Stock Market Today: Stocks Sizzle to Start Off the New Week

The market rebounded violently from last week's selloff, led by a roaring energy sector in the face of climbing oil-price estimates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Perhaps last week's selloff was a touch overdone.

That seemed to be the stock market's implied message Monday, anyway, as the broader indexes all roared ahead despite no new major developments over the weekend.

Energy (XLE, +4.3%) was the clear leader today, fueled by a 2.8% surge in U.S. crude oil futures, to $73.66 per barrel, after Bank of America commodities strategist Francisco Blanch said oil could hit $100 per barrel in 2022. He cites drivers including "plenty of pent-up mobility demand after an 18-month lockdown," lagging mass transit and the potential for oil firms to spend less on production amid stricter government energy policies.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Oil stocks such as EOG Resources (EOG, +7.2%) and Marathon Oil (MRO, +6.9%) were among the sector's biggest winners.

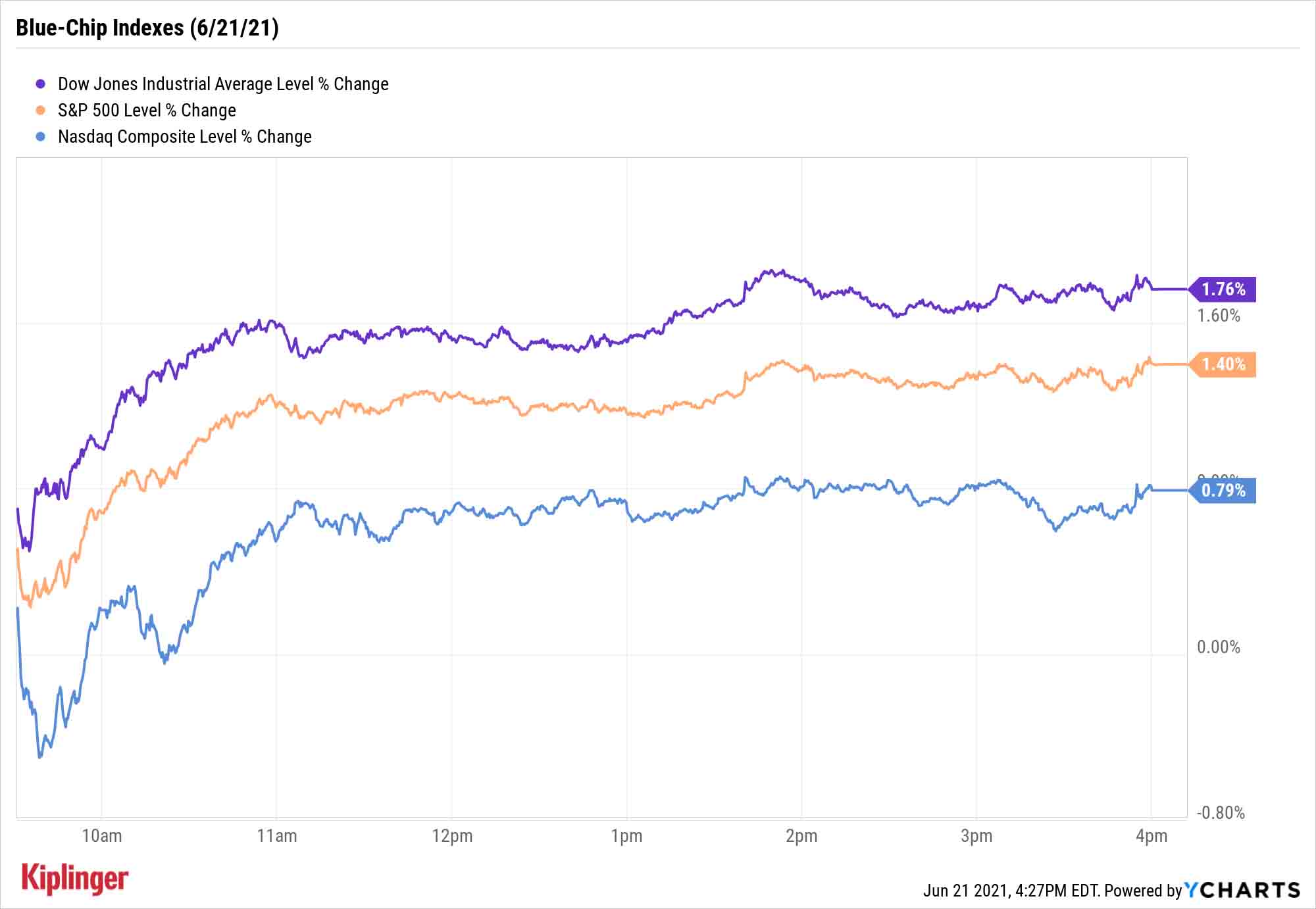

The Dow Jones Industrial Average (+1.8% to 33,876) reversed course after its worst week since October, as did the S&P 500 (+1.4% to 4,224) and Nasdaq Composite (+0.8% to 14,141) – a continuation of an up-and-down past couple months.

"Volatility is likely to continue as the financial markets are facing a period of reckoning," says Gene Goldman, chief investment officer at Cetera Investment Management, noting that interest-rate uncertainty and high equity prices raise at least the possibility of a market correction.

Other action in the stock market today:

- The small-cap Russell 2000 was the best of the major indexes on Monday, jumping 2.2% to 2,286.

- Moderna (MRNA, +4.5%) gained ground today, after The Wall Street Journal reported the drugmaker was adding two additional manufacturing lines at a plant outside Boston in order to increase capacity for producing its COVID-19 vaccine, as well as making booster shots for the virus. Company officials expect 50% growth in production due to the extra lines.

- It was another volatile session for Lordstown Motors (RIDE, -5.5%) after a regulatory filing revealed five top executives – including the president and former chief financial officer – sold blocks of stock in February, just ahead of the electric truck maker's mid-March earnings report. It has been a rough stretch for RIDE, which warned off serious cash problems earlier this month and saw its CEO and CFO step down one week ago.

- Gold futures rose 0.8% to settle at $1,782.90 an ounce.

- The CBOE Volatility Index (VIX) slumped by 13.3% to 17.95.

- Bitcoin prices didn't snap back over the weekend, declining 8.0% to $32,614.04. Fellow cryptocurrency Ethereum was even worse, off 10.2% to $1,946.76. "What is happening today is a classic deleveraging,” says Charlie Silver, CEO of Permission.io, a cryptocurrency-enabled provider of e-commerce permission advertising. “Ethereum is the currency that is mostly used in DeFi bets, which allow traders to lever up 100x or more. This move down over the last few weeks has caused an unwinding of highly leveraged bets, which [has led] to a cascade of selling." (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Where to Find Green-Energy Comeback Plays

2021 has been a great year for traditional energy, but a lousy one for green energy. But it's hardly a harbinger of doom for clean-energy stocks.

Take the iShares Global Clean Energy ETF (ICLN), for instance: The fund is off roughly 20% in 2021, grossly underperforming both the S&P 500 (+12.5%) and its energy sector (+42.4%), but that follows a 140%-plus run-up to all-time highs a year prior.

For opportunists, this drawdown is presenting a second chance on an industry that many analysts and experts believe will be a long-term winner.

The ways in which you can invest in a greener earth are growing, too.

There are solar stocks, a few of which have been around for decades and represent clean energy's "old guard." A little fresher-faced are electric vehicle (EV) stocks, which are growing in number like weeds.

If you're curious about the various ways you can "green up" your portfolio, however, consider this list of seven attractive green energy stocks representing numerous industries. There's something for everyone – from highflying growth chasers to income hunters seeking out juicy yields.

Kyle Woodley was long ICLN and XLE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.