Stock Market Today: Financials Hold Back Dow in Mixed Friday Session

Negative post-earnings reactions in some bank stocks, as well as a lousy December retail sales report, weighed on the industrial average.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

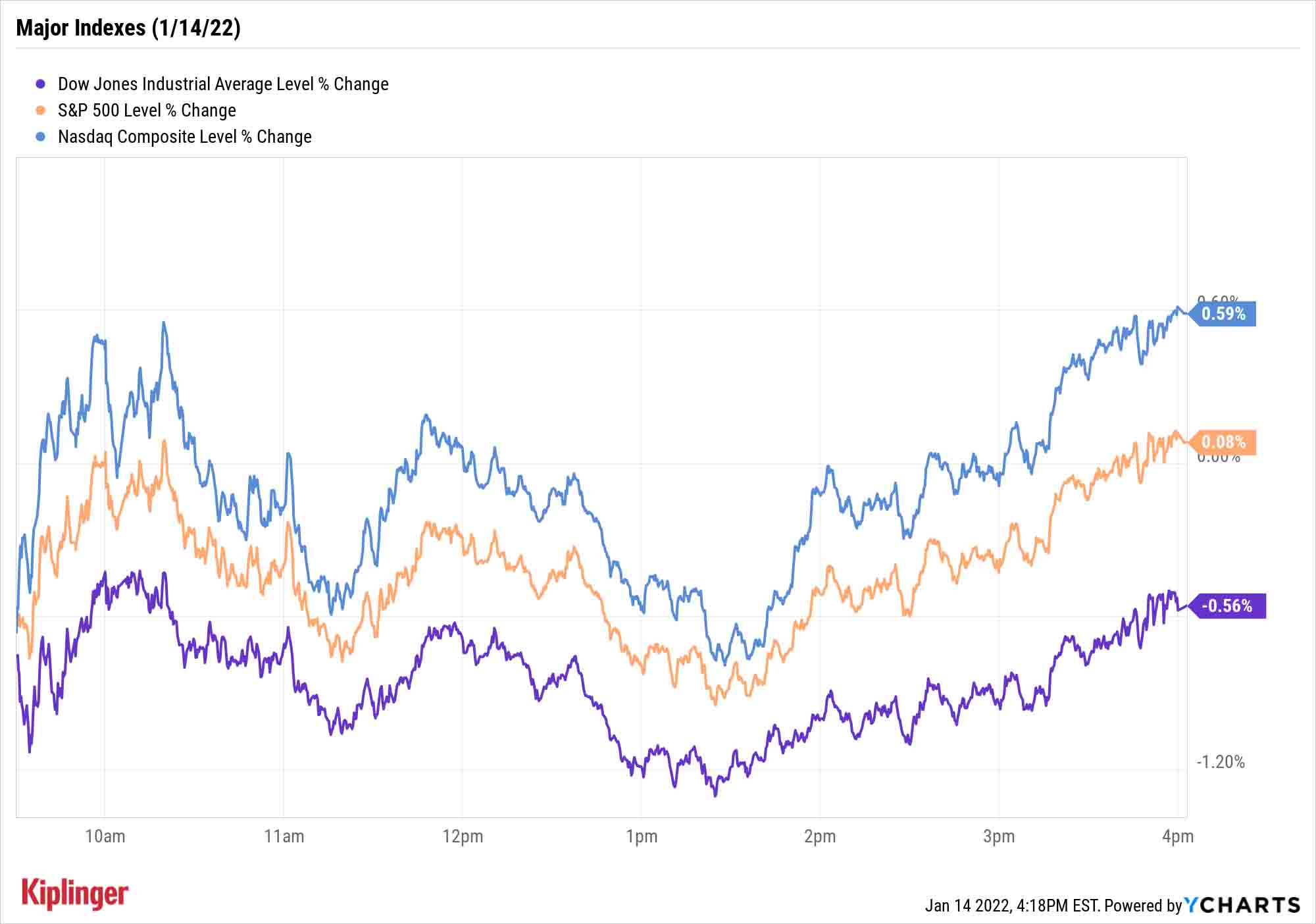

The fourth-quarter earnings season began in earnest Friday, but Wall Street's latest performance metrics did little to invigorate the bulls and saw the Dow Jones Industrial Average finish in the red.

A bevy of blue-chip financial stocks put up mostly strong Q4 headline numbers before the opening bell, but other factors contributed to mixed results in their shares.

Wells Fargo (WFC, +3.7%) reported an 86% year-over-year pop in quarterly net income, while revenues and earnings per share both topped analyst expectations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Dow component JPMorgan Chase (JPM, -6.2%) delivered similar beats on the back of a 28% jump in investment-banking revenues, but investors turned tail after CFO Jeremy Barnum said in a conference call that the company likely will fall short of its 17% target for returns on capital thanks to headwinds including higher expenses and stabilizing trading revenue.

Citigroup (C, -1.3%) exceeded top- and bottom-line estimates, too, though Q4 profits were off by 26%.

Also weighing on sentiment was a wide miss by December retail sales, with a 1.9% month-over-month decline coming in far worse than expectations for a mere 0.1% slip.

"The bulk of this decline came from the control group (core) category, with sales down a sharp 3.1% month-over-month," says Barclays economist Pooja Sriram. "These prints follow from downward revisions to the November data, and in our view, suggest a stronger pull-forward of sales into October, as households likely accelerated their Christmas shopping in view of widespread warnings in the press about goods shortages and shipping delays."

But she adds that it's hard to attribute all of December's decline to this effect.

"Instead, we believe there are likely transitory effects on demand at play, due to the Omicron variant, which likely affected spending on categories such as restaurants and in-store purchases," she says, adding that elevated inflation and waning government transfers have also weighed on households' inflation-adjusted disposable incomes.

"The retail sales number was ugly, there's no getting around it, especially since these numbers are nominal and not adjusted for inflation," says Cliff Hodge, Chief Investment Officer for Cornerstone Wealth, adding that "it's tough to say how much of the miss is related to inflation impacts."

The Dow took the worst of it, dropping 0.6% to 35,911. The S&P 500 managed a marginal gain to 4,662, and the Nasdaq Composite posted a decent 0.6% improvement to 14,893. All three indexes finished in the red for the full week.

A reminder: The stock market is closed Monday, Jan. 17, in observance of Martin Luther King Jr. Day.

Other news in the stock market today:

- The small-cap Russell 2000 managed a 0.1% improvement to 2,162.

- Growing tensions between Russia and Ukraine helped drive up U.S. crude oil futures, which settled 2.1% higher to $83.82 per barrel.

- Gold futures settled 0.3% lower at $1,816.50 per ounce.

- Bitcoin managed to squeak out a 0.7% improvement to $43,125.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Sherwin-Williams (SHW, -2.8%) was another earnings loser Friday. The company announced preliminary Q4 earnings results that were below what Wall Street was looking for. The company expects to earn $1.35 per share on revenues of $4.76 billion during its Q4, but the pros are looking for EPS of $1.69 on sales of $4.77 billion. Moreover, the company is now looking for full-year profits of $8.15 per share, which is lower than both its previous guidance of $8.35 to $8.55 per share, and analyst expectations for $8.48.

What Does 2022 Have in Store for Crypto?

The adrenaline junkies among us might want to keep a close eye on cryptocurrencies in 2022.

The asset class is coming off a transformative 2021 – one that saw digital coins ascend from small, speculative investments to … well, much larger, but still predominantly speculative investments. Cryptocurrencies ballooned from an $800 billion collective market cap at the start of 2021 to $2.25 trillion by year's end, so roughly a triple in a short 12 months' time.

We've already explored the best opportunities in stocks, exchange-traded funds (ETFs) and mutual funds for the year ahead; as we near the end of our annual previews, we turn toward crypto. Will digital currencies have nearly as productive a 2022 as last year? And if so, which coins are likeliest to drive those gains?

Read on as we explore the outlook for cryptocurrencies in 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.