-year growth may have bottomed in March, sooner than anticipated.

- Coinbase Global (COIN) shares plunged 26.4% on Wednesday after delivering a pretty disappointing quarterly report. Q1 revenues were off 27% year-over-year to $1.17 billion, widely missing analysts' expectations for $1.50 billion. Meanwhile, the company swung to a $430 million loss after earning $388 million in the year-ago period. Monthly users were down 19% YoY, too. Also raising eyebrows in the cryptocurrency community was an update to the Risk Factors section in its Form 10-Q, warning that users could potentially lose access to their assets in the event Coinbase ever had to go through bankruptcy proceedings.

Inflation Remains a Top Concern for Investors

Inflation remains top of mind for investors. This is according to the latest Charles Schwab Trader Sentiment Survey, which reviews the outlooks, expectations and trading patterns of 845 Charles Schwab and TDAmeritrade clients. Inflation was the main concern for those surveyed in the report (20% of respondents), followed by geopolitics (15%) and recession/domestic politics (12% apiece). And nearly half of participants (45%) do not believe inflation will begin to ease until 2023.

"Overall, in the second quarter, market sentiment among traders is unquestionably skewing bearish," says Barry Metzger, head of trading and education at Schwab. But market participants do see investing opportunities, the report notes.

Among the sectors survey respondents are most bullish on at the moment are energy (70%) and utilities (54%). The industries they are most upbeat toward include cybersecurity (71%) and agriculture (70%).

And 70% of those surveyed are interested in seeking out opportunities in defense stocks. While Russia's invasion of Ukraine has unsettled many parts of the stock market, it has also sparked an increase in global military spending, which could create a potential boon for the industry. Here, we've compiled a quick list of defense stocks that are poised to benefit from this spending build. The names featured include familiar names as well as some under-the-radar picks – and they all sport top ratings from Wall Street's pros.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.