Stock Market Today: Stocks Get a Lift on Solid Retail Sales

Wall Street also weighed strong earnings reports from blue-chip retailers Home Depot and Walmart.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The broader stock market gained ground today with investors bolstered by upbeat news from the retail sector.

For starters, data from the Commerce Department showed retail sales rose 1.7% in October, above the 1.3% increase expected by economists. "American retailers racked up their best month since the rebates-led spike in March, suggesting inflation has yet to clamp down on purchasing power," says Sal Guatieri, senior economist at BMO Capital Markets.

While Guatieri says a continued rise in inflation could create bigger challenges for families on a tight budget, "for now, both consumers and the economy, in aggregate, look to cap the year on a high note."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Adding to the bullish buzz were higher-than-expected earnings from blue-chip retailers Home Depot (HD, +5.7%) and Walmart (WMT -2.6%), with the latter saying inventory is up 11.5% year-over-year ahead of the holiday shopping season.

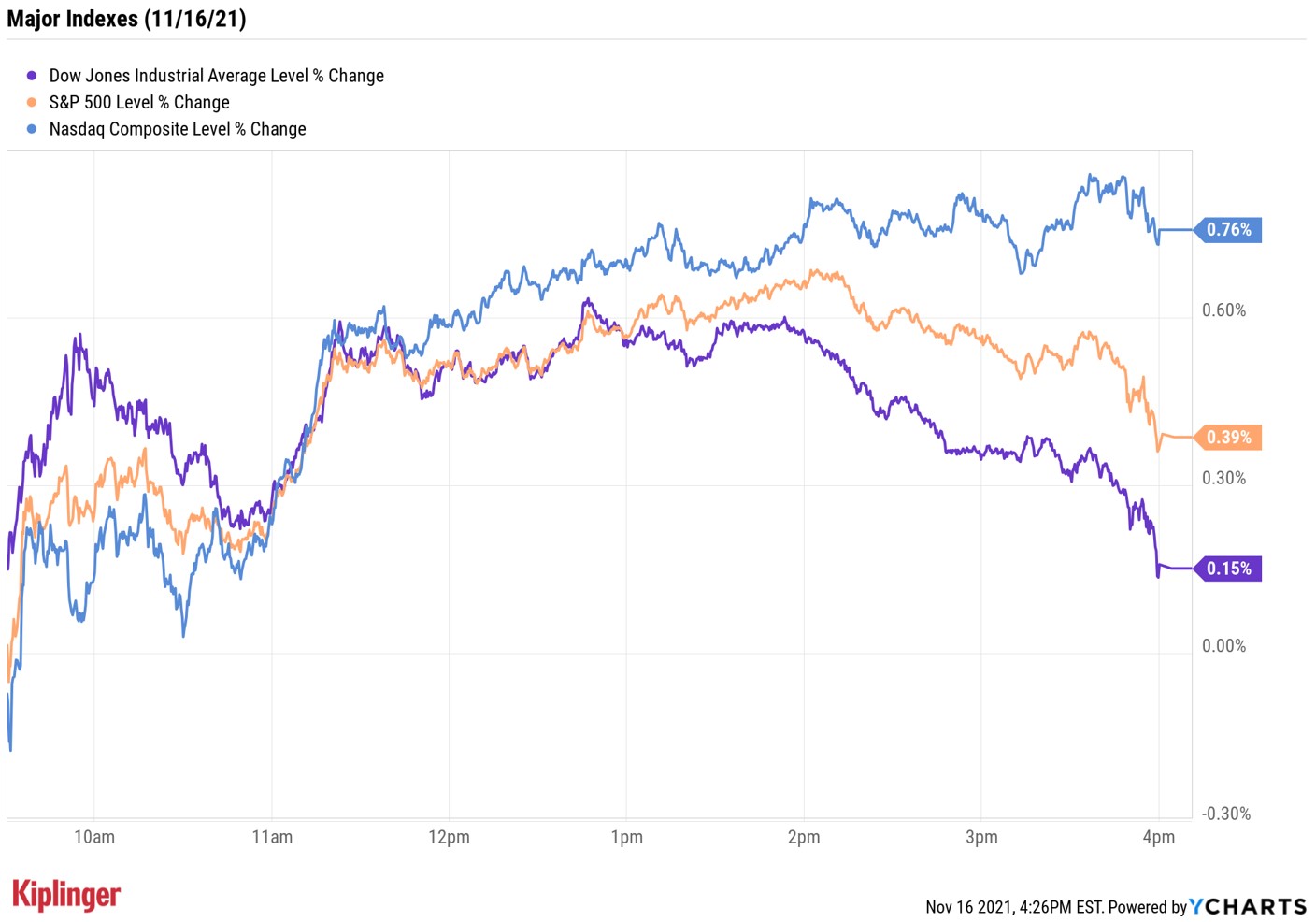

At the close, the Dow Jones Industrial Average was up 0.2% at 36,142, the S&P 500 Index was 0.4% higher at 4,700 and the Nasdaq Composite had gained 0.8% to 15,973.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.2% to 2,405.

- U.S. crude futures slipped 0.2% to finish at $80.76 per barrel.

- Gold futures shed 0.7% to settle at $1,854.10 an ounce.

- The CBOE Volatility Index (VIX) eased back 0.7% to 16.37.

- Bitcoin plunged 6.2% to $59,847.30. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.) "Today's action reminds us that markets are volatile and that there is always profit-taking and pullbacks," says Charlie Silver, CEO of Permission.io, a cryptocurrency-enabled provider of e-commerce permission advertising. "Short memories are a liability if you are a market participant. In July, Bitcoin hit $30,000 and has had a 100% rise in four months. This kind of appreciation is bound to see a 50% retracement. Leave trading to professionals who let the algorithms do the work. Avoid leverage and view pullbacks as opportunities."

- Peloton (PTON) shot up 15.5% after the company said it would sell 23.9 million shares at $46 apiece – a discount to the stock's Nov. 15 close at $47.49 – raising $1.07 billion for the at-home fitness company. Even with today's pop, PTON stock remains roughly 64% lower on a year-to-date basis.

- Rackspace Technology (RXT) surged 11.4% after the multi-cloud technology services company reported earnings. In its third quarter, RXT posted adjsuted earnings of 25 cents per share on $763 million on revenue, more than the 24 cents per share and $756 million analysts were expecting. Oppenheimer analyst Timothy Horan maintained his Outperform (Buy) rating in the wake of the results. "RXT is the only pure play cloud service provider and can pick and choose its customers," he wrote in a note. "Enterprise cloud adoption is early and accelerating. We believe RXT's managed services and software are best-in-class for multicloud and hybrid cloud deployments."

The Holiday Shopping Season is Just Ahead

Could today's earnings reports and economic data signal another strong holiday shopping season?

"We all know the worries," says Ryan Detrick, chief market strategist at LPL Financial. But today's data "is yet another reminder the U.S. consumer remains extremely healthy. Don't forget the consumer makes up two-thirds of the economy, so this is another great sign for our economy as we head into the holiday spending season."

This could mean good news for retail stocks, but investors will need to choose wisely, especially with so many companies facing supply-chain disruptions and staffing shortages.

For those wanting a broader approach to the retail sector, here are three online retail ETFs worthy of a closer look.

And for investors looking for individual plays, here are 13 of the best consumer stocks to consider. Many of the names featured here are trading at new highs amid solid fundamentals and all of them have a lot to offer investors through the end of the year and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.