Stock Market Today: Stocks Slip Despite Slew of Sturdy Retail Earnings

TJX, Lowe's and Target all delivered impressive third-quarter results, but weakness in financials and energy weighed on the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A day after the U.S. Commerce Department released better-than-expected retail sales data, corporate America followed up with a number of encouraging retail-industry reports.

T.J. Maxx parent TJX Companies' (TJX, +5.8%) stock popped Wednesday after the off-price retailer delivered plenty of good news: Namely, third-quarter revenue and earnings beat Wall Street estimates, same-store sales jumped 12.7%, and the company signaled that supply-chain issues won't be a concern heading into the holiday season.

"We are in an excellent inventory position, with most of the product needed for the holiday season either on hand or scheduled to arrive at our stores and online in time for the holidays," CEO Ernie Herrman says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

CFRA analyst Zachary Warring reiterated his Strong Buy rating on TJX shares, and raised his 12-month price target to $93 per share from $85.

"The company increased its store count by 19 in the quarter, returned $1.1 billion to shareholders through share repurchases and dividends, and raised its outlook for share repurchases for fiscal 2022 by $500 million," he says. "We see TJX well-positioned as consumer confidence drops, inflation continues to hit consumers' pockets, and government stimulus and savings fade."

Home improvement chain Lowe's (LOW, +0.4%) saw a more modest stock gain despite the retailer easily clearing top- and bottom-line estimates and raising its full-year revenue estimate to $95 billion from $92 billion previously.

Meanwhile, shares in discounter Target (TGT, -4.7%) took a sizable haircut, although not because of weak Q3 results. Indeed, a robust Halloween helped propel earnings and sales past Wall Street's expectations. Rather, investors were concerned about margins, as Target CEO Brian Cornell said his company is "protecting prices" for consumers by absorbing some of the input-cost inflation it's facing.

Weakness in financials (-1.2%) and energy (-1.5%) weighed on the major indexes, however. The latter sector slumped amid a 3.0% decline in U.S. crude oil, to $78.36 per barrel, after the International Energy Agency and the Organization of the Petroleum Exporting Countries warned that rising oil supplies could cut into prices.

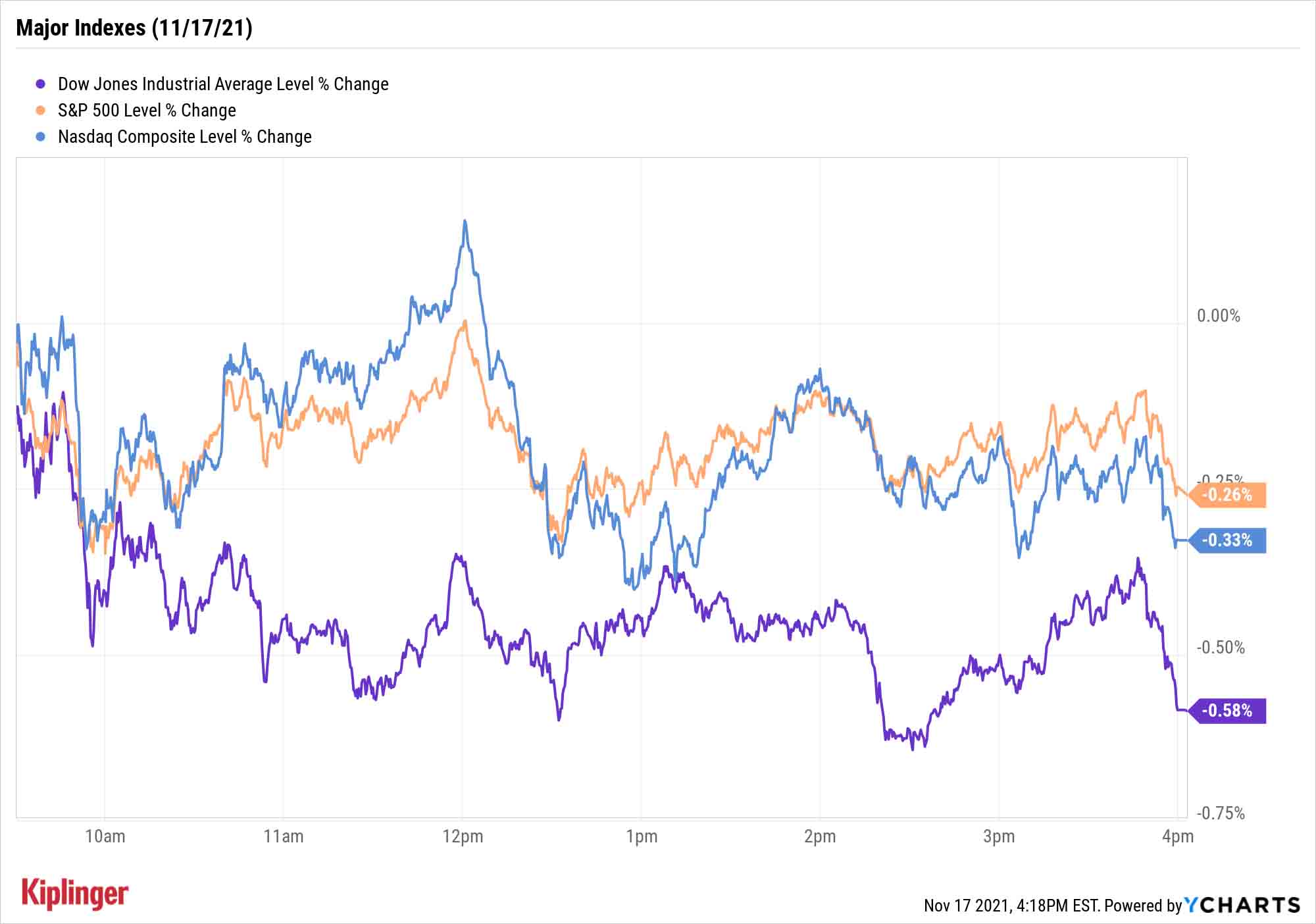

The Dow Jones Industrial Average declined 0.6% to 35,931, while the S&P 500 (-0.3% to 4,688) and Nasdaq Composite (-0.3% to 15,921) also took a breather.

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.2% to 2,377.

- Gold futures improved by 0.9% to $1,868.80 per ounce.

- The CBOE Volatility Index (VIX) jumped 4.2% to 17.06.

- Bitcoin edged 0.9% higher to $60,374.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Roku (ROKU) was a notable decliner, sliding 11.3% after MoffettNathanson analyst Michael Nathanson downgraded the streaming stock to Sell from Neutral (Hold). In a notee, Nathanson wrote that he believes Wall Street's longer-term earnings and revenue estimates are "just too damn high," especially in the wake of the stock's underperformance of late. Truist Securities analyst Matthew Thornton also chimed in on ROKU today, cutting his price target by $360 to reflect a "near-term supply chain headwind to ad revenue." With today's slide, ROKU is now down roughly 50% from its late-July record high near $490.

- Rivian Automotive (RIVN) suffered its first down day as a publicly traded company, slumping 15.1%. The electric vehicle (EV) maker had its first day of trading last Wednesday, Nov. 10, in what was the biggest initial public offering (IPO) of the year. RIVN stock opened at $106.75 that day before embarking on a five-day rally that saw the shares gain more than 61% through last night's close.

Warren Buffett's Latest Buys and Sells

Lost in the shuffle of a busy retail-earnings week was the latest regular treasure trove for Buffett-ologists.

Following Monday's close, Warren Buffett's Berkshire Hathaway (BRK.B) filed its latest Form 13F – a quarterly disclosure the SEC requires of all institutional investment managers with $100 million or more in assets.

We ask your forgiveness for sounding like a broken record, but the Oracle of Omaha was a big ol' bear once more. Berkshire trimmed or exited more positions than it added to or initiated for the fourth consecutive quarter, with a particularly downbeat focus on healthcare and financial-related stocks.

If you want to see what Buffett's full list of holdings looks like after the changes, we've updated our Berkshire Hathaway portfolio tracker.

But if you're primarily interested in Buffett's latest stock purchases and sales – including the two new positions he established, and the three stocks he kicked to the curb completely – check out our review of Uncle Warren's third-quarter moves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.