Stock Market Today: Earnings Help Stocks Muscle Higher Into the Close

The major indexes, prone to afternoon lulls of late, regained their momentum and finished strong Tuesday thanks to Amgen, Peloton and others.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Another slow-news session saw stocks rebound considerably from yesterday's slippage – then dodge what was shaping up to be another afternoon swoon.

With little on the data front, most eyes were on the earnings calendar, which provided a few fireworks. Peloton Interactive (PTON, +25.3%), for instance, reported a quarterly loss and hacked down its full-year revenue guidance – but shares still surged as the fitness company announced it would slash nearly $800 million in annual costs, including cutting 2,800 jobs, and said it would replace CEO John Foley.

"We believe Foley leaving the CEO post and moving to executive chair (being replaced by former Spotify and Netflix CFO [Barry McCarthy]) sets up a fork in the road path for Peloton in the months ahead," says Wedbush analyst Daniel Ives. "While Foley has supermajority B shares and ultimately controls the fate of Peloton, we believe shareholder pressure will build to solicit bids and sell Peloton to a strategic player with potential bidders Apple, Amazon, and Nike likely in the fold."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That helped at least temporarily stanch more than a year of bleeding, though PTON shares remain off by 76% from their January 2021 highs.

Pfizer (PFE, -2.8%) declined on the back of a fourth-quarter revenue miss, though profits beat expectations by 24% and the company said it expects record revenues in 2022.

And shares of Amgen (AMGN, +7.8%) rocketed higher after the company gave a bullish very-long-term outlook, predicting adjusted profits would grow by high single digits to low double digits through 2030. The biotech stock also said it would buy back $6 billion in its own shares during Q1 2022.

The mostly optimistic earnings news sent stocks higher early, but that has hardly been an accurate gauge of where they'd finish in this turbulent trading year.

"Over the last few weeks, the final hour of trade has been very volatile, and on multiple occasions we've seen the day's gain/losses quickly evaporate," says Michael Reinking, senior market strategist for the New York Stock Exchange.

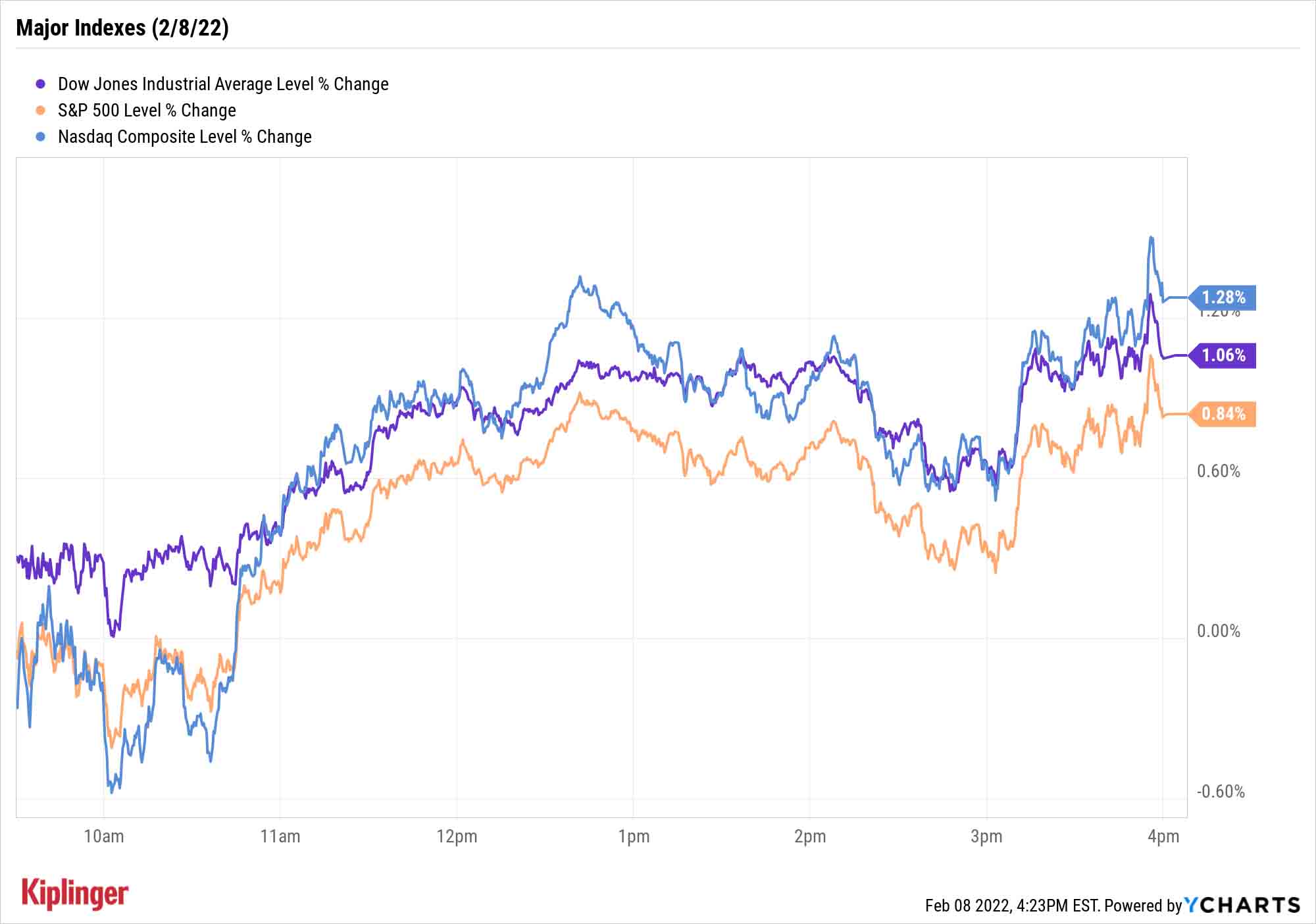

Still, stocks managed to survive a brief afternoon downturn and finish near their highs for the day. The Dow Jones Industrial Average closed up 1.1% to 35,462, the S&P 500 improved by 0.8% to 4,521 and the Nasdaq Composite gained 1.3% to 14,194.

Other news in the stock market today:

- The small-cap Russell 2000 advanced 1.6% to 2,045.

- U.S. crude futures slumped 2.2% to settle at $89.36 per barrel.

- Gold futures edged up 0.3% to finish at $1,827.90 an ounce.

- Bitcoin mustered a 0.1% gain to $44,224.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Fiserv (FISV) fell 6.0% after its quarterly results. In its fourth quarter, the fintech firm reported adjusted eanrings of $1.57 per share on $4.02 billion in revenue, up 21% and 11%, respectively, on a year-over-year basis. Analysts, meanwhile, were calling for earnings of $1.56 per share on $4.03 billion in sales. Susquehanna Financial Group analyst James Friedman maintained a Positive (Buy) rating on FISV after earnings. The company's earnings call "sounded more constructive to us, with Clover maintaining hyper-growth, numerous new banks starting to board and continued improvement in Carat. At these depressed levels we think there is a lot of overlooked optionality in the FISV shares.

- Harley-Davidson (HOG) was a big earnings winner, with the stock spiking 15.5% in the wake of its results. For its fourth quarter, the motorcycle company reported a profit of 14 cents per share compared to analysts' consensus estimate for a per-share loss of 37 cents. HOG also said revenue rose 40% year-over-year to $1.02 billion. Analysts were expecting the company to report $663.84 million in sales.

Could Fed Rate Hikes Spark a Value Rally?

Markets' herky-jerky start to 2022 might reasonably have many investors on their guard, but smoother sailing might be on the horizon.

Namely, one of the biggest drivers of volatility of late – worries about the Federal Reserve starting an aggressive bout of rate hikes this year – could be a boon, at least for certain parts of the market.

"While the commencement of a Fed hiking cycle has historically led to volatility in the equity markets, we find that sector selectivity and investible horizon remain key during these periods," says Gargi Chaudhuri, head of iShares Investment Strategy, Americas. "While the average performance three months prior to the start of a rate hiking cycle can be muted, our research shows that performance in the 12 months following the start of the cycle can be meaningfully higher, especially in sectors that are more sensitive to rising rates such as financials, energy and overall value sectors of the market."

That's especially good news for new buyers of truly value-priced stocks from these and other sectors, as they not only offer attractive entry points at the moment – but in many cases, higher-than-average yields thanks to still-depressed prices.

Today, we've dug into seven dividend stocks that are trading well below their own historical averages and offer more income than the broader market. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.