Stock Market Today: Energy Soars as Russia-Ukraine Volatility Resumes

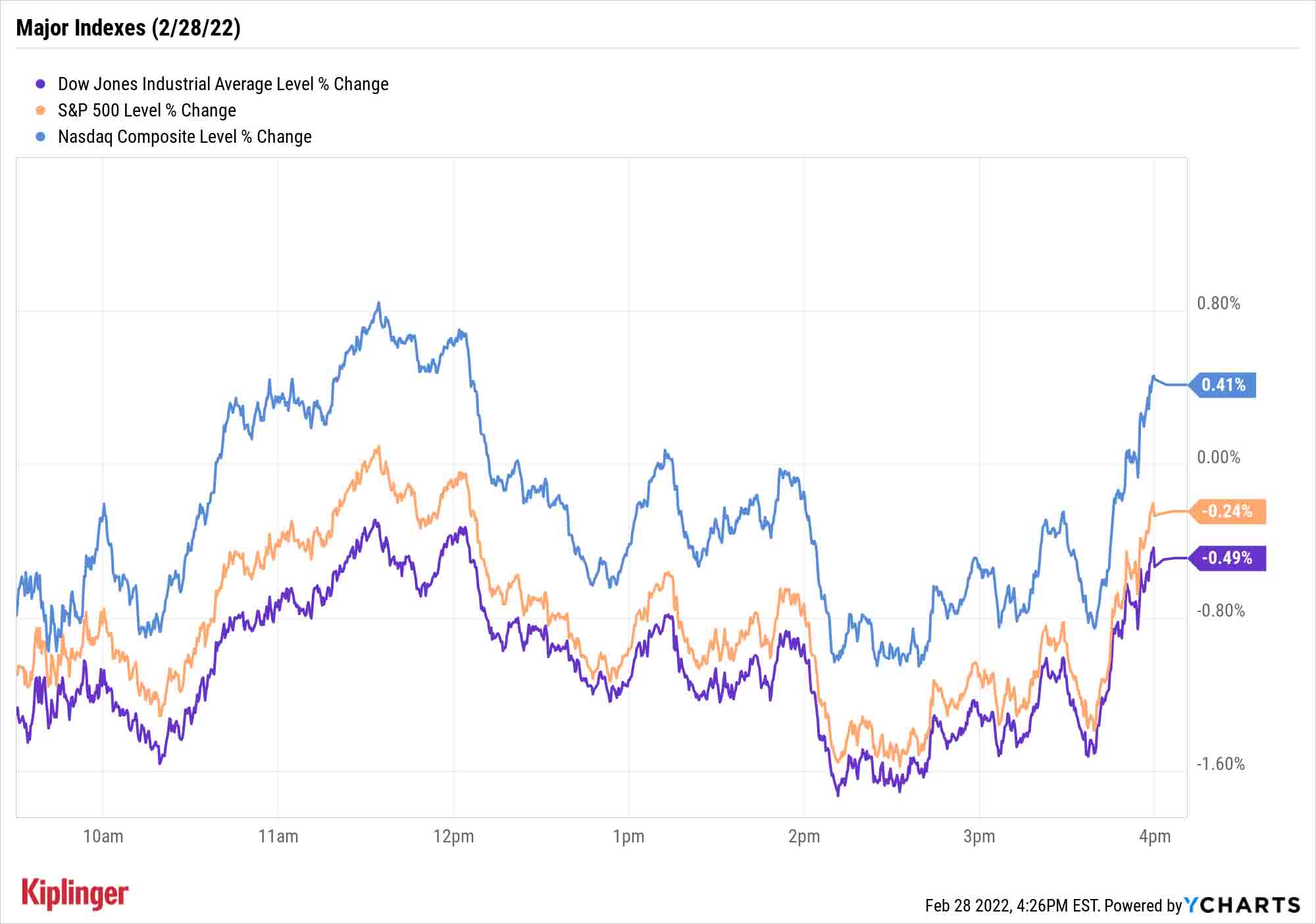

The major indexes put up mixed results Monday as investors digested a weekend's worth of sanctions, military actions and other changes in the Russia-Ukraine conflict.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

American stock markets were volatile again Monday as investors processed a laundry list of new developments in Russia's invasion of Ukraine.

Among those events: The U.S. and European nations have largely coalesced around the Ukrainian cause, providing varying military aid as well as isolating Russia through numerous new sanctions, including banning some Russian banks from using the SWIFT system that enables financial firms to settle cross-border transactions.

Also, as we mentioned in our free A Step Ahead e-letter, these efforts extended to the public markets. On Sunday, BP (BP, -5.0%) said it would exit a nearly 20% stake in Russian oil giant Rosneft, and on Monday, Shell (SHEL, -3.4%) announced it would exit all Russian operations, including a liquefied natural gas plant part-owned by Russia's Gazprom.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Regardless, it was still a great day for energy, which was the strongest S&P 500 market sector at 2.5%. U.S. crude oil futures rocketed 4.5% higher, to $95.72 per barrel, while Brent (global) crude topped $100 per barrel – lifting U.S. exploration and production companies such as Occidental Petroleum (OXY, +12.9%) and EOG Resources (EOG, +7.1%).

Meanwhile, the New York Stock Exchange and Nasdaq temporarily halted trading in several Russian stocks, and broad baskets of Russian equities – including the VanEck Russia ETF (RSX, -30.5%) and iShares MSCI Russia ETF (ERUS, -27.9%) – plunged.

The major indexes fininshed Monday in mixed fashion. The Dow Jones Industrial Average was off 0.5% to 33,892.60, closing down 3.5% across February. The S&P 500 lost a modest 0.2% to 4,373.94, declining 3.1% for the month. And the Nasdaq Composite managed to end the session up 0.4% to 13,751.40, checking out of February with a 3.4% drop.

One thing to watch going forward, say Jason Pride and Michael Reynolds, CIO of private wealth and vice president of investment strategy, respectively, at investment firm Glenmede, are additional supply-chain disruptions.

"The European Union relies on Russia for more than a third of its natural gas supply. Also, Russia and Ukraine combined account for a quarter of global wheat exports," they say. "Additionally, Ukraine is the source of 90% of the world's semiconductor-grade neon and Russia is responsible for 24% of palladium exports. Such large presence in these markets could cause more disruptions to already strained supply chains."

Other news in the stock market today:

- The small-cap Russell 2000 also managed a 0.4% improvement, to 2,048, finishing February better than its large-cap index cousins with a 1.0% gain.

- Gold futures edged up 0.7% to finish at $1,900.70, bringing their monthly gain to 5.8%.

- Bitcoin made an aggressive 7.2% advance to $41,937.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Block (SQ) jumped 6.4% after BMO Capital Research analyst James Fotheringham upgraded the fintech stock to Outperform from Market Perform (the equivalents of Buy and Hold, respectively). The analyst expects Block's May 18 investor day to be a potentially positive catalyst for the stock, and expects Square to turn in earnings and growth beats. "Our SQ model is more bullish than consensus due to out-year forecasts for a softer landing for Cash App (faster user growth and broader product monetization) and Afterpay accretion to revenue growth (+2%) and earnings per share (+4%)," Fotheringham says.

- Defense stocks caught a bid as Russia's attack continued. Additionally, among countries increasing aid to Ukraine was Germany, which said it would send 1,000 anti-tank weapons and 500 Stinger missiles. Germany also annnounced it would lift its defense spending above 2% of gross domestic product (GDP) from its 2021 estimated level of 1.53%, per NATO statistics. Raytheon Technologies (RTX, +4.7%), Northrup Grumman (NOC, +7.9%) and Lockheed Martin (LMT, +6.7%) were among those that finished higher.

The 25 Most Popular Blue Chips Among Hedge Funds

Every quarter, we take a long gander at what Wall Street's "smart money" is up to.

Naturally, Warren Buffett tends to dominate the spotlight – his Berkshire Hathaway equity portfolio is regularly scrutinized by those wondering what the world's most famous investor is buying and selling from one quarter to the next.

But we also look at which stocks have garnered the most attention from the hedge fund community.

Yes, hedge funds as a whole actually have a pretty poor long-term track record, but given their collective resources, monitoring their most popular ideas can still be educational. And let's give theim their due: Hedge funds are having a market-beating 2022 – which one would expect, as their hedging strategies are designed to limit downside risk. Unsurprisingly, hedge fund managers are elbow-deep in blue-chip stocks, as their massive market capitalizations and liquidity allow institutional investors to buy and sell in large quantities without drastically affecting pricing in those stocks.

Here, we look at the 25 blue chips that these smart-money managers are stashing away.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.