Stock Market Today: Stocks Start the Week With Sharp Losses

Another big jump in the 10-year Treasury yield weighed on tech stocks, but energy was the worst sector today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

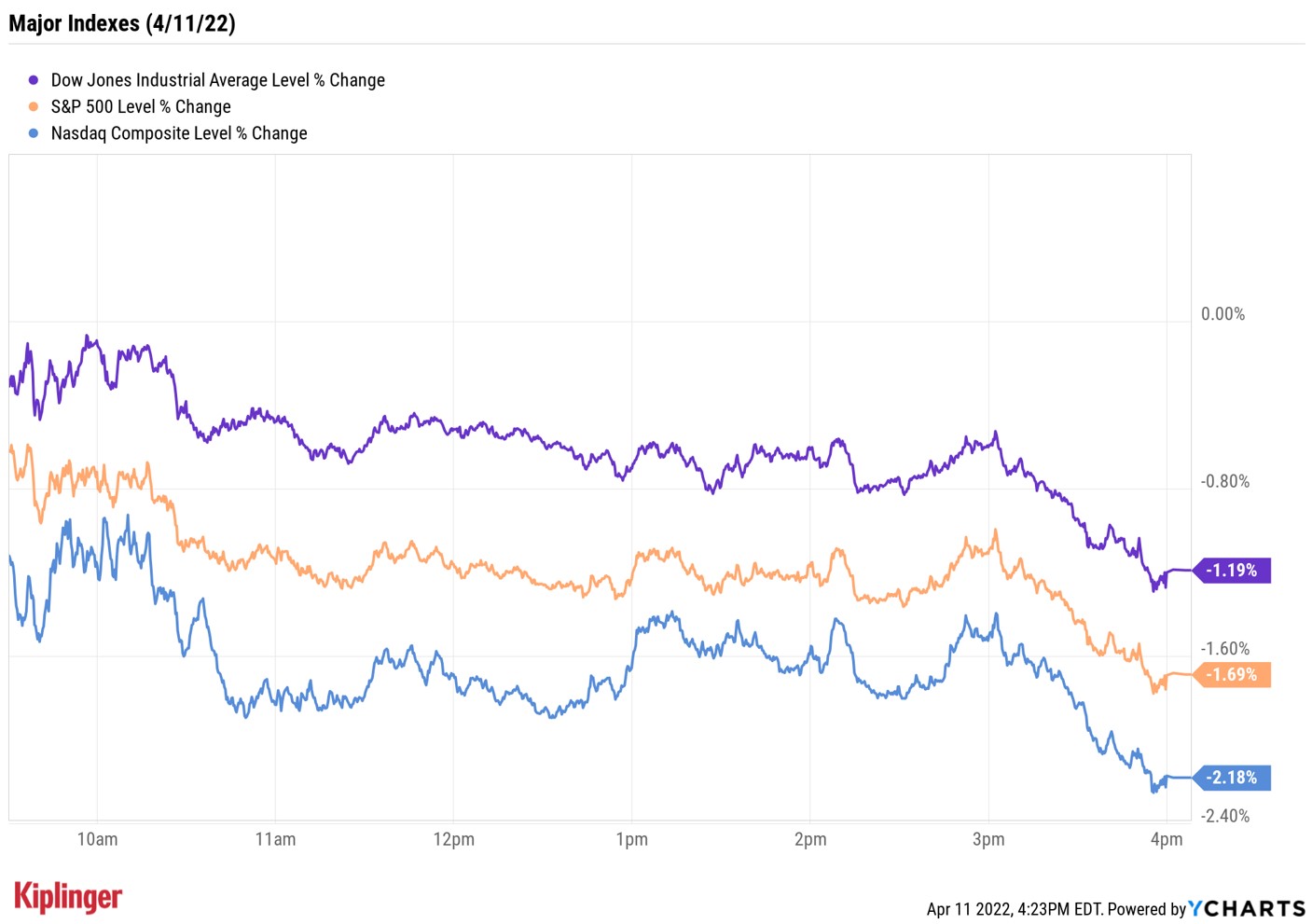

The market began the week just as it ended the last one, with interest rates rising and tech shares selling off.

Indeed, rates rose for a seventh straight day to hit levels not seen in some time. The yield on the 10-year Treasury note spiked 5.7 basis points Monday (a basis point is one-one hundredth of a percentage point) to a three-year high of 2.77%.

Predictably, the technology sector was one of the worst-performing sectors, sinking 2.5%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But it was the energy sector (-3.0%) that led the market lower, hurt by a drop in oil prices. U.S. crude oil futures shed 4% to settle at $94.29 per barrel amid fear that extended COVID-19-related shutdowns in China will sap global energy demand.

The Nasdaq Composite ended the day down 2.2% at 13,411, hurt by weakness in big-cap tech stocks like Microsoft (MSFT, -3.9%) and Nvidia (NVDA, -5.2%). The broader S&P 500 Index (-1.7% at 4,412) and blue-chip Dow Jones Industrial Average (-1.2% at 34,308) likewise finished the session in the red.

As a reminder, it's a short week for traders and investors. The stock market will be closed on April 15 for Good Friday.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.7% to 1,980.

- Gold futures gained 0.1% to settle at $1,948.20 an ounce.

- Bitcoin plunged 6.4% to $40,034.52. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR) stock was down more than 3% at its session low following news that Tesla (TSLA) CEO – and new TWTR stakeholder – Elon Musk would not be joining the social media firm's board of directors, as reported late last week. "Musk's decision to not join the board of Twitter is the culmination of a week of bizarre behavior and is simply a distraction from the many operational woes facing Tesla," says David Trainer, CEO of investment research firm New Constructs. "The Musk bump in Twitter shares is likely to fade as investors realize the only value Musk brought was publicity - not all of it good. Although Twitter remains a popular platform, it has its own problems and suggestions like removing a letter from its name can do more harm than good." TWTR was able to shake off its earlier weakness and end the day up 1.7%.

- AT&T (T) jumped 7.7% after the telecommunications firm's WarnerMedia unit on Friday officially completed its merger with Discovery. (The combined company – Warner Bros Discovery – began trading on the Nasdaq today under the symbol "WBD.") Additionally, J.P. Morgan analyst Philip Cusick resumed coverate on T with an Overweight (Buy) rating. "The company is investing in its wireless network with its 5G build out as well as expanding its fiber footprint to 30 million locations by 2025," Cusick writes in a note. "The network enhancements support wireless subscriber and service revenue growth in Mobility and broadband services in Consumer and Business Wireline."

Earnings Season is About to Begin

Although interest rates have been the market's main driver for months, earnings season will likely steal away traders' attention soon enough. Corporate results start flowing this week, and they're not projected to be as robust as we've come to expect.

"Analysts and companies have been more pessimistic compared to recent quarters in their earnings estimate revisions and earnings outlooks for the first quarter to date," says John Butters, senior earnings analyst at FactSet.

The current estimated earnings growth rate for the S&P 500 is 4.5%, which would mark the lowest earnings growth rate since Q4 2020, Butters says. However, considering that the majority of S&P 500 companies report earnings above estimates, the analyst expects the actual growth rate to top 10% for a fifth consecutive quarter.

JPMorgan Chase (JPM) headlines this week's earnings calendar when it unveils first-quarter results before Wednesday's opening bell, marking a stretch of reporting from a number of Dow Jones stocks and financial firms. Speaking of the latter, high inflation and rising interest rates put financial earnings in particulary sharp focus. Here, we've compiled a list of some of the most compelling plays in the sector, according to Wall Street's pros.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.