Stock Market Today: Nasdaq Sinks Again, Ends Worst Week Since 2020

A negative earnings reaction for Netflix (NFLX) and options expiration sparked a volatile session for stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks ended the holiday-shortened week (markets were closed Monday for Martin Luther King Jr. Day) how they started it – deep in the red.

And, as with Tuesday's trading, the bearish catalyst today was corporate earnings; specifically, dismal results from streaming giant Netflix (NFLX, -21.8%), which reported lower-than-expected subscriber numbers for its fourth quarter and forecast slowing subscriber growth in Q1.

"Investors are finally recognizing a huge risk that has been lurking around Netflix for years and that is increased competition in the streaming space," says David Trainer, CEO of Nashville-based investment research firm New Constructs. "Netflix has lost its first mover advantage in the streaming space and Disney (DIS) is its biggest threat."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Another possible culprit behind today's huge volatility is options expiration. "The options market has become critically important to stock investors, even if they don't trade options," says Michael Oyster, chief investment officer for asset-management firm Options Solutions.

"Friday's options expiration was the second-largest on record as $1.3 trillion of equity options expired. This impacted how stocks behaved and drove many prices higher or lower based on options action."

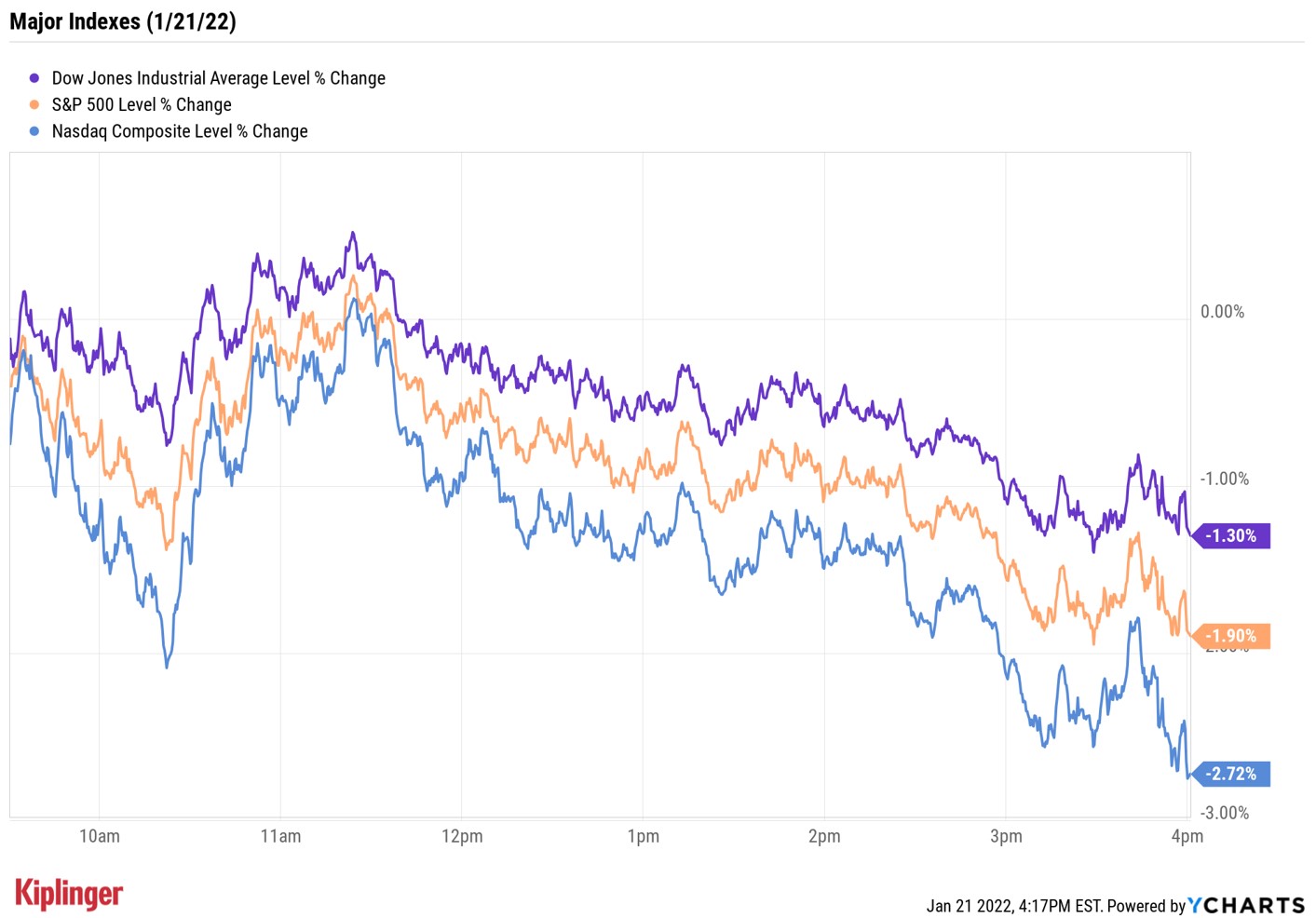

Despite a brief midday pop into positive territory, the Nasdaq Composite ended the day down 2.7% at 13,768 – marking its first close below 14,000 since June 9 – the S&P 500 Index was off 1.9% at 4,397 and the Dow Jones Industrial Average was 1.3% lower at 34,265.

What's more, the Nasdaq suffered its worst weekly loss since March 2020 (-7.6%), while the S&P 500 and Dow also ended sharply lower on a weekly basis (-5.7%, -4.6%, respectively).

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.6% to land at 1,987.

- U.S. crude oil futures followed equity markets lower, though they still finished with just a modest 0.5% decline to $85.14 per barrel. Oil futures also secured a fifth consecutive weekly gain.

- Gold futures similarly notched a weekly finish in the green despite slipping 0.6% to $1,831 per share.

- Bitcoin continued its 2022 slide, suffering a severe 10.3% plunge to $38,328.63, its lowest level since August 2021. "It is already difficult to interpret the trend of traditional currencies, let alone that of cryptocurrencies that, historically, have always been characterized by very strong volatility. Sometimes a tweet is enough to hit a record," says Eloisa Marchesoni, an angel investor and cryptocurrency consultant. She cites the Federal Reserve's interest-rate signaling, as well as the worsening situation in Kazakhstan (the second-largest Bitcoin miner behind the U.S.), among Bitcoin's woes, but adds that "these are exogenous events that have nothing to do with the structural resilience of the crypto market, so we should be patient and wait for the consequences of such events to unroll." (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- A host of mega-cap stocks took outsized responsibility for Friday's broad-market declines. Among companies worth $200 billion or more by market cap that lost at least 3% today? Wells Fargo (WFC, -2.4%), Meta Platforms (FB, -4.2%), Tesla (TSLA, -5.3%), PayPal Holdings (PYPL, -5.6%), Amazon.com (AMZN, -6.0%) and Walt Disney (DIS, -6.9%).

- If there's any glimmer of hope for the rest of the stock market (eventually), it might be Friday's violent rebound in Peloton Interactive (PTON, +11.7%). The stock finally bounced after a painful 2022 that saw the workout-equipment company lose as much as a third of its value through Thursday, driven partly by yesterday's news that it would stop producing exercise bikes and treadmills amid slowing demand. Of course, whether Friday's performance is merely a dead-cat bounce remains to be seen, and PTON shares are still off by a painful TK% year-to-date through today's close.

Tech Earnings, Fed Ahead

Next week could bring a fresh bout of volatility to the markets. In addition to Apple (AAPL) and Microsoft (MSFT) headlining a tech-heavy earnings calendar, there's also the two-day Federal Open Market Committee (FOMC) policy-setting meeting, set to kick off on Tuesday, Jan. 25.

While the Fed isn't expected to raise rates until at least the March meeting, anxiety about the start of the central bank's rate hikes has served as a spark for the recent market selloff, so that even just a gathering of central bankers could spook markets.

But while stock volatility may be exacerbated in the short term, the current rate cycle is needed in order for "a return to normal," says Brad McMillan, chief investment officer for registered investment advisor Commonwealth Financial Network. Yes, higher rates will likely mean slower growth and lower stock valuations, but "the economy and markets can and do adjust to changes in interest rates." he adds.

One way for investors to "keep calm and carry on," as McMillan advises they do, is to focus on the long term and make sure their portfolio is full of stable, dividend-paying stocks.

There are plenty of income-producing ideas across the market, with real estate investment trusts (REITs), utilities and consumer staples among the most generous payers – many of which show up on our list of the 22 best retirement stocks for 2022. The names featured here offer secure dividends based on solid fundamentals and have strong potential to keep increasing their payouts over the long term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.