Stock Market Today: Infrastructure Progress Sends Dow, S&P 500 to New Highs

The Senate's passage of a roughly $1 trillion infrastructure bill provided a tailwind to materials, industrials and energy stocks Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Senate on Tuesday green-lit a roughly $1 trillion infrastructure bill that was greeted with cheers by much of the market – though, not all of it.

The Bipartisan Infrastructure Investment and Jobs Act lived up to its name by passing the Senate 69-30. The bill, if passed, would authorize about $550 billion in new federal spending on traditional infrastructure such as roads, tunnels and bridges, as well as on projects such as expanding access to broadband internet and building electric-vehicle charging stations.

The industrial (+1.0%), materials (+1.5%) and energy (+1.8%) sectors led the way, the latter aided by a 2.7% improvement to U.S. crude oil futures, to $68.29 per barrel. Exxon Mobil (XOM, +1.7%), Caterpillar (CAT, +2.5%) and Freeport-McMoRan (FCX, +4.8%) were among some of the day's notable risers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Not everyone was ready to chalk up all of Tuesday's gains to the Senate's action, however.

"Some of this may be a result of the infrastructure bill but I think it has more to do with a resurrection of the cyclical, value-oriented rally that we saw earlier in the year," says Brian Price, head of investment management for Commonwealth Financial Network a Massachusetts-based registered investment adviser and independent broker/dealer. "We’ve seen this before when interest rates increase, and we’re seeing more of that lately with some hawkish commentary from certain members of the Fed."

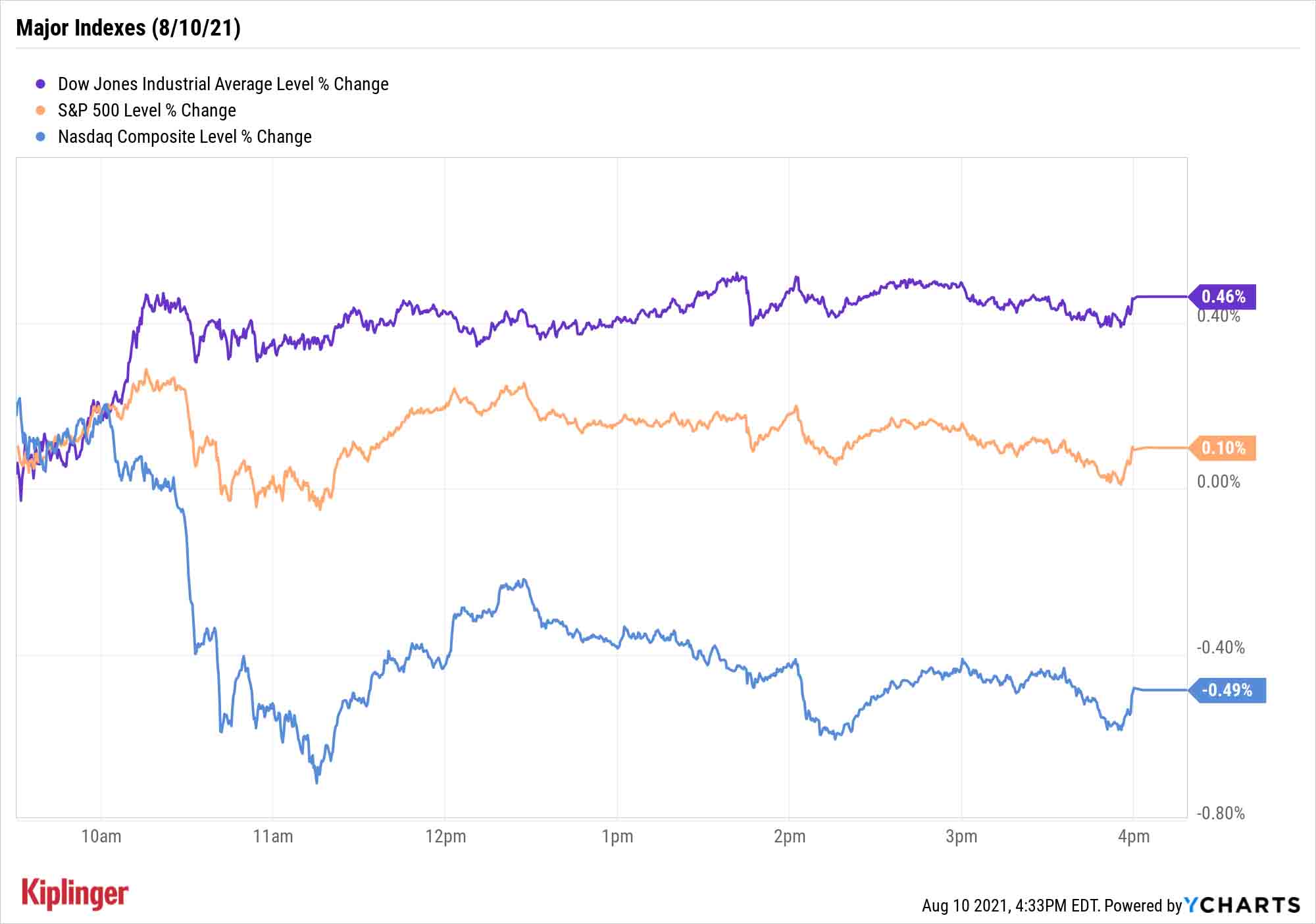

The Dow Jones Industrial Average improved by 0.5% to a record close of 35,264. The S&P 500 gained 0.1% to 4,436, surpassing its previous all-time high by a fraction of a point.

But the Nasdaq Composite (-0.5% to 14,788) struggled thanks to slippage in the tech sector (-0.8%) amid a bump higher in interest rates.

Other news in the stock market today:

- The small-cap Russell 2000 managed a 0.2% improvement to 2,239.

- 3D Systems (DDD) enjoyed a massive earnings pop Tuesday. In its second quarter, the 3D printing specialist reported adjusted earnings per share of 12 cents on $162.6 million in revenue. Both figures came in above what analysts were expecting and represented strong growth from the year prior,when 3D Systems reported a quarterly loss of 13 cents per share on $112.8 million in revenue. DDD stock closed up 21.5%.

- AMC Entertainment (AMC) stepped into the earnings confessional bright and early, reporting a slimmer-than-anticipated net loss of 71 cents per share on higher-than-anticipated revenue of $444.7 million. The company also said it would start accepting Bitcoin at its movie theaters by the end of the year. But while the meme stock was up nearly 10% earlier in the day, it closed with a 6.1% loss.

- Gold futures gained 0.3% to settle at $1,731.70 an ounce.

- The CBOE Volatility Index (VIX) edged 0.5% higher to 16.80.

- Bitcoin prices stalled Tuesday, declining 1.0% to $45,514.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Where Infrastructure Progress Could Help the Most

It ain't over 'til it's over, of course.

The House likely won't even take up the infrastructure bill until late September, when it returns from recess, and even if it passes, the spending will be spread out across several years.

But progress is progress.

"While many initiatives in the bill could take a few years to kick in, the boost from this round of stimulus could come just as the recovery wears off," says Lindsey Bell, chief investment strategist at investment platform Ally Invest. "We may start seeing the market price in higher infrastructure spending as investors try to get ahead of the game."

Bell adds that several groups of stocks could get a lift the closer the bill gets to President Joe Biden's desk – the industrial and materials sectors, for instance, as well as more specific industries such as semiconductors and electric vehicles.

If you're looking for a quick list of investment options from a wide variety of specializations, however, consider these 14 infrastructure stocks. These picks range from machinery manufacturers to EV charging station producers to telecom real estate plays – and all could reap rewards if this infrastructure spending plan is passed into law.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.