Stock Market Today: Energy Leads Broad Market Snap-Back

Upbeat economic data helped provide a tailwind for most stocks, but energy really shone as tight inventories sent oil prices soaring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A broad and robust relief rally that saw all but one sector finish in the green provided investors with a little respite Wednesday.

Lifting spirits were a pair of economic data points. First: This month's reading of the Empire State Manufacturing Index, which measures general business conditions in New York, nearly doubled, to 34.3 from 18.3 in August, shattering expectations.

Michael Reinking, senior market strategist for the New York Stock Exchange, notes that while the index usually isn't closely watched, being the "the first piece of September economic data the market has had to digest" might have merited the extra attention.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on Wednesday, the Federal Reserve released August industrial production numbers that matched estimates, rising 0.4% month-over-month.

Energy stocks (+3.7%), including the likes of EOG Resources (EOG, +8.3%) and Devon Energy (DVN, +7.3%), were by far the best sector performer. They were aided by a 3.1% surge in U.S. crude oil prices, to $72.61 per barrel, as U.S. inventories tightened.

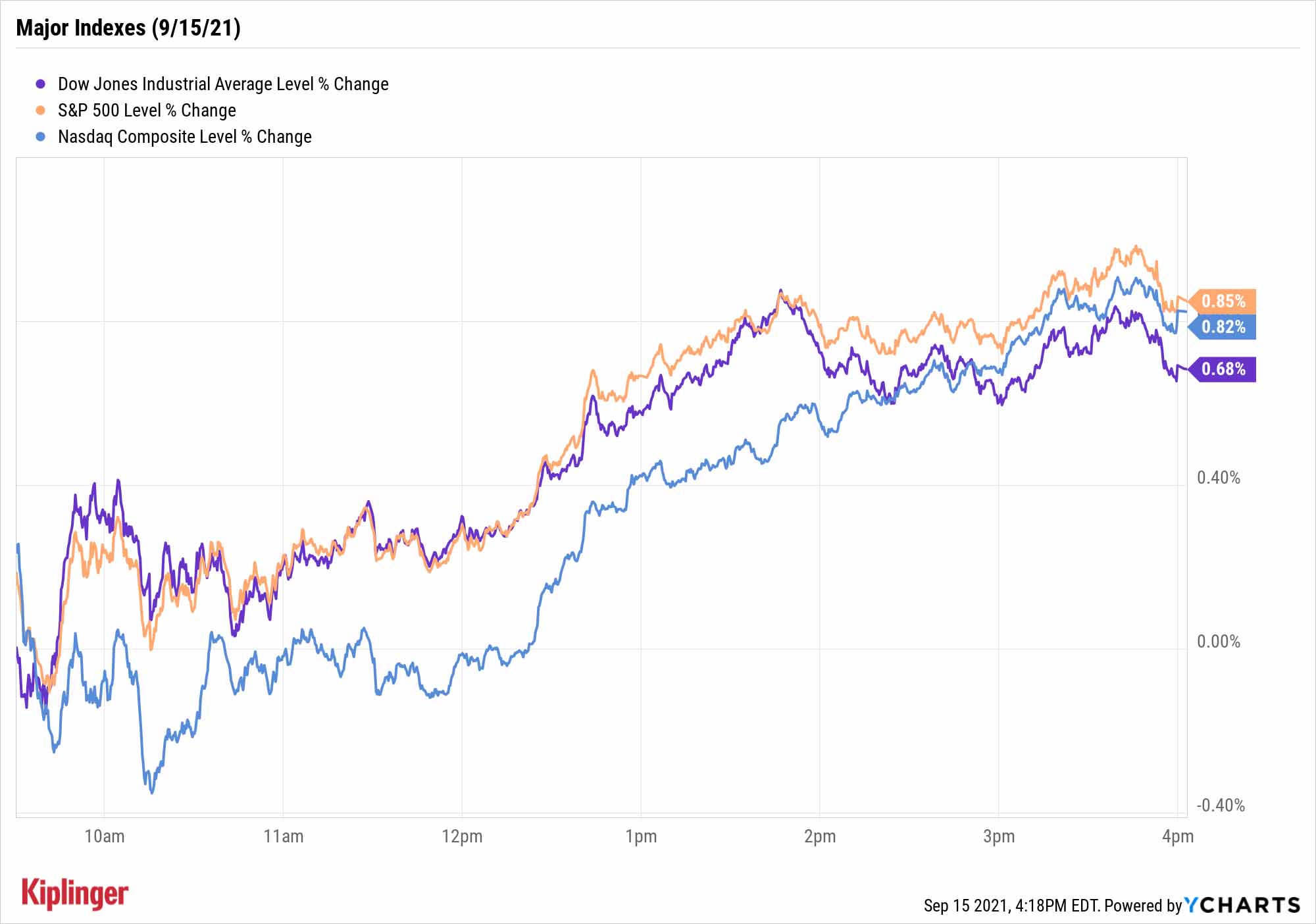

The major indexes all finished with similar returns: The Dow Jones Industrial Average climbed 0.7% to 34,814, the S&P 500 improved 0.9% to 4,480, and the Nasdaq Composite snapped its five-session skid with a 0.8% gain to 15,161.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.1% to 2,234.

- It was a second day of sharp losses for casino stocks after the Macau government kicked off a 45-day review of casino operations in the Chinese territory. The process is being conducted as a means of garnering public input on amending gambling laws, with speculation swirling that it could lead to stricter regulations for casino operators. Among today's notable decliners were Wynn Resorts (WYNN, -6.3%), MGM Resorts International (MGM, -2.5%) and Las Vegas Sands (LVS, -1.7%).

- SoFi Technologies (SOFI, +6.6%) got a boost today after Mizuho Americas analysts Dan Dolev and Ryan Coyne initiated coverage of the fintech stock with a Buy. "SoFi is a one-stop shop digital financial services firm that is in the midst of a powerful transition to a full-fledged mobile-first, super-app neo-bank with in-house next-gen issuing capabilities," they wrote in a note to clients. SoFi went public in early June via a merger with a special purpose acquisition company (SPAC).

- Gold futures shed 0.7% to end at $1,794.80 an ounce.

- The CBOE Volatility Index (VIX) retreated by 6.4% to 18.21.

- Bitcoin had another strong day, advancing 3.5% to $48,099.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's the Best Brokerage for You?

Investors rarely have the luxury of control and certainty.

For instance, let's say you conduct tireless research before you purchase a stock or fund. That should improve your chances of making a smart investment, but every now and again, an exogenous shock – like COVID – rips apart your thesis.

That's why it's vital to make the most of what we do have complete control over.

One such area is costs. That's part of the idea behind our Kip 25 mutual fund and Kip ETF 20 lists – it's good to identify quality investment products, but it's all the better when more of their returns are flowing back into your pockets, thanks to lower fees.

Another thing you can control: your brokerage account.

While the race to zero-commission trading has reduced (and hidden) differences on the fee front, different brokerages still have different approaches to features such as tools, research, investment choices and customer service.

So, what's the right brokerage for you? Check out our latest rankings of the best online brokers, where we delve into the major brokerages' features and drawbacks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.