Stock Market Today: Financials Lead as S&P 500, Nasdaq Set Fresh Highs

Upward pressure on Treasury rates Wednesday helped spur gains in the financial sector on a modest up day for the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

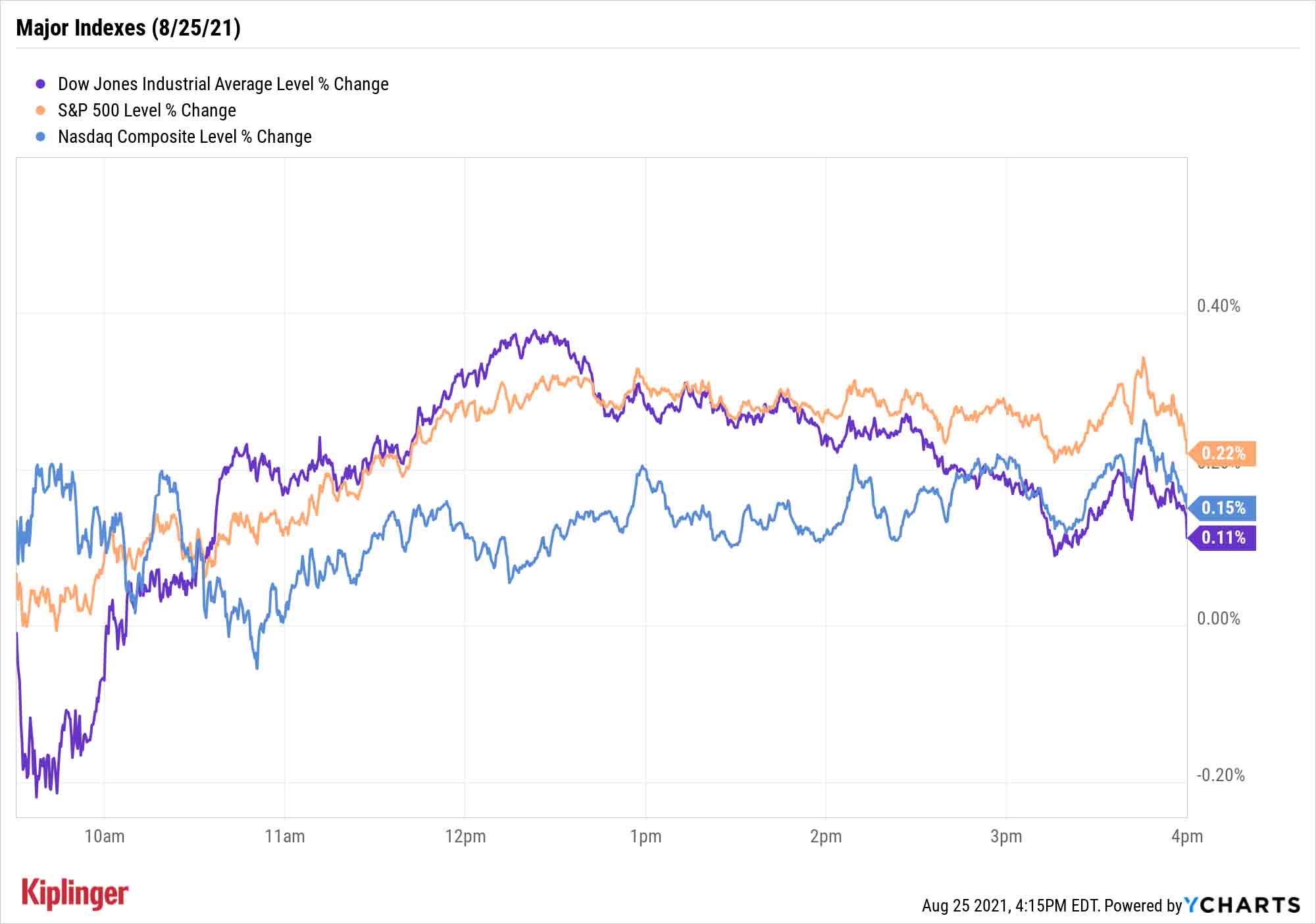

The S&P 500 and Nasdaq Composite continued to push even further into record territory Wednesday amid a fairly quiet day for the broader markets.

July's durable-goods reading helped provide some positivity; while headline orders declined 0.1% month-over-month, new orders (backing out the volatile transportation category) were up 0.7% MoM.

Treasury yields continued their near-term momentum, climbing as high as 1.35%; that helped financial stocks (+1.2%) produce the day's best sector performance, helped by the likes of JPMorgan Chase (JPM, +2.1%) and Citigroup (C, +1.6%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Interest rates should remain in the spotlight through Friday, when the Fed holds its annual symposium in Jackson Hole, Wyoming. The event will be entirely virtual this year – "telling us that Fed officials are taking the Delta variant seriously," says LPL Financial Fixed Income Strategist Lawrence Gillum. "We'll have to see if that alters the tapering timeline and, importantly, the market's expectations for when the Fed will start to increase short-term interest rates."

The S&P 500 climbed 0.2% to an all-time high of 4,496, the Nasdaq (+0.2% to 15,041) produced another record finish, and the Dow Jones Industrial Average (+0.1% to 35,405) inched closer to its Aug. 16 high of 35,62

Other news in the stock market today:

- The small-cap Russell 2000 pushed ahead by 0.4% to 2,239.

- Western Digital (WDC, +7.8%) got a jolt after The Wall Street Journal reported the data storage company is in advanced talks to merge with Japanese NAND flash-memory chip maker Kioxia Holdings, according to people familiar with the matter. The all-stock M&A deal could reportedly be valued at more than $20 billion and be finalized as early as mid-September.

- Deere (DE) made headlines after the agricultural equipment maker said it hiked its quarterly dividend to $1.05 per share – a 16.7% increase from its previous payout of 90 cents per share. The new dividend implies an annual yield of 1.1%. DE stock finished the session up 2.3%.

- U.S. crude oil futures climbed 1.2% to settle at $68.36 per barrel after data from the Energy Information Administration showed domestic crude supplies notched a third straight weekly decline for the week ended Aug. 20.

- Gold futures fell 1% to finish at $1,791 an ounce.

- The CBOE Volatility Index (VIX) declined 3.7% to 16.59.

- Bitcoin prices gained 1.1% to $48,797.41. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Your Passport to Cheaper Stocks

As stock prices remain aloft, so too do stock valuations.

The S&P 500 is trading at downright decadent multiples – although the index's forward price-to-earnings ratio is slowly thinning out thanks to improving profit estimates, stocks still are trading near 20-year highs, according to Yardeni Research.

Fortunately, value-minded investors can find relief outside our borders, as stocks in several international markets are trading for much more reasonable prices.

The "easy route" to international exposure goes through exchange-traded funds (ETFs). For instance, these 10 international ETFs – selected with an eye toward minimizing exposure to China amid its tight governmental crackdowns of late – provide access to dozens if not hundreds of stocks at once.

But stock pickers certainly have a wealth of options.

The income-minded should start their hunt with overseas payout royalty – Europe and Canada alike each boast their own Dividend Aristocrats, selected for their dedication to regularly improving cash distributions.

However, if you're just looking for overall buy-and-hold excellence, consider these seven international stocks. Each pick possesses a one-two punch of relatively cheap valuation and potent profit-growth potential.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.