Stock Market Today: Stocks Race to Best Weekly Gains Since 2020

A news-light Friday did nothing to snuff stocks' newfound upward momentum, helping the major indexes close with their best weekly gains in more than a year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Friday had little to add to a week of big developments that included the Federal Reserve's first rate hike since 2018 and a slew of improving economic indicators. But it did tack on more equity gains to an already fruitful week.

Today, President Joe Biden sought to dissuade China from aiding Russia in its invasion of Ukraine, laying out potential economic and political consequences to his Chinese counterpart, Xi Jinping, in a nearly two-hour phone call.

Also Friday, the National Association of Realtors said existing-home sales declined in February, by 7.2% to a 6.02 million-unit pace. But Wells Fargo strategists warn that "while it is tempting to blame rising mortgage rates for February's larger-than-expected drop, the decline continues a recent pattern with annualized sales bouncing around from month-to-month."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Technology (+2.1%) and consumer discretionary stocks (+2.1%) continued their relief rally Friday, helping the major indexes maintain their momentum heading into the weekend.

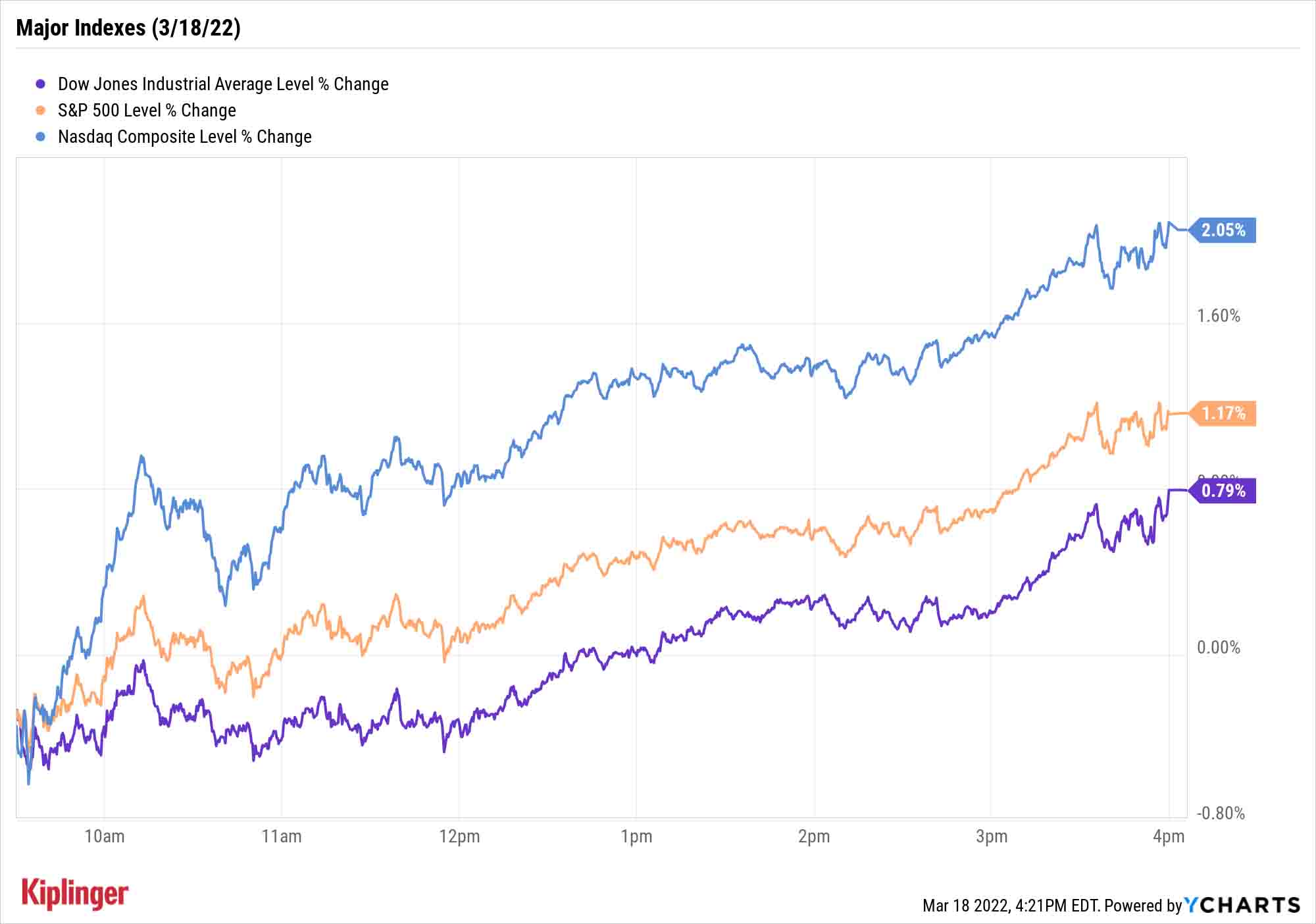

The Dow Jones Industrial Average (+0.8% to 34,754), S&P 500 (+1.2% to 4,463) and Nasdaq Composite (+2.1% to 13,893) all finished with their heads well above water.

That resulted in weekly 5.5% and 6.2% gains for the Dow and S&P 500, respectively, both of which enjoyed their best weekly improvements since November 2020. That also was true of the Nasdaq, which closed out the week up 8.2%.

Other news in the stock market today:

- The small-cap Russell 2000 closed 1.0% higher to 2,086.

- U.S. crude oil futures improved by 1.7% to finish at $104.70 per barrel, ending the week with a 4.2% gain.

- Gold futures declined 0.7% to settle at $1,929.30 per ounce, posting a 2.8% weekly loss.

- Bitcoin strengthened into the close, climbing by 3.3% to $42,240.62. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Boeing (BA, +1.4%) shares closed in the green amid a Reuters report that the firm is nearing a deal with Delta Air Lines (DAL) to secure as many as a hundred 737 Max 10 jets, according to people familiar with the matter. Reuters notes this would be "the first order from Delta for Boeing's best-selling single-aisle airplane family, and the first major Boeing order for the carrier in a decade."

Use Big Dividends to Battle High Inflation

One clear takeaway from this week: Higher interest rates are here, and more of the same is on the way.

"Coming exactly one week after the end of the quantitative easing (QE) process, the Fed is embarking upon a clear move higher in rates and is signaling future balance sheet reductions (likely beginning sometime in the summer)," says Rick Rieder, BlackRock's chief investment officer of global fixed income. "Many economic projections had the Fed not hiking rates until late 2023 and maybe not until 2024, and more recently, projections for 2022 rate hikes surged from no hikes to seven hikes by many."

That includes Kiplinger, which expects six more quarter-point hikes by 2022's end.

We mentioned earlier this week that dividend growth is one way to position your portfolio for outperformance in such an environment. Another related tactic is to seek out high overall yield – investments that throw off so much income that rising rates on bonds are still little match for them.

Indeed, research from ETF provider Global X notes that "in 7 out of the 10 rising interest rate periods since 1960, high dividend stocks outperformed the S&P 500."

High-single-digit dividends can be found in several market niches, like master limited partnerships (MLPs) or mortgage real estate investment trusts (mREITs). There are only a few dozen publicly traded options for these, but their special business structures or underlying rules allow them to deliver oversized dividends.

Another particularly interesting source of high yield is the business development company (BDC) – a private equity-esque company designed to provide capital to small and midsized businesses, and that, like REITs, must distribute at least 90% of taxable income back to shareholders as dividends. Here, we look at five BDCs yielding between 6.2% and 11.6%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.