Stock Market Today: Dow 36,000 at Last!

The Dow closed above the 36,000 level for the first time ever Tuesday, while earnings also pushed the S&P 500 and Nasdaq to new heights.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dow Jones Industrial Average cleared the 36,000 level on a closing basis, and the major indexes extended their rally into record highs yet again Tuesday, as investors digested another round of encouraging earnings reports and prepared for tomorrow's much-anticipated Federal Reserve meeting.

Among the splashier earnings reports was Avis Budget Group (CAR), whose stock more than tripled intraday and finished up 108.3% after announcing a wide third-quarter profit beat ($10.74 vs. $7.24 expected) and after management made general overtures toward boosting its electric-vehicle fleet.

The good news very likely triggered a short squeeze in Avis; the car-rental name had a high 21% of its shares sold short as of the most recent data, meaning that 21% of shares available for trading were being used to bet against CAR going higher.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also, Avis’s move was large enough to trigger a confirmation move concerning Dow Theory, which predicts when the market is in a broader trend higher.

"Speaking of Dow Theory, there was actually confirmation by the Dow Jones Transports today, which traded to a new all-time high for the first time since May,” says Michael Reinking, senior market strategist for the New York Stock Exchange. “This happened in somewhat of an ominous fashion, as the index rallied over 12% intraday as Avis became the most recent meme target. With the stock still up 100% on the day, the index is up ~6%. [The Dow Jones Transportation Index finished up 6.9%] … The Reddit era is clearly pushing the boundaries of technical analysis."

Pfizer (PFE, +4.2%) climbed higher as COVID-19 vaccine sales lifted revenues and earnings by 134% and 133% year-over-year, respectively. And Under Armour (UAA, +16.5%) rocketed ahead after besting top- and bottom-line estimates and raising its full-year outlook.

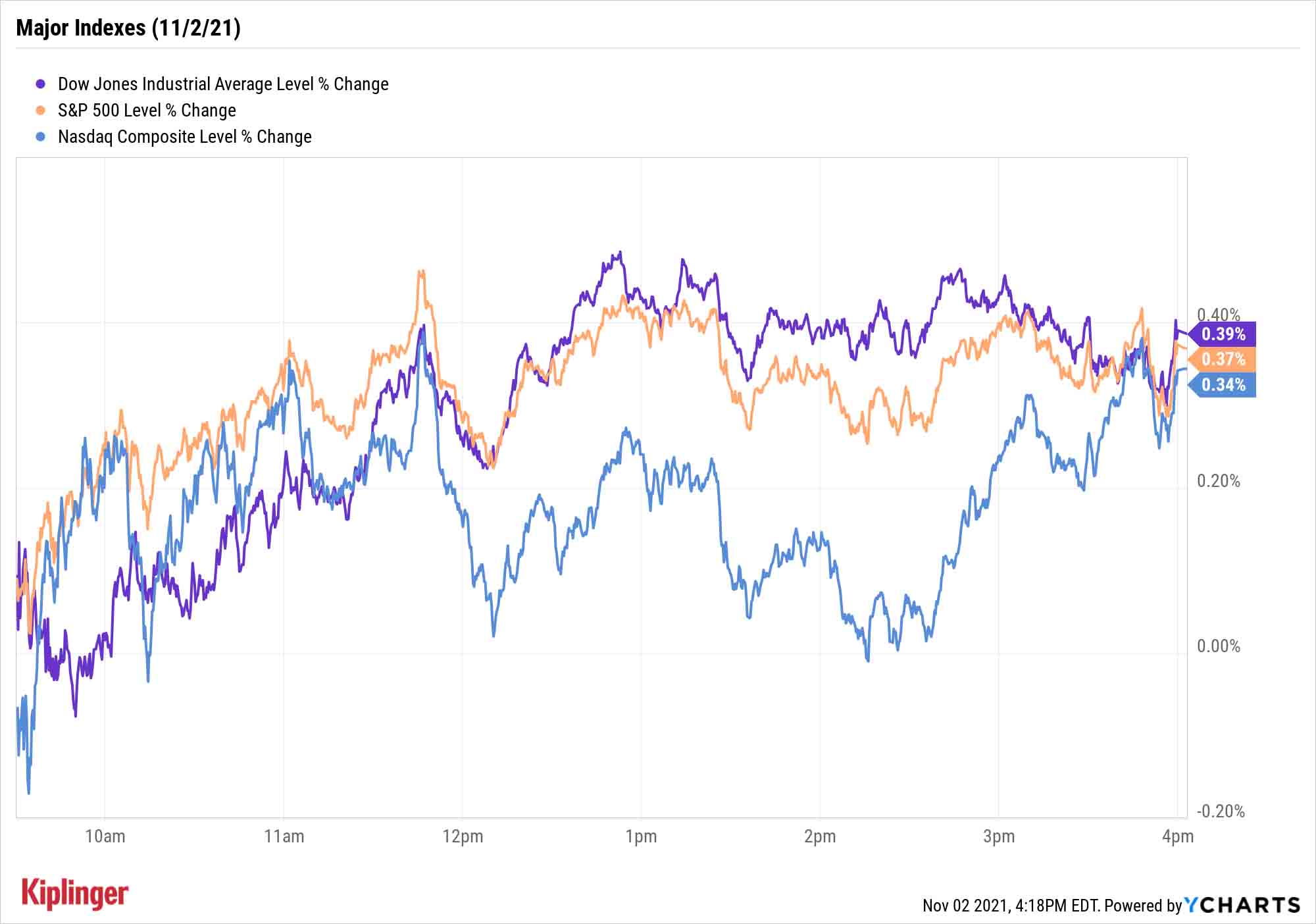

The Dow (+0.4% to 36,052), interestingly enough, was helped most by non-earnings moves in Cisco Systems (CSCO, +2.7%) and Amgen (AMGN, +2.1%), and eclipsed the 36,000 mark on a closing basis for the first time. That puts the final touches on a prediction made (in)famous by the book Dow 36,000, co-authored by Kiplinger's columnist James Glassman – a missed call from which Glassman says he has learned many lessons.

Joining the Dow at all-time highs were the S&P 500 (+0.4% to 4,630) and the Nasdaq (+0.3% to 15,649). And the small-cap Russell 2000, which managed a mere 0.2% gain to 2,361, nonetheless managed to finally outdo its previous high of 2,360, which was set back on March 15.

Other news in the stock market today:

- U.S. crude futures slipped 0.2% to finish at $83.91 per barrel.

- Gold futures shed 0.4% to settle at $1,789.40 an ounce.

- The CBOE Volatility Index (VIX) declined 2.5% to 16.00.

- Bitcoin climbed 3.6% to $63,619.82. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Chegg (CHGG) plunged 48.8% today after the education technology company warned of an industry "slowdown" in last night's earnings report. While CHGG said third-quarter revenue grew 12% year-over-year to $171.9 million and earnings per share (EPS) arrived at 5 cents compared to a year-ago loss of 29 cents per share, the company forecast fourth-quarter revenue to range between $194 million and $196 million – well below the $205.7 million in revenue it reported in Q4 2020. Chegg is also anticipating adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of $67 million to $69 million, below the $87.9 million it earned the year prior. CHGG stock received several downgrades as a result, including one from Raymond James analysts – to Market Perform (Hold) from Outperform (Buy). "We don't see a catalyst for improved growth over the next few quarters," they wrote in a note. "This should make shares range-bound, and more deserving of a Market Perform rating."

- DuPont (DD) was a big earnings winner, surging 8.8% in the wake of its results. For the third quarter, the chemicals company reported adjusted earnings of $1.15 per share on $4.3 billion in revenue – both figures above what analysts were expecting. The company also lowered its full-year net sales and adjusted EPS outlooks due to rising raw material costs and a slowdown in orders linked to the global semiconductor shortage. Additionally, DD said it is buying electronics material maker Rogers (ROG, +29.6%) for $5.2 billion to help boost its presence in the electric vehicle (EV) and 5G infrastructure markets and that it is selling a large portion of its Mobility and Materials business. "The transactions enable DD to expand its position in high-growth markets while reducing earnings cyclicality, in our view," says CFRA Research analyst Richard Wolfe, who reiterated his Strong Buy on the stock.

What to Expect From the Fed

Next up: the Fed's statement from its Nov. 2-3 Federal Open Market Committee meeting, due out tomorrow afternoon.

Wall Street's expectations are largely straightforward and uniform, with most expecting the Fed to announce that it will begin to taper asset purchases – and that stocks have largely priced that in.

"The Federal Reserve's tapering could begin by year end and we'll likely hear more commentary during Wednesday's meeting," says Greg Marcus, managing director of UBS Private Wealth Management. "But we don't expect any tapering actions to disrupt the stock market's rally. The Federal Reserve has been signaling its tapering plans for some time."

Invesco Chief Global Market Strategist Kristina Hooper largely concurs, adding that the central bank will likely maintain its messaging on rate hikes, too.

"I expect [the Fed] to continue saying what it's been saying: Rate hikes have been decoupled from tapering, so we shouldn't expect rate hikes to begin until the back half of 2022," she says.

Should the expected come to pass, investors might feel emboldened to continue chasing what's been working – transportation stocks, for instance, which also sit at all-time highs, or energy stocks that have built up a head of steam.

Conversely, investors might want to take the road much, much less traveled. The stock market is vast, spanning thousands of stocks that rarely if ever see the light of analyst or media coverage – and among that group are a number of quality equities just chugging along without any fanfare. Today, we've put a spotlight on a dozen of these under-the-radar plays.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.