Elon Musk Cleverly Dumps Nearly $6B in Tesla Stock

Wall Street's pros expected Tesla's CEO to exit part of his position. Musk turned a routine event into a publicity stunt ... and a savvy tax move.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sure enough, Tesla (TSLA) CEO Elon Musk has sold about $5.8 billion worth of stock in the world's largest automaker by market value so far this week – just days after asking in a Twitter poll whether he should do so.

But it looks like investors can finally stop worrying. After a couple days of deep price declines – likely fueled in part by the mercurial billionaire's sale threats – TSLA stock at least appears to have found its footing.

Given that the electric vehicle stock carries significant weight in scads of basic market-index funds held by most investors, that's an encouraging development.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Musk's Stock Sales Confirmed

Over the weekend, Musk conducted a Twitter poll asking followers whether he should sell 10% of his stake in TSLA stock, and promised to abide by the results of the poll.

The majority – some 3.5 million followers, or 58% – voted "yes."

But it seems likelier than not that the Twitter poll was just a stunt heralding something Musk already had planned.

"Today Musk owns roughly 21% of Tesla and it was viewed by many on the Street that he would sell up to ~5%/6% of his ownership stake before the Twitter poll fiasco began," says Wedbush analyst Daniel Ives.

Either way, Musk made good on his promise. Regulatory filings made public late Wednesday revealed that Musk exercised options Monday and then sold about 2.1 million of the TSLA stock he received to raise $1.1 billion in cash to pay taxes stemming from the transaction.

Interestingly, the option exercise and sales were pursuant to a Rule 10b5-1 trading plan. Insiders are required to adopt such plans so as to not run afoul of the Securities and Exchange Commission. The trading plan was filed with the SEC on Sept. 14, or well before Musk's infamous Twitter poll of Nov. 6.

It's also worth noting that the options were not set to expire until August 2022. Exercising options early is actually a bullish move on Musk's part, notes Barron's Al Root:

"It's important to remember that Musk had no looming bill from the options exercise. The tax is due only when the transaction happens. And Musk exercised the options before he had to, making it a bullish trade in theory.

Exercising options early and holding the stock bought is better, for tax purposes, when an options holder believes a stock is going up. That's because the tax rate on options exercise is the tax rate on ordinary income – and the tax rate on long-term capital gains is lower than the rate on ordinary income."

But let's not digress, because Musk's sale saga hardly ends here.

After exercising options on Monday, Musk undertook a series of sales on Tuesday and Wednesday, per regulatory filings. In those trades, the chief unloaded 3.5 million TSLA shares worth nearly $3.9 billion. Then on Friday, following our original story, new filings showed that Musk unloaded another $687.3 million worth of shares.

These transactions, however, were not made under a Rule 10b5-1 trading plan. That is, they were not scheduled sales.

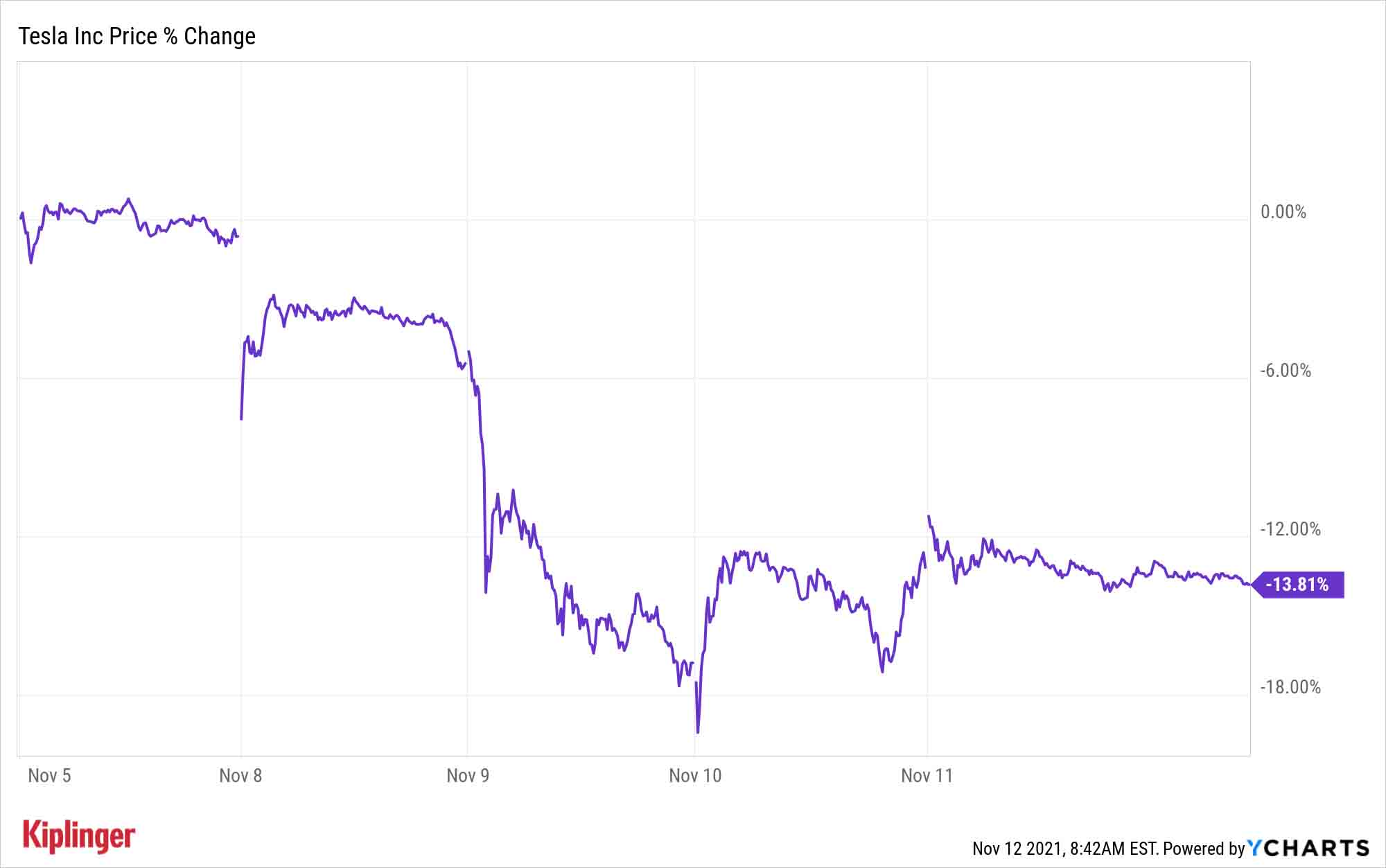

Shares in Tesla tumbled more than 19% from the close on Friday, Nov. 5 through its intraday low on Wednesday, Nov. 10. Pressure from Musk dumping nearly $5 billion worth of Tesla stock into the market – and the uncertainty created by his Twitter poll asking if he should sell 10% of his total holdings – likely didn't help.

The pain caused by this selloff wasn't limited to holders of TSLA stock. With a market capitalization of more than $1 trillion, Tesla has a great deal of sway in cap-weighted indexes – the S&P 500 and Nasdaq Composite, for example – and scores of exchange-traded funds, such as the Invesco QQQ Trust (QQQ). Tesla has an outsized effect on consumer discretionary funds, as well. For instance, it accounts for more than 19% of the Consumer Discretionary Select Sector SPDR Fund's (XLY) $23 billion-plus in assets.

In other words, even investors who don't hold TSLA stock directly have skin in Musk's game.

Encouragingly, shares in Tesla began to stabilize Wednesday and continued to do so Thursday and Friday.

What Now for TSLA Stock?

For those worrying about Musk bailing out on his baby, the world's richest man still holds more than 167 million shares of Tesla stock, or roughly 16% of the electric vehicle maker's shares outstanding. Vanguard is the distant No. 2 shareholder, holding 5.9% of the company's outstanding stock.

Make of that what you will. And to reiterate: Musk's options exercise and sales were planned well in advance of his Twitter stunt – the point of which remains elusive to anyone but the Tesla chief.

To be fair, Musk's quick but precipitous sale of TSLA stock might have been the best course of action for Tesla's CEO.

"With 10% being a higher amount that surprised some investors, ultimately it's a digestible number we are not overly concerned about, although it has given fuel to the bears pressuring the name this week," Ives says. "In a nutshell, we would rather Musk rip the band-aid off now and sell this portion of stock quickly rather than it lingering over the next year and feeding into any non-fundamental bear thesis on the story."

Will Musk make good on selling even more of his stake? That's anyone's guess, but the bullishness he showed by exercising options early suggests it's probably one of his goofs.

The bottom line is there is no bottom line. We can only hope the billionaire feels sated by his latest jape, and whatever whim that follows causes less consternation for both TSLA stock and the broader market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.