3 MLPs Throwing Off Massive 8%-9% Yields

Energy master limited partnerships (MLPs), largely responsible for energy transportation and storage, offer up some of the market's largest payouts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you've had to fill up your gas tank or heat your home lately (so, most of us), you might have noticed that your wallet is a lot lighter than usual. That's because oil and gas prices have been surging over the past few months amid a perfect storm of supply-demand imbalances and rising geopolitical tensions.

But while these pressures have been miserable for consumers, they have been a boon to energy stocks, including energy master limited partnerships (MLPs).

MLPs, which first began to form in the 1980s, are a type of "pass-through entity." That's because their income isn't taxed at the corporate level, and is instead "passed through" directly to owners and investors via dividend-esque "distributions." This system typically results in much-higher-than-average yields, often in the 7%-9% range.

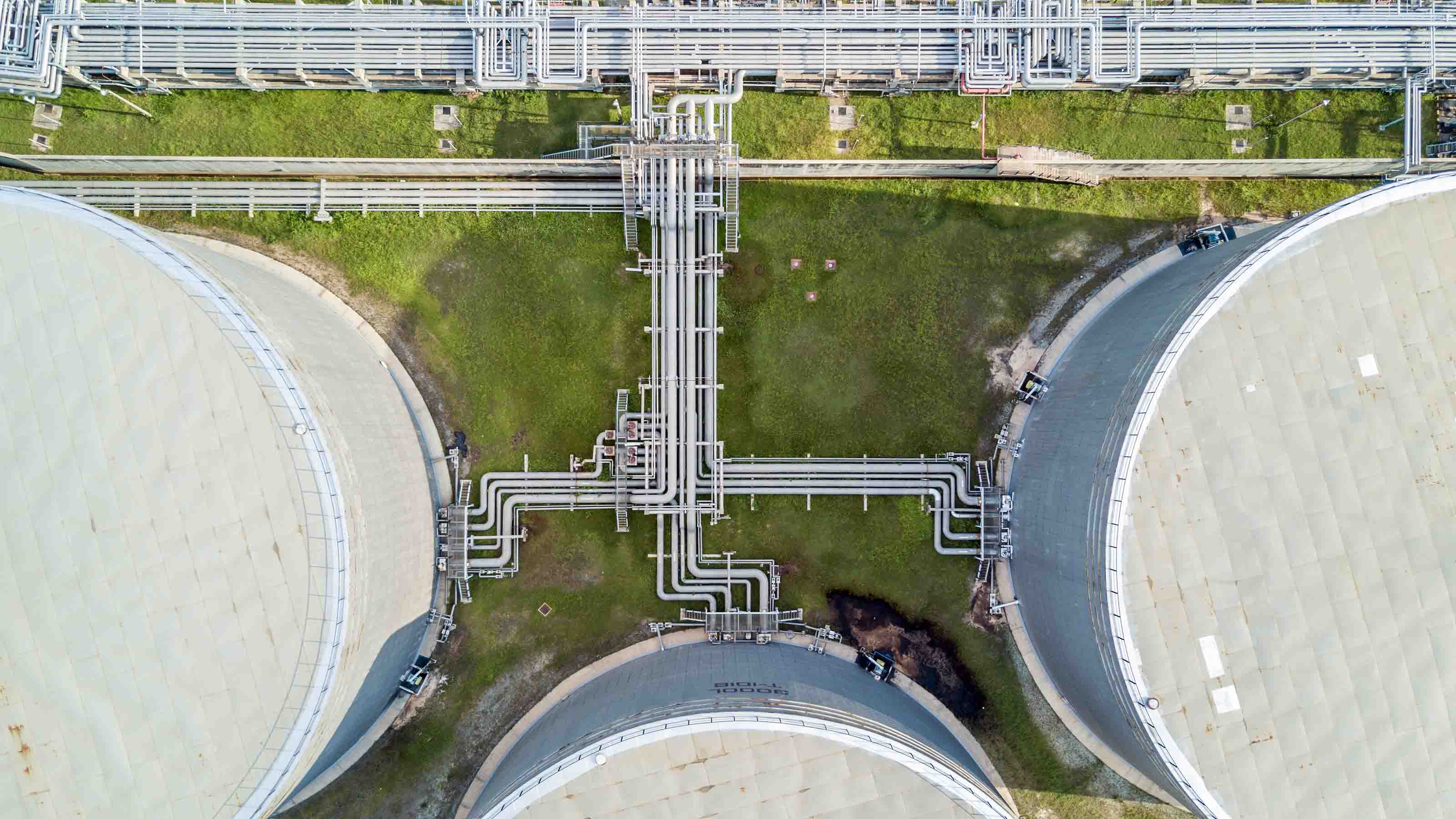

Better still, because of what they own – most energy MLPs hold midstream infrastructure such as pipelines and storage facilities – depreciation and other deductions tend to greatly exceed taxable income. That means much of an MLP's cash distributions will be tax-deferred. There is one downside: You'll typically have to deal with complicated K-1 tax forms each year. But for many, the income is worth it.

Here, we will look at three MLPs currently yielding between 8% and 9%. Thanks to recent changes to the tax code, the MLP world has been shrinking threw corporate reorganizations. These three partnerships represent some of the top choices among the remaining options.

Data is as of Feb. 23. Distribution yields are calculated by annualizing the most recent distribution and dividing by the unit price.

Enterprise Products Partners LP

- Market value: $51.1 billion

- Distribution yield: 8.0%

Scale and scope are a major advantage for MLPs as it pertains to finding new ways to generate cash flows, and to keeping the cash flowing. Enterprise Products Partners LP (EPD, $23.41) has these qualities in spades.

EPD is one of the largest midstream energy companies in America, boasting roughly 50,000 miles of pipelines transporting crude oil, natural gas, natural gas liquids (NGLs) and refined products. On top of that, it controls assets such as barges, coal terminals and several key shipping docks and ports along the Gulf Coast. This includes one of the only facilities approved to export ethane and other fuels to ports outside the U.S.

This size and diversification has provided EPD with relatively strong and stable cash flows, which it has used to grow its distribution for 23 consecutive years. The latest quarterly payout was a 46.5-cent distribution representing a 3.33% increase from 2021. As of the fourth quarter, EPD had a healthy DCF coverage ratio of 1.6. (Distributable cash flow, or DCF, is the amount of cash that's left over to share with unitholders after expenditures and other expenses.)

Enterprise Products Partners is working to improve its scale further, too. In January, the company bought privately held Navitas Midstream Partners for $3.25 billion in cash. EPD now has access to 1,750 miles of pipelines and cryogenic natural gas processing facilities right in the prolific Permian Basin. This gives Enterprise Products Partners a significant foothold in an area that has plenty of production upside.

"We expect the company to post strong revenue and EBITDA in any energy market environment, and to maintain a healthy balance sheet with below-industry-average leverage," say Argus Research analysts, who rate the stock at Buy. "We also expect EPD to benefit from continued recovery in gathering and processing volumes, new growth projects, and the planned acquisition of Navitas Midstream Partners."

Magellan Midstream Partners LP

- Market value: $9.8 billion

- Distribution yield: 9.0%

The key to Magellan Midstream Partners LP's (MMP, $46.20) long-term success has been its "oily" focus and some of the most conservative management in the business.

Magellan is a large pure-play in the transportation raw crude oil and various refined products including gasoline and jet fuel. It does so through 2,200 miles of crude-oil pipelines, as well as 9,800 miles of refined-product pipelines. Its other facilities include 81 refined-product terminals, storage facilities and a condensate splitter. Many of these are located in areas such as Cushing, Oklahoma – the "pipeline capital of the world."

The business model is fairly simple. Energy producers book time on its pipeline system to get their products to refiners and/or end users, and these refiners and end users book time on the system to get their products to market. MMP gets a check based on the volumes flowing through its pipes and sitting in its storage tanks.

While other rivals meandered more into natural gas and other energy products during boom years, MMP added more oil-focused projects to its umbrella. And during the pandemic, management ridded itself of noncore assets and bought back units.

"We continue to favor MMP's conservative financial profile, modest distribution growth and equity repurchase activity," say Stifel analysts, who rate the stock at Buy.

Magellan's main selling point is, of course, the distribution. For years, the company raised its payout every quarter – while that practice stopped during the pandemic, the company did return to hikes with a 1% improvement announced in October 2021. Its $1.0375-per-unit distribution translates into a yield of 9% – and MMP has 1.2 times the amount of DCF it needs to cover that payout.

Holly Energy Partners LP

- Market value: $1.8 billion

- Distribution yield: 8.4%

Most MLPs are set up for a distinct purpose. For instance, an energy producer might form a partnership, then place all of their gathering lines inside it to reap the tax benefits. Such is the case with Holly Energy Partners (HEP, $16.72).

HEP was formed by refiner HollyFrontier (HFC) to hold pipelines, storage terminals, and other assets that directly feed its own refineries. As such, Holly Energy effectively receives about 70% of its revenues from serving HollyFrontier and other affiliates, with the rest coming from third-party relationships. This situation has largely been great for both parties, as refineries need a constant flow of oil to crack into gasoline, diesel and jet fuel.

"Holly Energy Partners has long-benefited from a strong strategic relationship with its sponsor that is backed by substantial [minimum volume commitments], shielding it from broader macro volatility," say Raymond James analysts, who rate the stock at Outperform (equivalent of Buy).

Not that it's invincible by any means. The pandemic forced HEP to slash its distribution by 48 cents to 35 cents per unit. However, demand is rising and both companies are on better footing now; Holly Energy had about twice the distributable cash flow it needed to cover the distribution as of the start of 2022.

For those worried about the lack of diversification, HEP has continued to seek expansion efforts and reduce its reliance on its refiner parent. This has included new joint ventures with Plains All-American Pipeline (PAA) and expansion efforts along its system.

Yes, HEP remains a riskier pick than the aforementioned EPD and MMP. But it might be one of the best MLPs for bargain hunters, as it features a dirt-cheap price-to-free-cash-flow ratio of less than 8 – cheaper than our other two picks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Municipal Bonds Stand Firm

Municipal Bonds Stand FirmIf you have the cash to invest, municipal bonds are a worthy alternative to CDs or Treasuries – even as they stare down credit-market Armageddon.

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.