Stock Market Today: Rate-Hike Rumblings Rattle the Stock Market

Powell commentary made a 50-basis-point interest-rate increase in May appear even more certain, throwing stocks for a loop Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

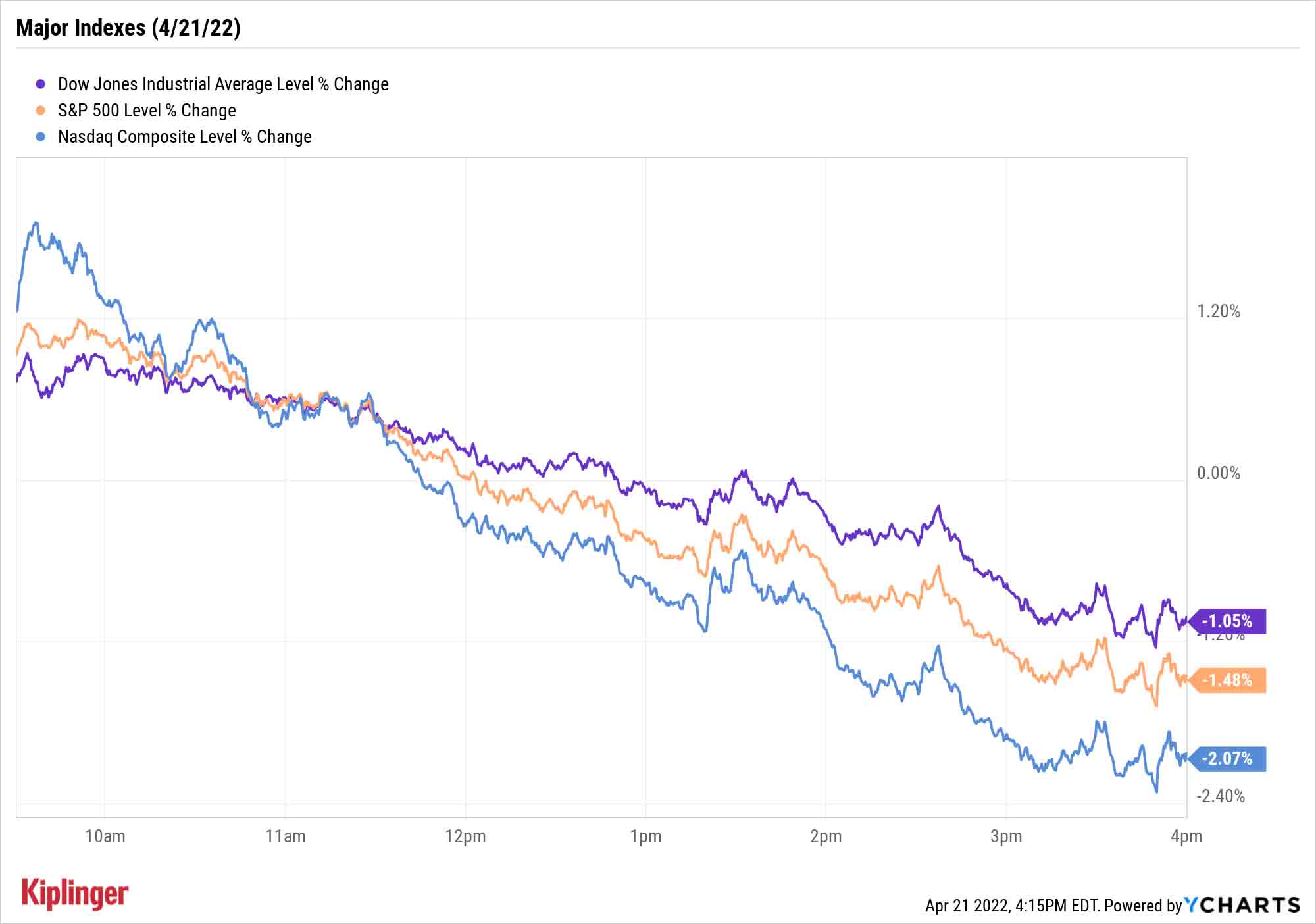

Stocks flipped sharply from green to red Thursday as interest-rate fears swelled again across Wall Street.

Federal Reserve Chair Jerome Powell sent the latest signal that the central bank's next rate hike might be soon, and bigger than usual. Powell told an International Monetary Fund panel that it's "appropriate in my view to be moving a little more quickly" to raise interest rates, adding, "I would say 50 basis points will be on the table for the May meeting."

The yield on the 10-year Treasury popped in response, from 2.836% to as high as 2.954%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Initial jobless claims for the week ended April 16 came in at 184,000 – a bit higher for estimates for 182,000, but still historically low and under the previous week's revised 186,000.

"That said, employment metrics have taken a back seat to inflation and interest rate hikes, so the read today is unlikely to move the needle for the market," says Mike Loewengart, managing director of investment strategy for E*Trade.

Corporate earnings didn't do much to turn the tide. Tesla (TSLA, +3.2%) popped after it reported a record $3.3 billion overall profit and easily beat analysts' consensus earnings estimates. So too did AT&T (T, +4.0%) despite missing on overall revenues; that said, core revenues related to its wireless business improved 2.5% in Q1.

But the major indexes didn't follow suit. Dips in communication services (-2.8%) and technology (-1.8%) weighed most on the Nasdaq Composite (-2.1% to 13,174), though the S&P 500 (-1.5% to 4,393) and Dow Jones Industrial Average (-1.1% to 34,792) sustained sizable declines, too.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 2.3% to 1,991.

- U.S. crude oil futures finished off their highs but still improved by 1.6% to $103.79 per barrel.

- Gold futures slipped by 0.4%, settling at $1,948.20 per ounce.

- Bitcoin also shed more than all of its morning gains, declining marginally to $41,207.81. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Carvana (CVNA) plummeted 10.1% after the online used car dealer reported a loss of $2.89 per share in its first quarter, wider than the $1.58 per-share loss analysts were expecting. The company beat on the top line, however, bringing in $3.5 billion versus a $3.4 billion consensus estimate. "Carvana is facing several industry-wide and company-specific headwinds that are impacting unit volumes and margins," says Stifel analyst Scott Devitt, who reiterated a Buy rating on CVNA stock. "While near-term trends are challenged, we believe the long-term thesis remains intact as the company continues to capture market share and develop the assets needed to realize significant leverage at scale."

- Airline stocks got a lift after positive earnings from United Airlines Holdings (UAL, +9.3%) and American Airlines Group (AAL, +3.8%). While United missed on both the top and bottom lines in its first quarter, the company said it expects to report its highest quarterly revenue and return to a profit in the second quarter. American also reported a wider per-share loss than analysts were expecting in its first quarter, but it beat on revenue and said it expects to post a pre-tax profit in the second quarter. CFRA Research analyst Colin Scarola maintained a Strong Buy rating on UAL, saying its shares are "materially undervalued." The analyst also kept a Hold rating on AAL. "Low efficiency, much higher debt, and a history of negative free cash flow in 2017-2019 leave us preferring AAL's peers to invest in the post-pandemic travel recovery," Scarola writes in a note.

The Market's Latest Ideas Are in Wall Street's Newest ETFs

Ever find yourself in an investment rut? Well, if you're looking for fresh investment strategies to tickle your brain cells, turn your eyes toward the exchange-traded fund (ETF) industry, where there's always something new.

Indeed, more than 100 ETFs have launched so far in 2022 as the industry sucks up an ever-growing gob of cash – globally, ETFs drew in $305.6 billion in net inflows during the first quarter, marking the second-highest total behind only Q1 2021's record $361.1 billion. That tally also follows 2021's record-breaking annual intake.

"Given back-to-back record-breaking calendar years of net inflows, it is less of a surprise that the supply of ETFs has expanded," says Todd Rosenbluth, head of research at ETF Trends.

Our core ETF recommendations, such as the Kip ETF 20 and the Best ETFs for 2022, are primarily built around established funds and seasoned with the occasional newcomer. But spanking-new ETFs, while unproven, are also worth keeping an eye on given that many of them tend to feature novel investment strategies, emerging industries or cheaper ways to accomplish traditional portfolio goals.

Read on as we highlight nine noteworthy new ETFs that have hit the market in 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.