Stock Market Today: Apple Lifts Stocks to Cap Wild Week

Apple's raucous post-earnings rally Friday helped the major indexes secure weekly gains from a volatile five-day stretch.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If nothing else, the stock market was tenaciously consistent in its inconsistency this week. Stocks managed to finish up Friday, but not before a fifth consecutive session that saw stocks close far differently than how they opened.

The fourth-quarter earnings season did much of the driving today. First and foremost was Wall Street's largest company – $2.7 trillion Apple (AAPL, +7.0%), which announced record quarterly revenues and 25% earnings growth, beating analysts' estimates on both the top and bottom lines.

"We would characterize this quarter as a "stunner" on iPhone/Services demand and Cupertino's ability to navigate a supply chain shortage in almost Teflon-like fashion," says Wedbush analyst Daniel Ives, who reiterated his Outperform rating and $200 price target.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Visa (V, +10.6%) and Mastercard (MA, +9.2%) both surged on the former's Q4 report, which saw the credit-card processor eclipse $7 billion in quarterly sales for the first time and easily beat revenue and profit expectations.

Chevron (CVX, -3.5%) provided some drag, however, after reporting a mixed final quarter of 2021; revenues of $48.1 billion were better than expected, but net income of $2.56 per share was woefully shy of Wall Street's bar, set at $3.12 per share.

Also Friday, the Bureau of Labor Statistics said that employment costs grew 1.0% during the fourth quarter – below expectations for 1.2% and a slower pace than Q3's 1.3%. Meanwhile wages increased 4.5% year-over-year, and benefit costs rose 2.8%.

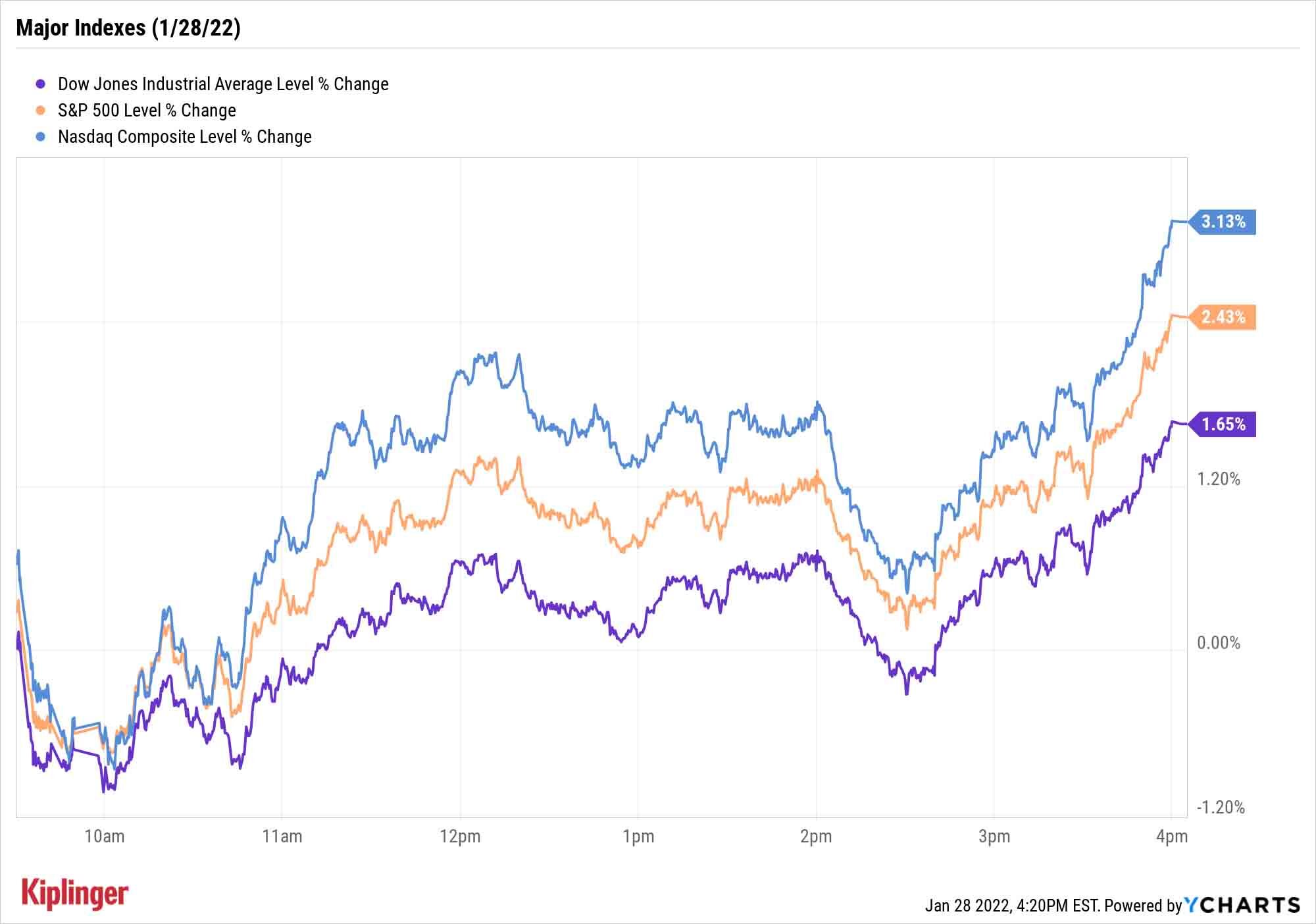

The Nasdaq Composite was Friday's biggest winner, up 3.1% to 13,770, while the S&P 500 (+2.4% to 4,431) and Dow Jones Indsutrial Average (+1.7% to 34,725) also advanced. And with Friday's rally, all three indexes secured weekly gains.

Today was more exception than rule in that Wall Street largely hasn't responded well to what has been a decent (albeit not stellar) showing from corporate America. According to FactSet, 77% of S&P 500 companies beating earnings-per-share estimates for Q4, slightly above the five-year average of 76%.

"The upshot is that the recent market correction likely cooled expectations, so the back half of this reporting period could feature better post-earnings stock performances," says Lindsey Bell, chief markets and money strategist for Ally Invest.

"We find the Information Technology sector particularly interesting. Tech shares entered earnings season down 11% for the year, and Q4 EPS growth estimates barely budged. Sales growth is expected to be strong at more than 9% from a year ago, while the sector's EBIT margin will continue to be market-leading at above 30%. With valuations declining for many tech stocks heading into earnings season, good results could help stabilize the market."

Other news in the stock market today:

- The small-cap Russell 2000 popped 1.9% to 1,968.

- U.S. crude oil futures rose 0.2% to end at $86.82 per barrel. For the week, crude oil futures jumped 2%, marking their sixth straight weekly gain.

- Gold futures gave back 0.5% to settle at $1,786.60 an ounce, bringing their weekly deficit to 2%.

- Bitcoin roared back to life on Friday, jumping 6.2% to $37,772.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Robinhood Markets (HOOD) was down more than 14% at its intraday low as investors reacted to lower-than-expected monthly active users (MAUs) in the brokerage platforms first quarter (17.3 million actual vs. 19.8 million expected) and a disappointing first-quarter revenue outlook (the company expects $340 million in sales, down 35% year-over-year, and well below the consensus forecast for $448.2 million). However, HOOD stock swung to a 9.7% gain by the close, with many pointing to the firm's new slate of upcoming product launches, including a crypto wallet. Mizuho Securities analyst Dan Dolev (Buy) called the initial reaction "knee-jerk," and pointed to early signs of stabilizing MAUs and average revenue per user (ARPU) as "notable positives."We expect a further stabilization of the business as the year progresses," he writes.

- Caterpillar (CAT, -5.2%) was the worst Dow Jones stock today following its earnings report. In its fourth quarter, the construction equipment maker reported adjusted earnings of $2.69 per share on $13.8 billion in revenues, higher than the $2.26 per share and $13.2 billion analysts were expecting. The data points that stuck in investors' craw, though, were surging operating costs (+23.7% year-over-year to $12.2 billion) which dragged on operating margin (down to 11.7% from 12.3%).

The Case for Wall Street's Worst Stocks?

Despite Friday's improvements, January likely will finish as a downright lousy month for equities. The Dow is off 4.4%, the S&P 500 is down 7.0%, the Nasdaq is in correction territory at 12.0% declines, and the Russell 2000 (in a bear market from its Nov. 8 highs) has lost 12.3% in 2022.

But those indexes are really nothing more than averages – and within those averages, many stocks have performed much better and several have performed far, far worse.

Consider the Russell 3000, which includes the 3,000 largest U.S.-listed companies by market capitalization. Within this index, 835 stocks have fallen by at least 20% year-to-date, according to S&P Global Market Intelligence data. And going back a little farther, a whopping 262 have seen their shares cut by at least half over the past three months.

Thing is, while many investors' instincts might be to shield themselves from recent volatility by diving into defensive stocks or bond funds, a few opportunists might consider extending their arms and trying to catch one or two of these falling knives.

Many of these plummeting names are expected to continue hurtling toward the earth, but equity analysts are almost surprisingly sunny about a handful of crashing stocks. We look at seven in particular that, despite losing at least 50% of their value over the past quarter or so, Wall Street views as high-conviction buys.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.