Stock Market Today: Stocks Soar as Fed Hikes Rates

The Fed raised its key interest rate as expected and projected several more rate increases this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

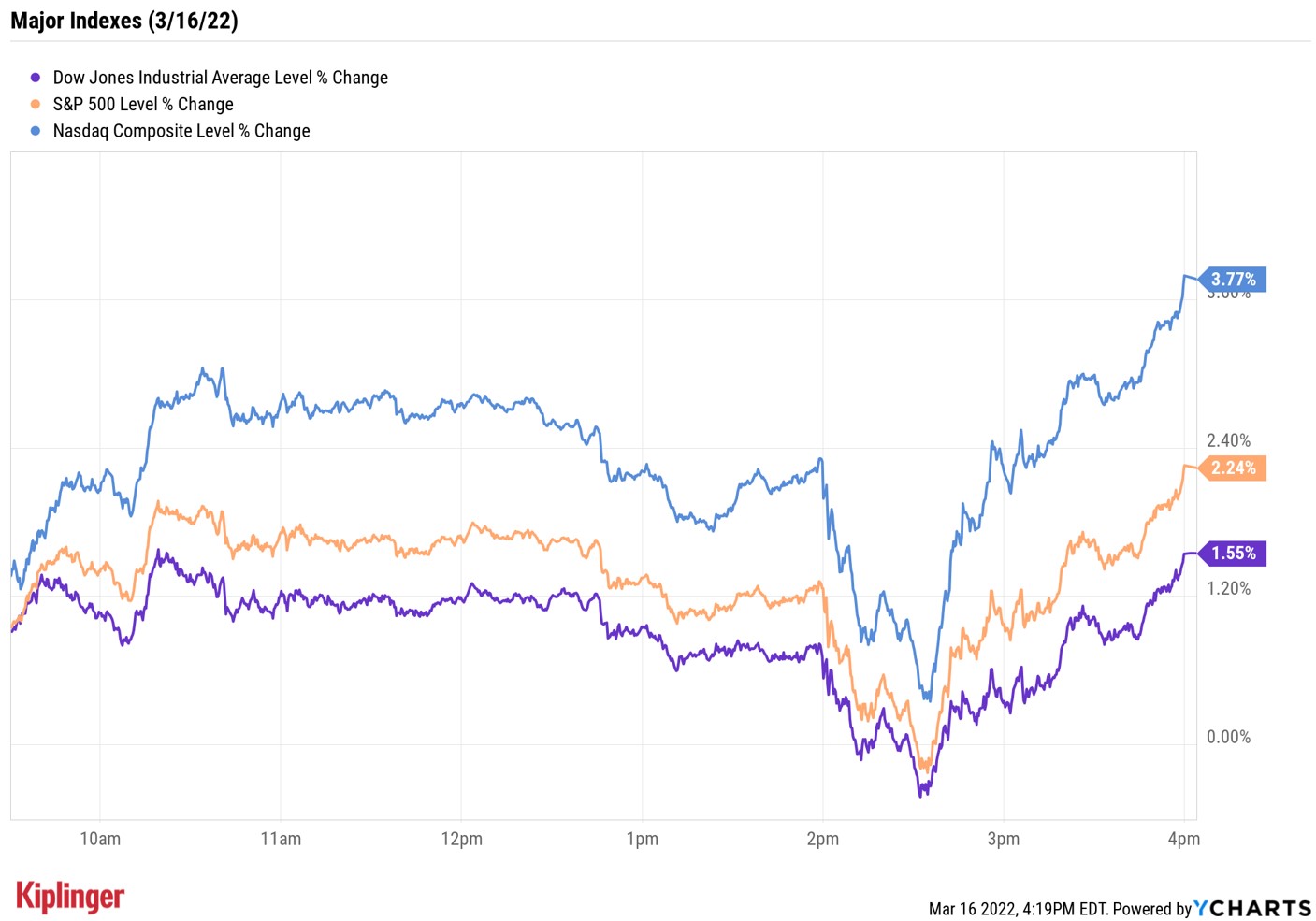

Stocks started the day on solid footing, with the three major benchmarks all sporting gains of at least 1.5% in the lead-up to the Federal Open Market Committee's (FOMC) mid-afternoon policy announcement.

Trading got dicey in the immediate aftermath of the Fed's decision, though, with markets paring some of this earlier upside.

The central bank raised its key interest rate by 25 basis points – a basis point is one-one hundredth of a percentage point – or 0.25%, as widely expected, and forecast at least six additional rate hikes this year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Today's Fed meeting offered some level of clarity to investors in that they are no longer waiting to make significant steps to tighten current monetary policy," says Charlie Ripley, senior market strategist for Allianz Investment Management.

And the updated version of the Fed's economic projections and forecasts for policy rates "emphasizes an urgency coming from the Fed" and "a level of hawkishness" we have not seen for some time, Ripley adds.

The major benchmarks quickly shook off this post-meeting dip to rally hard into the close. The Nasdaq Composite outpaced its peers, surging 3.8% to 13,436, as Chinese tech stocks like Pinduoduo (PDD, +56.1%) and Baidu (BIDU, +39.2%) bounced back after several days of sharp selling.

The S&P 500 Index (+2.2% at 4,357) and the Dow Jones Industrial Composite (+1.6% at 34,063) also finished the day with impressive gains.

Other news in the stock market today:

- The small-cap Russell 2000 surged 3.1% to 2,030.

- U.S. crude futures fell for a third straight day, retreating 1.5% to settle at $95.04 per barrel.

- Gold futures shed 1.1% to finish at $1,909.20 an ounce.

- Bitcoin jumped 2.7% to $40,844.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Starbucks (SBUX) gained 5.2% after Kevin Johnson announced he would step down as CEO after five years in the top spot. Johnson will be replaced on an interim basis by founder and former CEO Howard Schultz.

- Micron Technology (MU, +9.0%) got a big boost after Bernstein analyst Mark Li upgraded the chipmaker to Outperform from Underperform (the equivalents of Buy and Sell, respectively), saying Russia's invasion of Ukraine will likely not be disruptive to the DRAM market. The analyst also expects DRAM prices to rise later this year.

Don't Fear the Fed

While Wall Street has collectively fretted over the expected resumption of rate hikes during the past few months, investors shouldn't automatically fear this shift in Fed policy.

"Investors need to remember that Fed rate hikes usually happen near the middle of the economic cycle, with potentially years left of gains in stocks and the economy," says Ryan Detrick, chief market strategist for LPL Financial. "In fact, a year after the first hike in a cycle has been fairly strong."

Specifically, across the six times the Fed has started a rate-hiking cycle between 1988 and 2015, the S&P 500 has averaged nearly 14% gains over the subsequent 12 months.

Still, investors looking to give themselves an even better chance of success in the current environment might look toward dividend-growth stocks. Their rising payouts help counter the effects of inflation and keep their yields more competitive with bonds … and better still, they historically outperform regardless of rates' direction.

Some investors prefer aggressive dividend growers – like these 14 stocks that have doubled their payouts of late – as they can be a way to rapidly improve your portfolio yield. Others, however, prefer a track record of reliability, which typically leads them to the ranks of the Dividend Aristocrats and their decades of dividend growth. But even within these 66 stocks are a number of cliques for investors looking to achieve different goals.

Today, we've highlighted five stocks for those looking for a little calm amid the market's choppy waters – in addition to dividend prowess, they also boast extremely low volatility compared to both the broader market and their Aristocrat peers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.