Stock Market Today: Tech Rallies, Nasdaq Just Shy of New Highs

Investors brushed past inflation and interest-rate fears Thursday to drive technology and other growth shares higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

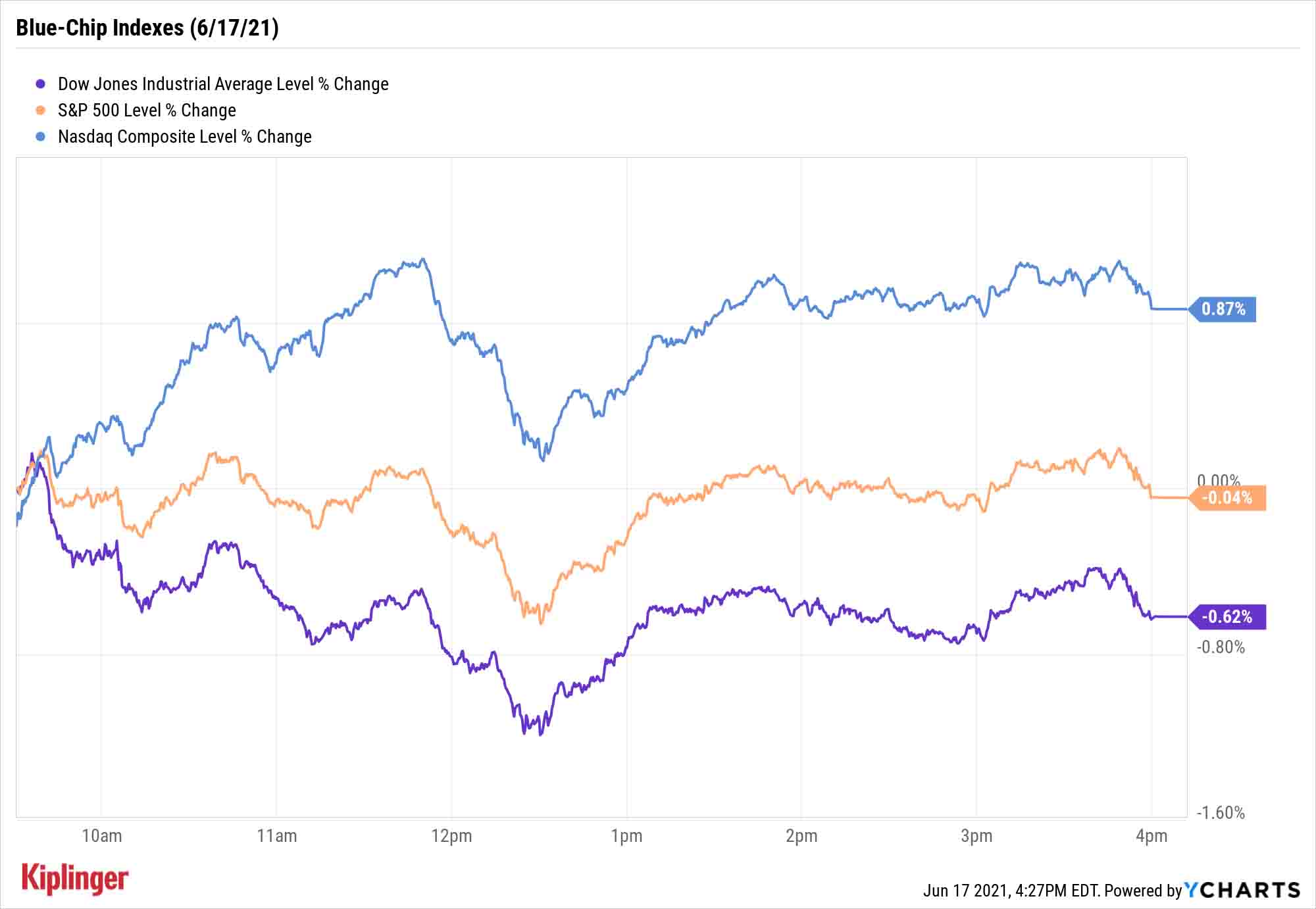

The Nasdaq Composite pressed higher Thursday, to within just a few points of a fresh closing record, flipping the script on how the technology-heavy index has acted for much of 2021.

The Federal Reserve yesterday revealed higher expectations for inflation and signaled that rising interest rates might be here sooner than previously expected. Both of these factors were blamed for the Nasdaq's underperformance earlier this year, but today, the composite greatly outperformed its blue-chip index peers.

Robust gains in tech and tech-esque stocks such as Nvidia (NVDA, +4.8%), Amazon.com (AMZN, +2.2%) and Tesla (TSLA, +1.9%) powered a 0.9% advance in the Nasdaq to 14,161, just shy of its previous high of 14,174.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Based on our ongoing correlation studies between [interest] rates and the equity markets/sectors, we believe that tech may continue to lead on a relative basis over the short-run," says Dan Wantrobski, technical strategist at Janney Montgomery Scott. "It is not yet confirmed whether this tech outperformance will itself prove 'transitory,' or if a longer-term theme is emerging here."

The S&P 500 (off marginally to 4,221) and Dow Jones Industrial Average (-0.6% to 33,823) were more subdued, hobbled in part by a surprise increase in weekly unemployment filings; last week's 412,000 claims were the most filed since mid-May.

Also Thursday, Congress passed legislation making Juneteenth, or June 19, the 12th federal holiday, and President Joe Biden signed it into law. It will go into effect immediately, with federal employees getting a paid day off Friday, June 18 (Juneteenth falls on Saturday this year). The stock and bond markets will remain open tomorrow, though they're widely expected to observe the holiday in the future.

Other action in the stock market today:

- The small-cap Russell 2000 declined for the fourth consecutive session, slumping 1.2% to 2,287.

- Tenet Healthcare (THC, +2.8%) popped today on some M&A activity. The Texas-based healthcare services provider said it is selling five hospitals and related physician operations in Florida's Miami-Dade and Southern Broward counties to privately owned Steward Health Care for $1.1 billion.

- Lennar (LEN, +3.6%) was another notable mover today. The housing stock got a lift after the company reported better-than-expected earnings and revenues in its fiscal second quarter, while homebuilding gross margin also came in above analysts' consensus estimate.

- U.S. crude oil futures fell 1.5% to end at $71.04 per barrel after the Fed's relatively hawkish tone on Wednesday (projecting higher interest rates in 2023) boosted the U.S. dollar.

- A rising greenback weighed on gold futures, too, with the malleable metal sliding 4.7% to settle at $1,774.80 an ounce.

- The CBOE Volatility Index (VIX) settled 2.2% lower to 17.75.

- Bitcoin prices declined 2.4% to $37,765.72. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Billionaires Are Unloading These 25 Stocks

We keep tabs on Wall Street's top minds and what opportunities they're eyeing throughout the year. That's because you can gain an edge by tapping into the deep knowledge of analysts who closely monitor the stocks in their coverage universe, and by tracking the market moves of large institutional managers and stock pickers (think Warren Buffett) that have far greater research resources than your average investor.

However, while we mostly focus on the purchasing records of Wall Street's "smart money" – such as these 30 stock picks of the billionaire set – it also pays to examine what they're selling.

Today, we've put the spotlight on 25 stocks that billionaires have sold in the most recent quarter.

But we suggest you read closely.

Yes, in some cases, billionaires and other institutional managers have unloaded shares because they've lost faith in the underlying companies … but in others, a turn toward the exits might just be prudent profit-taking after a red-hot run.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.