Tesla (TSLA) Q2 Earnings: 4 Things to Watch

Our preview of the upcoming week's earnings reports includes Tesla (TSLA), Alphabet (GOOGL), Apple (AAPL), Microsoft (MSFT) and Facebook (FB).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

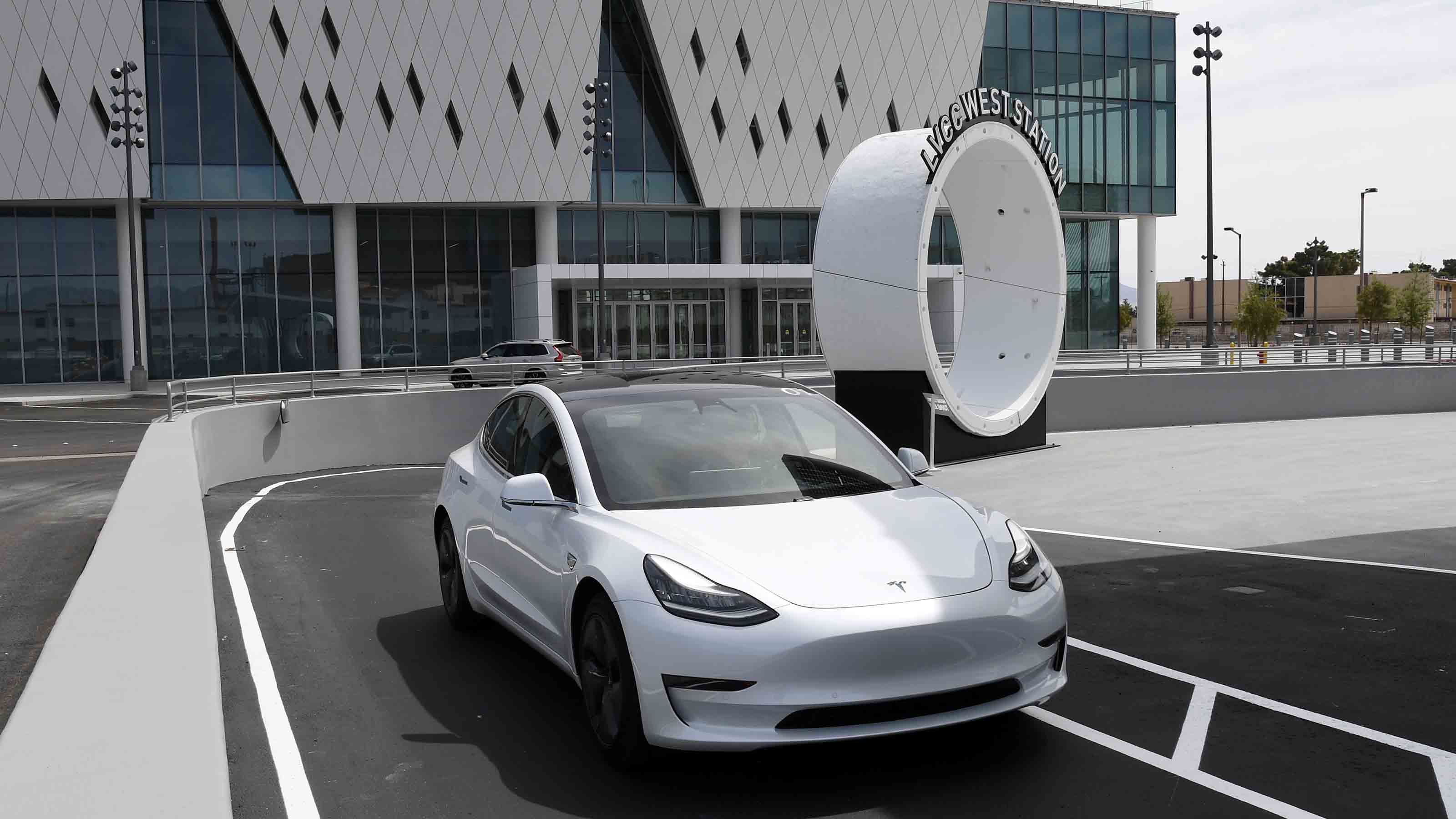

We're about to enter the busiest week of this earnings season so far, and Tesla (TSLA, $645.33) will help lead the charge after the market closes on Monday, July 26, when it reports second-quarter results.

The electric vehicle (EV) maker last took its turn in the earnings confessional in April, when it reported better-than-expected profit and revenues thanks in part to gains from its bitcoin investment.

But a lot has happened since then.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For starters, Tesla CEO Elon Musk announced in May that the company will not sell any of its Bitcoin and will no longer accept the cryptocurrency as a payment for its cars until a more environmentally friendly alternative can be found for mining the coins.

Plus, the price of Bitcoin plunged roughly 40% in Q2.

While Bitcoin's impact on TSLA's bottom line will certainly draw interest from Wall Street, Credit Suisse analyst Dan Levy (Hold) is homing in on three additional key themes in the final print.

First is the company's capacity build-out, particularly as TSLA looks to get new factories in Texas and Berlin online. Second is the status of the firm's full self-driving (FSD) capabilities, as "some have cited concern over Tesla's release of features that aren't fully validated." And lastly, Levy is looking for upside on gross margin.

"We assume volume strength, price increases and favorable mix should more than offset higher raw material costs and production inefficiencies," he says. Levy expects gross margin, excluding regulatory credits, will arrive at 25% – up 300 basis points (a basis point is one-one hundredth of a percentage point) from Q1 – while earnings per share (EPS) will land at $1.34.

Overall, the consensus estimate for Tesla's second-quarter report is for earnings of 96 cents per share, up 118% year-over-year (YoY), with revenues expected to rise 85.8% from the year prior to $11.2 billion.

A Boisterous Bounce-Back for Alphabet Earnings?

The pros are upbeat ahead of Alphabet's (GOOGL, $2,665.95) announcement due out after the July 27 close, expecting the Google parent to report EPS of $19.21 in its second quarter, which would mark an 89.6% improvement from the year prior, on $56.0 billion in revenues (+46.3% YoY).

"We remain positive on GOOGL and highlight [it] among our favorite large-cap picks as we believe it should benefit from ad spend recovery, pent-up demand for Google Cloud and call options on Waymo and other non-advertising initiatives," says Jefferies analyst Brent Thill, who rates the stock at Buy.

BofA Big on Apple Ahead of Q3 Report

Analysts are optimistic ahead of Apple's (AAPL, $148.59) fiscal third-quarter earnings report, too, with consensus estimates for the iPhone maker's EPS docked squarely at $1.00 (+56.3% YoY). Meanwhile, revenues are projected to arrive at $72.9 billion, which is 22.2% higher than what AAPL brought in this time last year.

However, BofA Global Research is guiding for even better numbers from Apple (EPS of $1.05 on $77 billion in revenue). "We expect AAPL to report a strong June quarter on broad-based hardware strength," the firm says.

BofA Global Research has a Neutral (Hold) rating on the tech stock, with a $160 price target, representing expected upside of 8% over the next 12 months or so.

Apple will report Tuesday after the closing bell.

Cloud Expected to Lift Microsoft Results

Microsoft (MSFT, $289.38), which also reports Tuesday evening, is expected to report earnings of $1.90 per share in its fiscal fourth quarter – up 30.1% from the year prior. Revenues are forecast to arrive at $44.1 billion (+16% YoY).

"We expect MSFT to broadly outperform Street expectations on the heels of sustained strength within the company's commercial business lines, particularly Office 365 and Azure," says Stifel analyst Brad Reback, who has a Buy rating on the stock.

"We continue to believe that the pandemic is forcing organizations of all sizes to accelerate the pace of their respective cloud migrations and that MSFT should continue to be a key beneficiary as its broad stack enables it to capture Tier 1 workloads previously out of reach."

Analysts Have High Q2 Expectations for Facebook

After a slow start to the year, Facebook (FB, $371.94) has been trending higher since late March, and is now more than 36% higher for the year to date. Part of this upside came in the wake of the social media giant's first-quarter earnings results in April.

Specifically, FB shares jumped 7.3% the day after the company reported stronger-than-anticipated earnings and revenue thanks to a 30% year-over-year pop in the average price per ad and a 12% rise in the number of ads shown.

Canaccord Genuity analysts Maria Ripps and Michael Graham think ad revenue continued to accelerate in the second quarter. "Digital advertising spend remains robust as ongoing momentum from COVID beneficiary verticals like e-commerce and technology is now accompanied by a recovery from travel, traditional retail, and movie studios," the analysts say. And for FB's second quarter, they are targeting year-over-year ad revenue growth of 47.4%.

The pros are generally positive for Facebook's top- and bottom-line growth, as well. For its second quarter, the average analyst estimate is for revenues of $27.8 billion, up 59.9% from one year ago, while EPS are expected to come in at $3.02 (+67.2%). FB will unveil its Q2 report after the July 28 close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

These Small Money Habits Really Can Plant Roots

These Small Money Habits Really Can Plant RootsFebruary gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.