Stock Market Today: Records Crumble as Wall Street Cheers Jobs Report

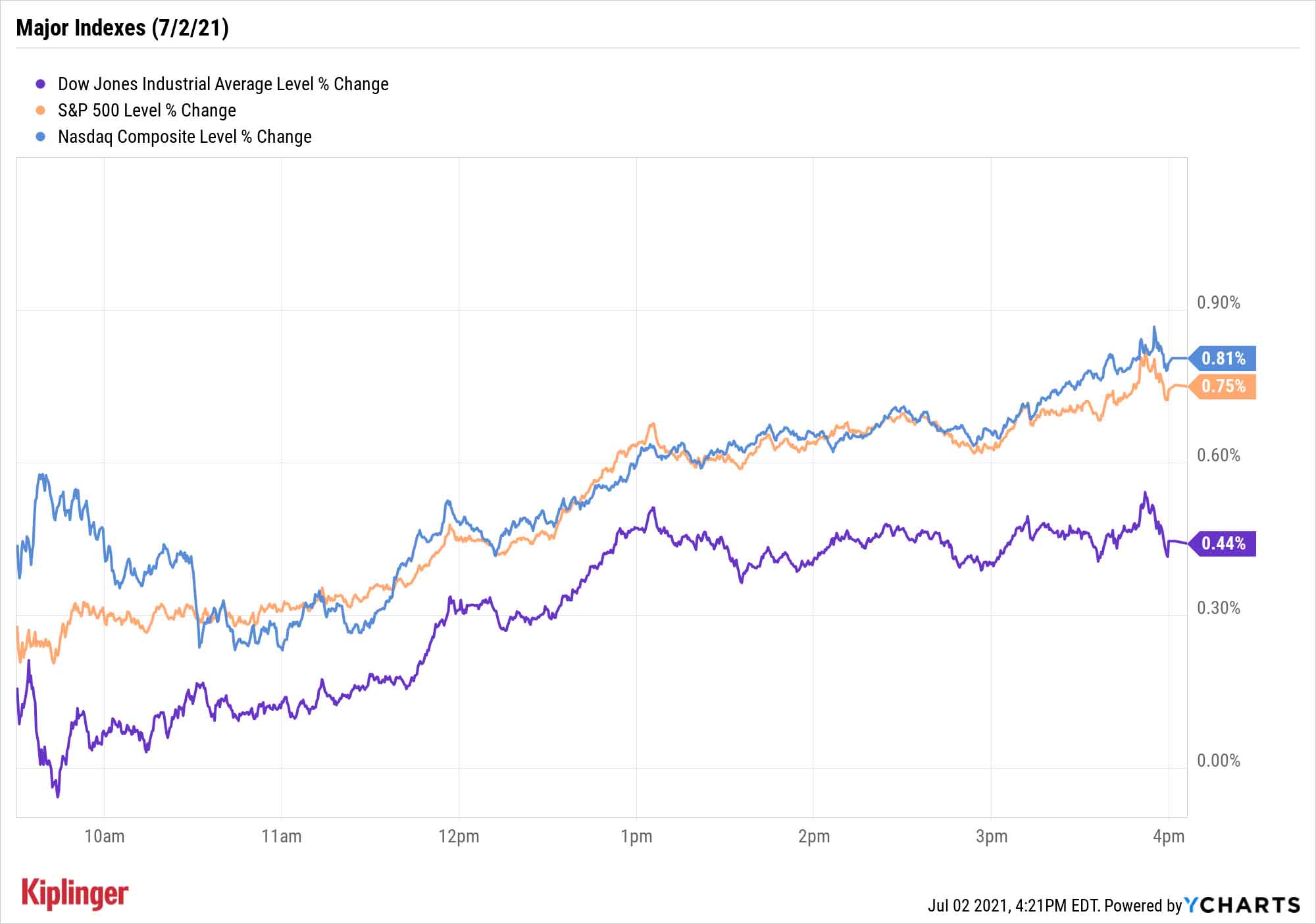

The Dow finally rejoined the S&P 500 and Nasdaq in setting record territory after Friday's June jobs report triggered a broad rally.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Better-than-expected employment news was Wall Street's central focus Friday, and the driving force behind new record highs in all three of the major stock indexes.

The Labor Department reported that the U.S. added 850,000 nonfarm payrolls in June, well above the consensus economist expectation of 720,000.

One unwelcome surprise, however, was the unemployment rate, which ticked higher to 5.9%, from 5.8% in May, and exceeded the 5.6% figure economists were looking for.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Despite the snappy headline print, the June jobs report actually casts a dimmer light on the economic recovery," says Sal Guatieri, senior economist at BMO Capital Markets. "Most of the new jobs now being created are in sectors that were slammed by the pandemic, while companies in other industries are struggling to find available workers … this doesn't bode well for strong organic growth."

So, why the clearly positive response in equities?

"The payroll report is effectively a goldilocks report for both the economy and markets," says Amit Sinha, head of Multi-Asset Design at Voya Investment Management. "It validates the growth story while reducing fears of the Fed taking away the punch bowl anytime soon."

The S&P 500 (+0.8% to 4,352) and Nasdaq Composite (+0.8% to 14,639) both closed at new all-time highs – a routine occurrence of late. The Dow Jones Industrial Average joined the party, finishing up 0.4% to 34,786, surpassing its previous record close of 34,777, set on May 7.

LPL Financial Chief Market Strategist Ryan Detrick adds that the June jobs report provided some clues into the near-term future for inflation.

“The sustainability of bargaining power for relatively lower wage service sector workers who return to the labor force is going to be an important tell on the inflation debate,” he says. “Wage increases can lead to stickier inflation, and at the moment some employers have no choice but to pay up in order to meet surging demand. Whether this dynamic holds past summer and into the fall, though, remains to be seen.”

And guess what? We're now rolling into a long weekend, as the markets will close Monday in observance of Independence Day.

Other action in the stock market today:

- The small-cap Russell 2000 didn't participate in the rally, declining a full 1.0% to 2,305.

- International Business Machines (IBM) was the worst Dow stock today, shedding 4.6%. Today's drop came in response to news that the tech company's president, Jim Whitehurst, is stepping down. Whitehurst took the role following IBM's acquisition of Red Hat – where he served as CEO for 12 years – in April 2020. He will stay on in an advisory role.

- Virgin Galactic Holdings (SPCE) was a big mover on news the company's founder, Richard Branson, will be on its July 11 spaceflight test. This gives Branson the upper hand in the "billionaire space race," beating out Amazon.com (AMZN) founder Jeff Bezos, who is slated to be a passenger on a July 20 spaceflight from his company Blue Origin. SPCE ended the day up 4.1%.

- U.S. crude oil futures finished with a marginal loss at $75.16 per barrel.

- Gold futures settled up 0.4% at $1,783.30 an ounce.

- The CBOE Volatility Index (VIX) declined 2.1% to 15.15.

- Bitcoin prices improved a modest 0.5% to $33,267.56. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

Tech for the Long Term

We've spent much of the past couple weeks looking ahead to the rest of 2021, and most forecasts call for continued strength in value sectors such as energy, industrials and financials.

But once you start to look out years rather than months, many of the best growth opportunities are exactly where you'd expect them: technological trends.

Take electric vehicles (EVs), a global market that research firm Million Insights estimates will grow by 41.5% annually to reach $1.2 trillion by 2027. Or artificial intelligence (AI), which Grand View Research sees expanding by 40.2% annually to nearly $1 trillion by 2028.

But these and other tech trends all have one thing in common: They're powered by semiconductors.

Chip stocks, then, are almost impossible to ignore. Not only do they make up the foundations of most bleeding-edge technologies you can think of, but they're a necessary component of just about any device we interact with on a daily basis. But which plays stand out? Check out our look at seven of the best semiconductor stocks to buy.

Kyle Woodley was long SPCE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Slip to Start Fed Week: Stock Market Today

Stocks Slip to Start Fed Week: Stock Market TodayWhile a rate cut is widely expected this week, uncertainty is building around the Fed's future plans for monetary policy.

-

Crypto Trends to Watch in 2026

Crypto Trends to Watch in 2026Cryptocurrency is still less than 20 years old, but it remains a fast-moving (and also maturing) market. Here are the crypto trends to watch for in 2026.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.