Stock Market Today: Stocks Stage Big Bounce as Bulls Reemerge

The major benchmarks all posted solid gains, snapping a three-day losing streak.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was another volatile day on Wall Street, though Tuesday's price action was to the upside as buyers emerged after three straight days of selling.

"While there has not been any change to the broader narrative there were a couple of headlines that are helping sentiment," says Michael Reinking, senior market strategist for the New York Stock Exchange.

Specifically, he pointed to reports that President Joe Biden's Build Back Better bill may not be completely dead, with Senate Majority Leader Chuck Schumer saying he will schedule a vote on the social infrastructure bill in January.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Plus, "there is some relief that President Biden's strategy to deal with the omicron surge does not include lockdowns," Reinking adds. Instead, the president's plan of attack includes distributing 500 million free at-home COVID-19 testing kits and deploying medical staff to hard-hit areas.

Meanwhile, solid quarterly reports from athletic footwear and apparel maker Nike (NKE, +6.2%) and chipmaker Micron (MU, +10.5%) created tailwinds for the broader consumer discretionary (+2.6%) and technology (+2.5%) sectors, respectively.

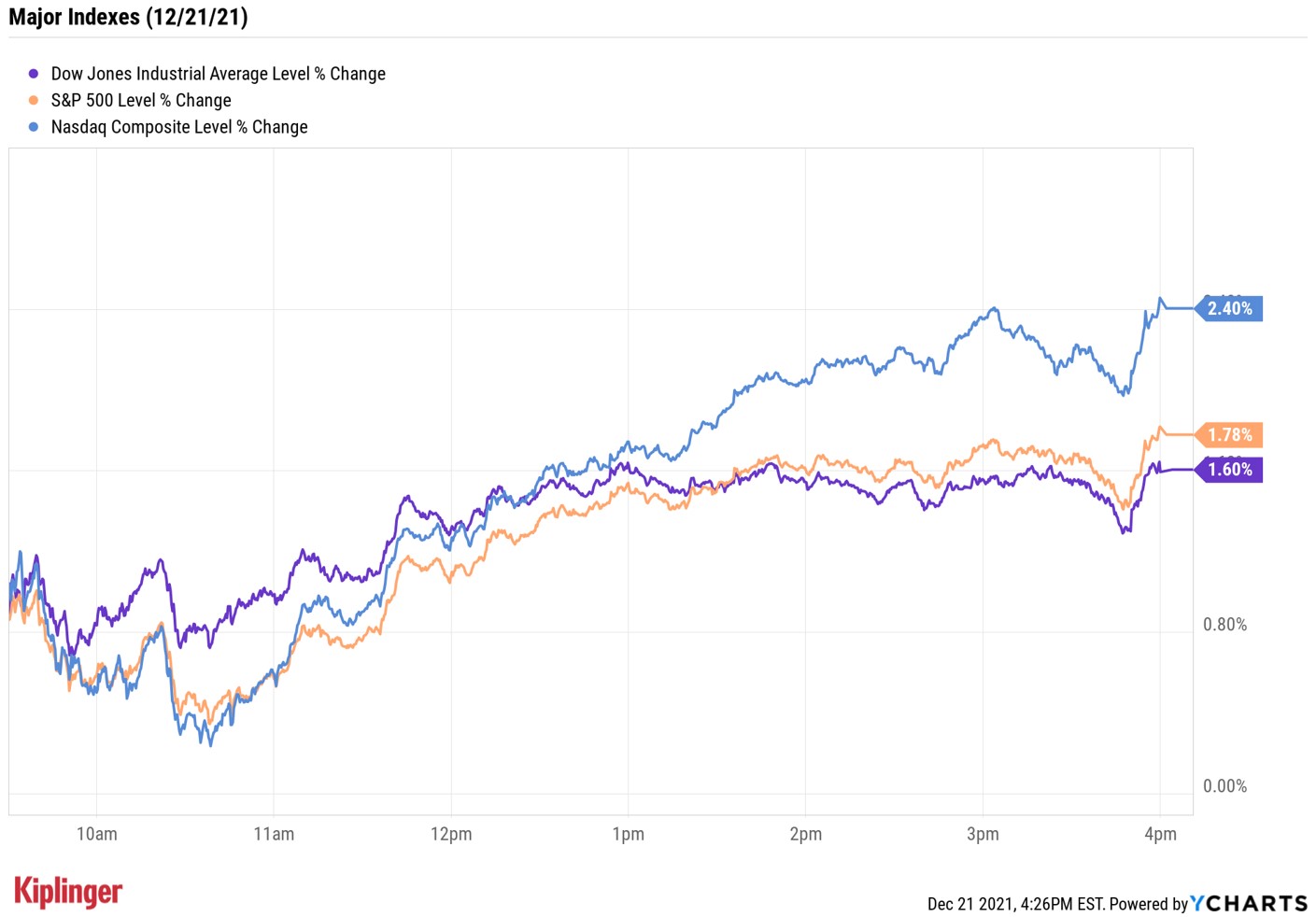

After posting sharp losses in Monday's session, the Dow Jones Industrial Average finished today up 1.6% at 35,492, the S&P 500 Index gained 1.8% to 4,649 and the Nasdaq Composite spiked 2.4% to end at 15,341.

Other news in the stock market today:

- The small-cap Russell 2000 surged 3.0% to end at 2,202.

- U.S. crude oil futures jumped 3.7% to finish at $71.12 per barrel.

- Gold futures gave back 0.3% to settle at $1,788.70 an ounce.

- Bitcoin rallied 3.4% to $48,608.66. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Rite Aid (RAD) rose 21.4% after the drugstore chain reported earnings. In its third quarter, RAD reported revenues of $6.23 billion on adjusted earnings of 15 cents per share. While Rite Aid fell short of the top-line consensus estimate of $6.32 billion, it beat on the bottom line, with analysts expecting the company to report a per-share loss of 32 cents. Additionally, RAD said it has identified 63 locations it plans to shutter in the first phase of its store closure program, which it believes will result in a roughly $25 million benefit to its annual EBITDA (earnings before interest, taxes, depreciation and amortization).

- Citrix Systems (CTXS) was another big mover today, jumping 13.6%. Today's pop came after a Bloomberg report indicated Elliott Investment Management and Vista Equity Partners are potentially mulling a joint takeover of the enterprise software firm, according to people familiar with the matter. Elliott took a stake in CTXS in the third quarter of this year.

Keep Value Stocks on Your Radar

Today's headlines were well-received, but there's still plenty of anxiety as we head into 2022.

For starters, inflation continues to hover at levels not seen in decades, eating away at profit margins for businesses. At the same time, the Federal Reserve intends to hike interest rates several times next year. These macro realities only add to the pile of risks both companies and investors face, but that hardly means all hope is lost.

"The cyclical value sectors such as energy, materials and industrials have historically done well leading up to the start of Fed rate hikes," says Jeff Buchbinder, equity strategist for LPL Financial. While every cycle is different, "we wouldn't be surprised to see value stocks make another run as the economy picks up some speed after the latest waves of COVID-19 variants fade," he adds.

For investors looking to position for higher inflation and higher interest rates, we've recently compiled a list of the top-rated value stocks heading into 2022. These are some of the most compelling plays, according to Wall Street pros, and all sport cheap valuations relative to the broader market.

Karee Venema was long NKE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.