Stock Market Today: Dow Sinks 981 Points in Wide Market Washout

Powell's rate-hike remarks continued to plague equities Friday as the major indexes suffered their worst single-day losses since early March

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Thursday's downward momentum spilled liberally into Friday's trade, with almost the entire market working in concert to deliver a week-closing stinker.

Weighing on sentiment again were yesterday's comments by Federal Reserve Chair Jerome Powell that all but guarantee we'll see a 50-basis-point Fed funds rate hike following the central bank's May meeting.

"When a Fed official suggests a 50-basis-point hike, markets immediately start trying to price in 75-basis-point hikes," says Jamie Cox, managing partner for Harris Financial Group. "It's madness really. Most investors would be well served to ignore the machinations of the pricing craziness and wait to see what actually happens with rates."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Fed is prepared to inflict real economic pain on the economy to achieve its inflation goals," adds Dean Smith, chief strategist at investment technology platform FolioBeyond.

John Butters, senior earnings analyst at FactSet, notes that the S&P 500 Index is reporting single-digit earnings growth for the first time since the fourth quarter of 2020, thanks in part to tough year-over-year comparisons, but also macro headwinds.

"[The Fed's] hawkish stance is giving investors pause as many are left to evaluate the impact on profit margins and equity multiples moving forward," says Brian Price, head of investment management for Commonwealth Financial Network. "We're still very early into earnings season, but higher costs are already denting profit margins and there doesn't appear to be any material relief in sight."

Friday's financial-results calendar did little to improve the market's earnings situation.

Gap (GPS, -18.0%) crumbled after reporting a 2-cent-per-share quarterly adjusted loss compared to a 67-cent profit the year prior; it also hacked at its current-quarter sales estimates and announced that Old Navy CEO Nancy Green would be stepping down. Verizon (VZ, -5.6%) beat profit expectations but said full-year earnings would come in at the bottom of its predicted range, which sits below analysts' views.

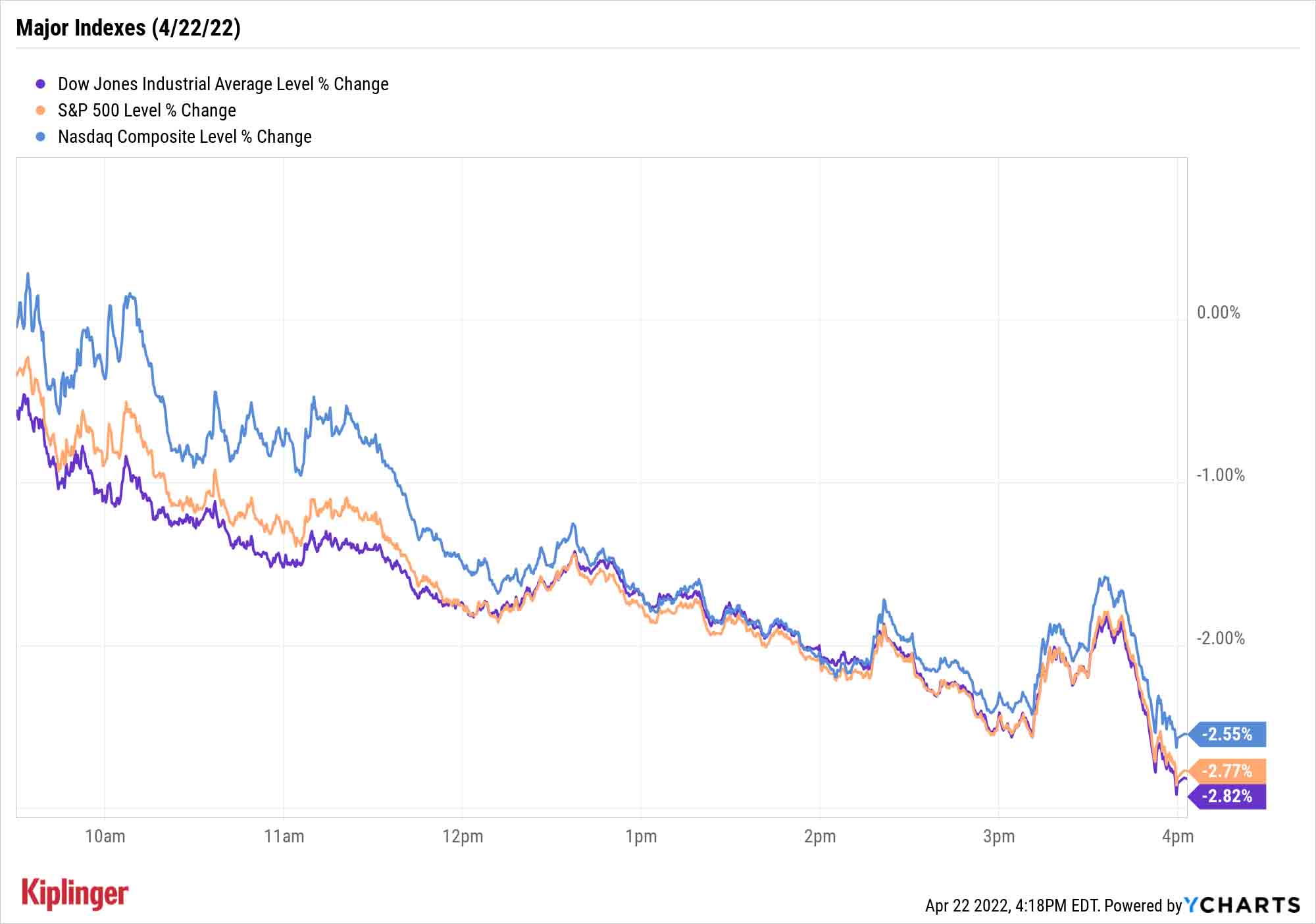

The major indexes all bled plenty. The Dow Jones Industrial Average (-2.8% to 33,811) saw all of its 30 components finish in the red. The same went for 489 of the stocks in the S&P 500 (-2.8% to 4,271). The broader Nasdaq Composite finished 2.6% lower to 12,839, including tumbles for all but four of the Nasdaq-100's components. (The Nasdaq-100 is made up of the 100 largest non-financial components of the Nasdaq Composite.)

"[The CBOE Volatility Index, or VIX] seems to express widespread fear that the U.S. economy might teeter into a recession," says Michael Oyster, chief investment officer for asset-management firm Options Solutions. "Options investors are confronting the reality that the Fed may have to raise rates even more aggressively than what was expected six months ago."

Other news in the stock market today:

- The small-cap Russell 2000 was hardly immune from Friday's woes, dropping 2.6% to 1,940.

- U.S. crude oil futures fell 1.7% to settle at $102.07 per barrel.

- Gold futures retreated 0.7% to finish at $1,934.30 an ounce.

- Bitcoin swung back below $40k, retreating 4.1% to $39,499.01. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- HCA Healthcare (HCA) stock plummeted 21.8% after the Tennessee-based hospital operator lowered its full-year guidance due to higher labor costs. For 2022, HCA now expects earnings per share of $16.40 to $17.60 – down from its previous forecast for earnings of $18.40 per share to $19.20 per share – and revenue of $59.5 billion to $61.5 billion, $500 million lower than its prior guidance. The negative earnings reaction dragged on a number of healthcare stocks, including Universal Health Services (UHS, -14.0%), Tenet Healthcare (THC, -15.7%) and Community Health Systems (CYH, -17.9%).

- Kimberly-Clark (KMB) was a rare splash of green in today's market, with the consumer staples stock jumping 8.1% after earnings. In its first quarter, KMB reported adjusted earnings of $1.35 per share on $5.1 billion in revenue – more than analysts were expecting. The maker of Cottonelle toilet paper also raised its full-year revenue and organic sales growth forecasts. Still, CFRA Research analyst Arun Sundaram maintained a Sell rating on the stock. KMB is "unfavorably positioned versus some of its more diversified peers in navigating through this historic inflationary cycle," the analyst wrote in a note.

Investing Green on Earth Day

April 22 marks the 53rd birthday of Earth Day, which was created to highlight the need for environmental protections. And now, perhaps more than ever, Wall Street is getting involved in these efforts through the promotion of investments boasting strong environmental, social and governance (ESG) policies.

Indeed, even this year's Earth Day theme – "Invest in Our Planet" – reflects the growing corporate and investing community's involvement in maintaining our green-and-blue space marble.

"While from the top down, governments have been grappling with the commitments needed for climate change solutions, from the bottom up, the private sector's innovation and investment have been accelerating needed advances," says Jason Hoody, head of investment manager research and sustainable investing research for LPL Financial. "Sustainable investing has the possibility of leaving a double legacy: There is the legacy of potential returns that every investor seeks, but there is also a legacy of stewardship by meeting current needs without overburdening the environment or future generations."

That double legacy is, of course, the goal: Investors want to do right, but they also want to do well. Which is why ESG investors must thread a tight needle in targeting opportunities that are both good stewards of the world and community around them, as well as attractive investment targets.

To mark 2022's Earth Day, we've looked at five ESG picks that we think fit the bill – each underlying company has made great strides in several environmental areas, and each stock boasts high-quality fundamentals.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.