Stock Market Today: Tesla Snips S&P, Nasdaq Win Streaks

Another big drop in Tesla (TSLA) put an end to the Nasdaq's 11 consecutive advances, and the S&P 500's eight-session run.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A tenacious stock market rally finally stumbled on a light-news Tuesday.

The day's core piece of economic data was focused on inflation: The Labor Department said October's producer price index (PPI) was up 0.6% month-over-month, and 8.6% year-over-year – the fastest rate of growth in wholesale prices in more than a decade (though inline with economists' expectations).

"The October report showed continued strength in goods prices, which highlights persisting supply bottleneck issues, despite signs that supply has improved in some sectors," say Barclays economists Pooja Sriram and Blerina Uruçi. "Energy (+4.8%) and core goods (ex food & energy; +0.5%) rose at a strong pace. On the other hand, services PPI increased at a modest 0.2% m/m, similar to September, led by a sharp rebound in transportation and warehousing costs after September's decline. In particular, truck and air transportation costs jumped in October."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The October report signals that pipeline price pressures remain firm, especially for goods, which will likely remain a significant driving force for core goods (consumer price index) and (personal consumption expenditures price index) inflation this year," they add.

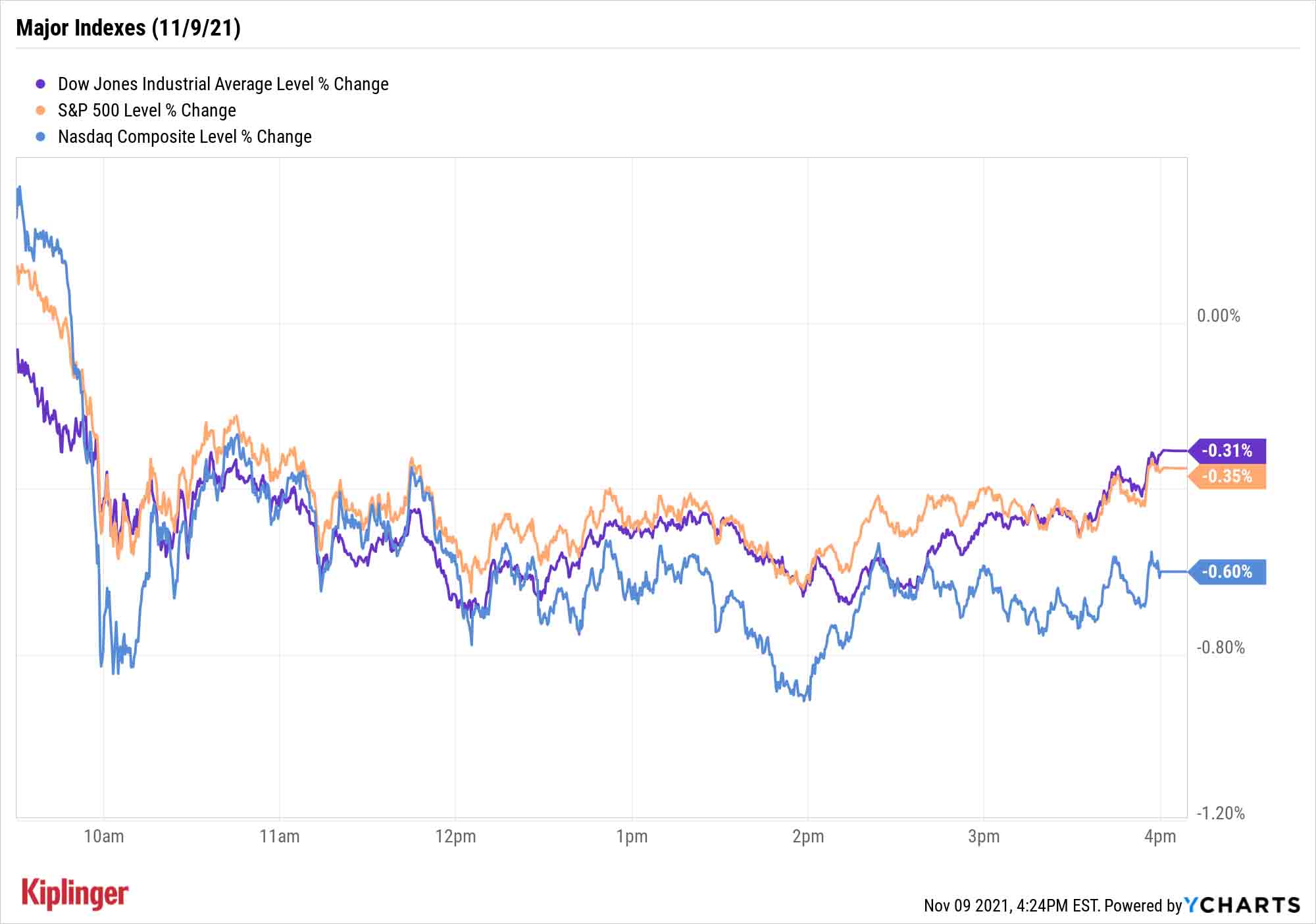

The Dow Jones Industrial Average suffered a mild setback, declining 0.3% to 36,319 as components including Visa (V, -3.2%) and International Business Machines (IBM, -1.7%) retreated.

Tesla (TSLA, -12.0%) – whose declines accelerated Tuesday after CEO Elon Musk's weekend poll asking whether he should sell 10% of his hefty stock position – proved a significant drag on the other major indexes. The Nasdaq Composite (-0.6% to 15,886) saw its 11-session win streak come to an end, while the S&P 500 (-0.4% to 4,685) was stopped at eight consecutive gains.

Other news in the stock market today:

- The small-cap Russell 2000 also dropped, by 0.6% to 2,427.

- U.S. crude futures improved by another 2.7% to hit $84.25 per barrel.

- Gold futures were higher by 0.2% to settle at $1,830.80.

- The CBOE Volatility Index (VIX) was up 3.5% to 17.82.

- Bitcoin's charge continued, with the cryptocurrency surpassing its previous high of $66,974.77 and rushing above $68,500 before pulling back to $67,313.50 by the afternoon. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- PayPal Holdings (PYPL) sank 10.5% following its Monday-evening quarterly report. The company earned an adjusted $1.11 per share that topped expectations for $1.07 per share, but revenues of $6.18 billion were slightly behind the pros' projections for $6.23 billion. More worrisome, however, was fourth-quarter guidance for $6.85 billion to $6.95 billion in revenues and $1.12 per share in adjusted profits, both of which fell under Wall Street's bar. That overshadowed an announcement that its Venmo service could be used as a checkout option on Amazon.com (AMZN) beginning in 2022.

A Bumper Year for ETFs

The exchange-traded fund (ETF) industry is guaranteed to finish 2021 in record fashion.

An all-time high $500 billion was poured into U.S. ETFs in 2020, but ETF inflows this year eclipsed that mark – in July – and have since gone on to hit $720 billion as of the end of October.

Kiplinger highly values actively managed mutual funds that can go above and beyond basic benchmarks, but there's no questioning the core driver behind ETFs' ever-growing popularity. While a few ETFs are actively managed, most are tied to an index, providing simple and typically inexpensive exposure to just about any corner of the market you can think of – from stocks and bonds to commodities and even cryptocurrencies.

However, even within the seemingly straightforward realm of index ETFs, similar-sounding funds can indeed be quite different from one another. Here, we try to separate the wheat from the chaff, highlighting 14 index funds across several categories that stand out thanks to their low fees, smart strategies and ability to outdo their peers.

Kyle Woodley was long PYPL as of this writing and initiated a position in TSLA during Tuesday's session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.