Stock Market Today: Stocks Zip Higher on Robust Retail Sales, Earnings

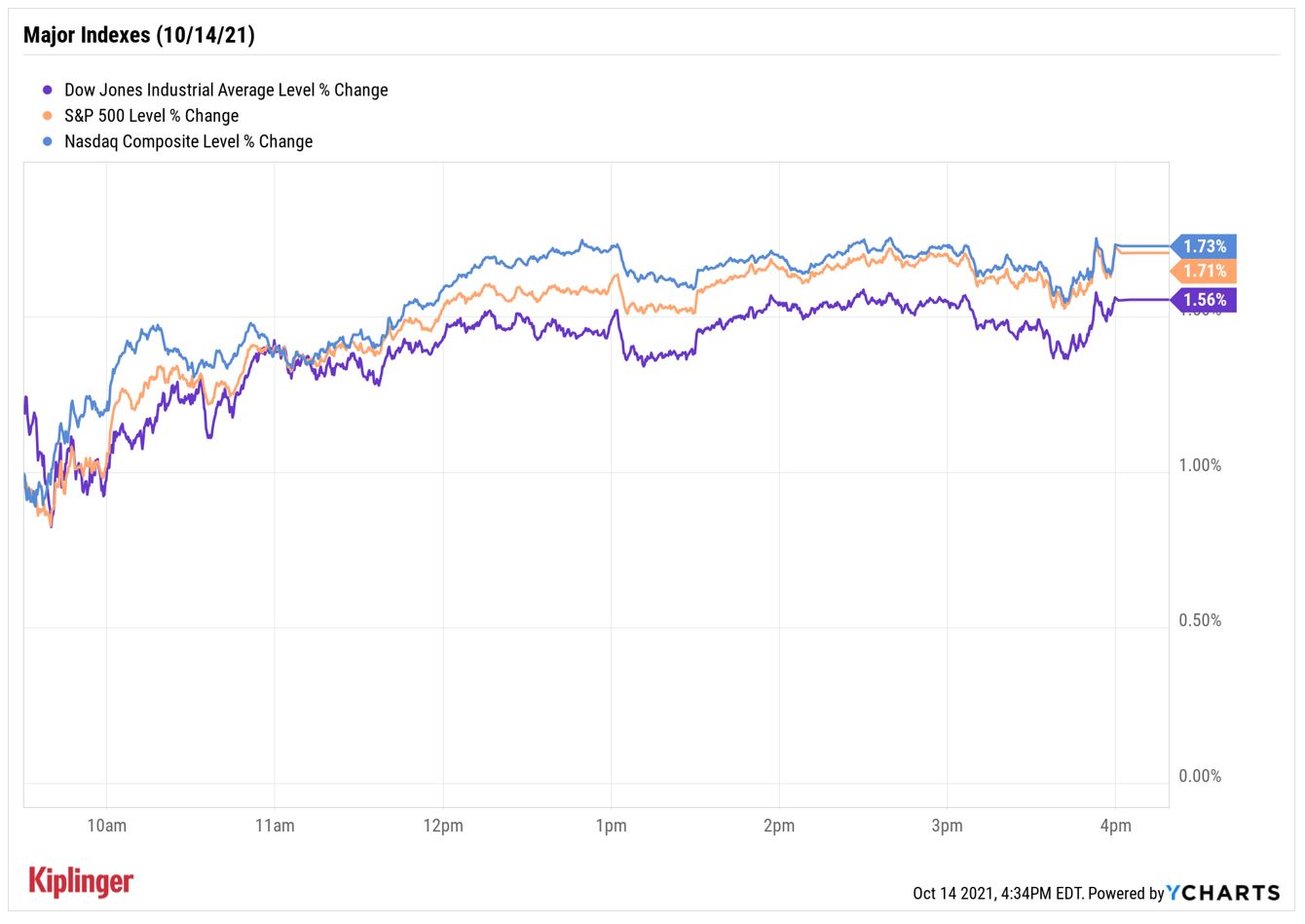

A second consecutive month of unexpected retail-sales growth and more sterling earnings from the financial sector gave Wall Street a lift Friday,

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most investors will be walking into this weekend with a spring in their step. They can thank booming retail sales and continued earnings momentum, which set up a fine Friday finish for the equity markets.

Headline retail sales unexpectedly grew for the second consecutive month, with September's figure up 0.7% month-over-month to exceed expectations for a 0.2% decline. And similarly to August, September's sales were boosted in categories including clothing, groceries, general merchandise, non-store retail and miscellaneous.

"Households also received a boost to incomes from government benefits in mid-August and September, by way of the advance Child Tax credit payments under the American Rescue Plan Act," says Barclays economist Pooja Sriram. "As we have pointed out previously, retail sales have tended to fare well in the months households received pandemic-relief stimulus."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also impressing the pros was Goldman Sachs (GS, +3.8%), which announced 63% profit growth and 26% revenue growth to top Q3 estimates and cap a week of encouraging reports from Wells Fargo (WFC, +6.8%), Bank of America (BAC, +2.9%), Citigroup (C, +2.1%) and others.

"Goldman Sachs is executing at a high level outpacing other large banks and is gaining wallet share in investment banking, trading, and consumer and wealth management," says CFRA analyst Kenneth Leon, who reiterated his Strong Buy rating on GS stock, and raised his 12-month price target to $260 per share from $245.

The Dow Jones Industrial Average led the major indexes with a 1.1% surge to 35,294, securing a 1.6% weekly gain. The S&P 500 (+0.8% to 4,471) was up 1.8% for the week, and the Nasdaq Composite (+0.5% to 14,897) climbed 2.2% over the past five days.

Other news in the stock market today:

- The small-cap Russell 2000 followed the same path as its larger-cap brethren for most of the day, but turned red in the late afternoon, slipping 0.4% to 2,265.

- Johnson & Johnson (JNJ, +0.7%) got a lift today after a Food and Drug Administration (FDA) advisory committee unanimously agreed the federal agency should authorize boosters of the pharma giant's single-dose COVID-19 vaccine to the roughly 15 million people in the U.S. who received a shot. This follows Thursday's news that the same panel recommended boosters for Moderna's (MRNA, -2.3%) COVID-19 vaccine to high-risk individuals and those 65 and older, and is considered a key step in getting regulatory approval for additional doses. Looking ahead, Johnson & Johnson is one of the highlights of next week's earnings lineup.

- J.B. Hunt Transport Services (JBHT) stock surged 8.7% after the freight operator reported higher-than-expected third-quarter earnings of $1.88 per share – up 59.3% from the year prior – and revenues of $3.1 billion, a 27.2% improvement from Q3 2020. "JBHT delivered on profits in the third quarter and the outlook for 2022 is excellent as capacity return," says Susquehanna Financial Group analyst Bascome Majors. But he maintained a Neutral (Hold) rating on the stock. "We just can't get there on valuation, with JBHT trading near long-term averages versus other more cyclical trucking and logistics-related businesses deeply below," he wrote in a note.

- U.S. crude futures jumped 1.2% to settle at $82.28 per barrel.

- Gold futures fell 1.7% to finish at $1,768.30 an ounce.

- The CBOE Volatility Index (VIX) finished off 3.4% to 16.29.

- As discussed today in our free A Step Ahead newsletter, the SEC is reportedly nearing its first approval of a futures-based Bitcoin ETF. That seemed to light a fire under Bitcoin, which shot 6.2% higher to $61,436.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Will the American Consumer Power U.S. Markets?

The latest retail-sales beat might be more than just a short-term boon for the stock market.

"The U.S. economy is 70% reliant on the consumer, and the doom-and-gloom forecasters who believed stagnant economic growth (especially in terms of the stagflation narrative) was ahead for the U.S. … are going to be surprised at the resilience of the U.S. economy, and we see higher equity prices ahead for this year and next year," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

"We believe that being long equities is the best course of action, and that cyclical stocks such as financials, industrials, energy and materials are positioned for further gains," he adds.

Of course, if you believe more market buoyancy is ahead, you can tap into that potential in more ways than just sector plays. You could consider values such as these cheap 13 Dividend Aristocrats or these five overly punished equities. You can also take the advice of the jet-set, following billionaires into their highest-conviction picks.

However, if you want to get yourself as close to the source as possible, check to see whether corporate insiders are eating their own cooking. The following are seven stocks that have seen noteworthy buying from at least one corporate insider of late – often a bullish signal that demonstrates high confidence that the company's fortunes are about to improve.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.