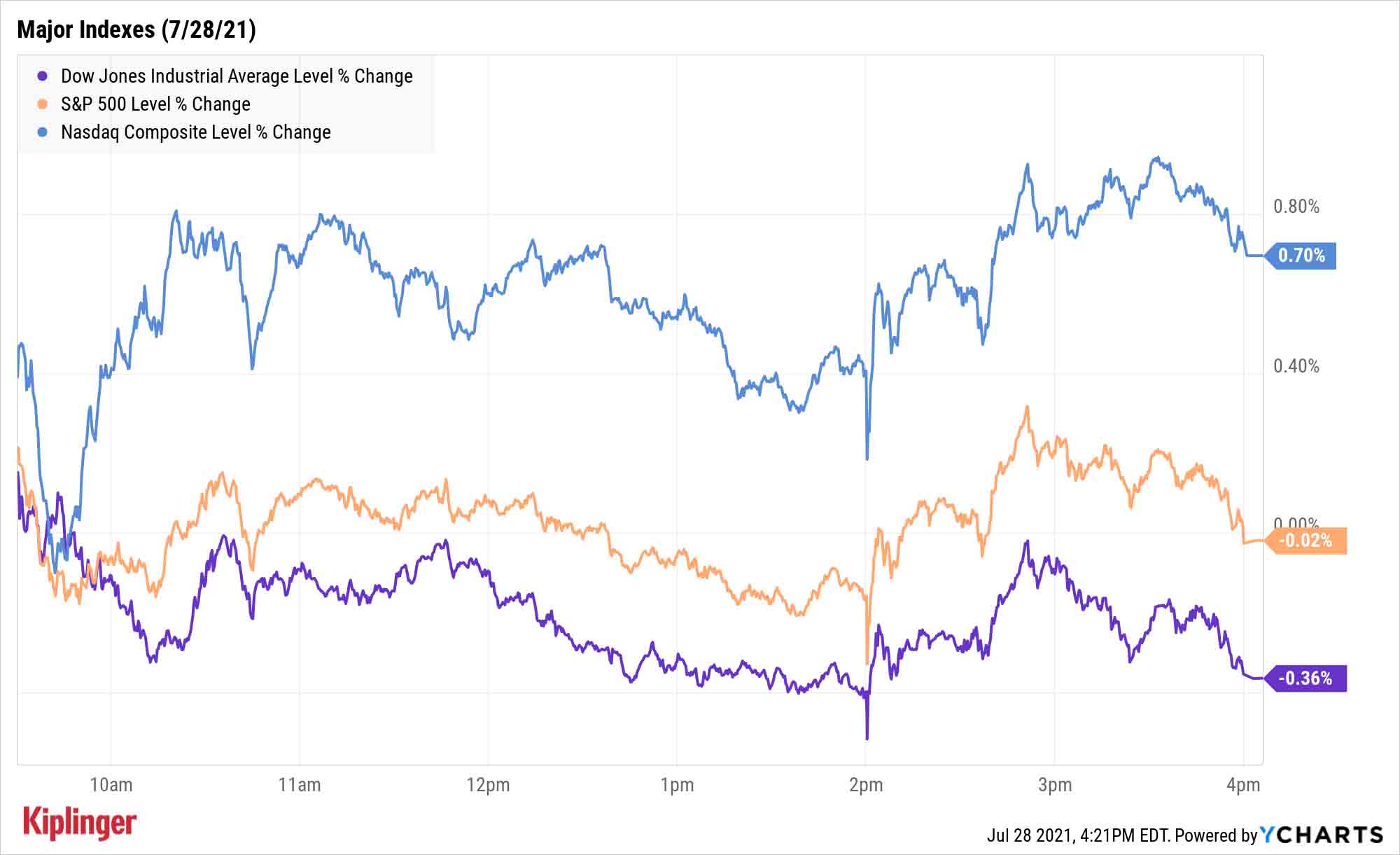

Stock Market Today: Stocks Finish Mixed as Fed Stays the Course

The Federal Reserve kept interest rates at near-zero and seemed loath to taper asset purchases, giving stocks a small afternoon lift in an uneven Wednesday session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Federal Reserve and Chair Jerome Powell brought a little cheer to parts of Wall Street on Wednesday, keeping benchmark interest rates steady (as expected) but also indicating that accommodative policy would stick around for some time.

In a release, Powell said that the U.S. labor picture would need to significantly improve before the central bank would pare back its monthly asset purchases.

"The Fed acknowledged that the economy has made progress towards meeting employment and inflation goals so we're likely getting closer to an official tapering announcement, but we still think September is when that is likely to take place," says Lawrence Gillum, fixed income strategist for LPL Financial.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Some members continue to express concern about the slow pace of recovery in the labor market, while others are more concerned about rising prices and the economic impact as a whole. Either way, Chairman Powell likely spent most of this meeting wrangling with other Fed officials on the timing and pace of slowing the Fed’s asset purchases,” says Charlie Ripley, senior investment strategist for Allianz Investment Management. “With no imminent decision signaled at this meeting, it appears that it’s going to take a couple more meetings to get everyone on the same page.”

Also front-and-center today were several strong earnings-related performances. Google parent Alphabet (GOOGL, +3.2%) delivered a massive 62% year-over-year jump on revenues as advertising rebounded, Pfizer (PFE, +3.2%) topped Q2 estimates and raised its full-year guidance on strong COVID vaccine sales, and Boeing (BA, +4.2%) recorded a surprise profit after six consecutive quarterly losses.

The small-cap Russell 2000 led the way with a 1.5% jump to 2,224. The Nasdaq Composite rebounded 0.7% to 14,762, and while the S&P 500 finished with a marginal decline, it closed well off the day's lows, at 4,400. The Dow Jones Industrial Average dipped 0.4% to 34,930.

Other news in the stock market today:

- McDonald's (MCD, -1.9%) was the worst Dow stock today following the fast-food chain's quarterly report. In its second quarter, MCD reported higher-than-anticipated adjusted earnings per share of $2.37 on $5.9 billion in revenue, up 259% and 57%, respectively, on a year-over-year basis. Additionally, global same-store sales surged 40.5% from the same period one year ago. In a subsequent earnings call, CEO Chris Kempczinski noted a "challenging labor environment," but added that it was "getting better" in the U.S. He also said the company is monitoring supply chain issues and the global chip shortage, particularly "on the equipment side."

- Apple (AAPL, -1.2%) was another blue chip that fell after its quarterly earnings report, even as Wedbush called the iPhone maker's fiscal third-quarter a "gold medal" performance. You can read all the highlights from AAPL's "drop-the-mic" quarter here.

- U.S. crude oil futures rose 1% to $72.39 per barrel.

- Gold futures closed marginally lower at $1,799.70 an ounce.

- The CBOE Volatility Index (VIX) slumped 5.5% to 18.29.

- Bitcoin prices bounced a robust 6.3% to $40,307.11. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is It Almost Infrastructure Week?

Another potentially bullish factor that flew under the radar: progress in Washington on an infrastructure deal. Specifically, a bipartisan group of senators agreed Wednesday on major issues for an infrastructure bill that would authorize $1.2 trillion in spending over the next eight years.

"Today was a critical step forward in passing the infrastructure bill; the main issue around payment appears to be resolved," says Josh Duitz, portfolio manager of the Aberdeen Standard Global Income Infrastructure Fund (ASGI). "While we're optimistic a deal will be signed before the August recess, the reality is that infrastructure investment is going to be strong going forwards regardless of what happens on Capitol Hill."

Duitz notes that two potential beneficiaries – green energy and 5G communications – are already on the rise, and that a new bill would only accelerate the revolutions already under way.

Investors looking for intriguing opportunities in the event Washington's bipartisan proposal becomes law should certainly explore both themes, but other industries could enjoy a lift, too. Read on as we delve into 14 of the best stocks to buy if America's aging infrastructure finally receives a cash infusion.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.