Stock Market Today: Stocks Slip on Mixed Economic Data Dump

While the major market indexes closed in the red, oil prices climbed to levels not seen since late 2018.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors have plenty to think about with the Federal Reserve's latest announcement on deck tomorrow, but on Tuesday they were first forced to consider a heaping helping of economic data – and found little to act on.

The biggest data point out today: U.S. producer price index (PPI) jumped 0.8% month-over-month in May to top economists' expectations.

"Following the May CPI report where core CPI also popped 0.7% [month-over-month], the PPI data add to the evidence of strong inflation pressures in the economy," say BofA Securities strategists.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also Tuesday, May headline retail sales declined 1.3% month-over-month, falling below expectations for a more modest 0.7% decline.

"May's decline in headline sales was mostly concentrated in durable goods categories, which had shown especially outsized gains in March," say Barclays economists Jonathan Millar and Michael Gapen. "In particular, the May estimates show substantial spending moderation in motor vehicles and parts, furniture, and electronics – albeit with all these categories still running at very high levels."

And last month's industrial production improved 0.8% month-over-month but remained below pre-pandemic levels.

"As a whole, the numbers were slightly disappointing but are not changing the narrative," Michael Reinking, senior market strategist for the New York Stock Exchange, says about Tuesday's data dump. "Markets have been discounting recent economic data with the belief that some of the base effects, supply chain constraints and bottlenecks (expect to hear that word a lot tomorrow) will begin to unwind as we approach Q3."

A few pockets of the market showed strength Tuesday. Oil stocks such as Exxon Mobil (XOM, +3.6%) and Chevron (CVX, +2.2%) advanced after oil futures settled 1.8% higher to $72.12 per barrel, a two-year high. The industrials sector (+0.4%) and utilities (+0.3%) both finished modestly in the black, too.

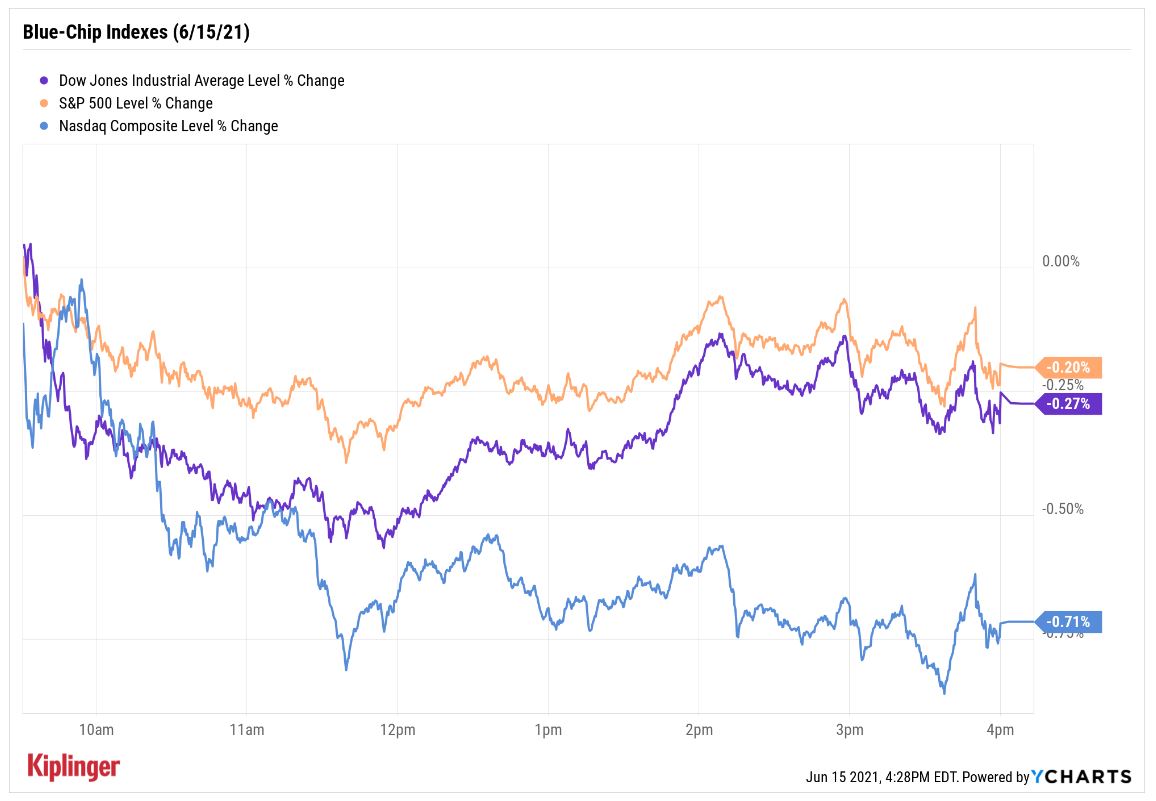

But the major indices mostly retreated, with the Dow Jones Industrial Average off 0.3% to 34,299, the S&P 500 declining 0.2% to 4,246 and the Nasdaq Composite slipping 0.7% to 14,072.

Other action in the stock market today:

- The small-cap Russell 2000 declined 0.3% to 2,320.

- DraftKings (DKNG, -4.2%) took a hit today after Hindenburg Research said it has a short position on the sports gambling stock. Among several criticisms of DKNG, Hindenburg noted in a report that its research of SBTech – a European tech firm that merged with DraftKings as part of a broader special purpose acquisition company (SPAC) deal – shows "a long and ongoing record of operating in black markets."

- Sage Therapeutics (SAGE, -19.3%) was a notable decliner after the biotech reported Phase 3 data for the depression drug it's producing with Biogen (BIIB, -2.5%). While the treatment met its main goal in the late-stage study, there was still some uncertainty over the longer-term effectiveness of the drug.

- Gold futures notched a third straight loss, slipping 0.5% to finish at $1,856.40 an ounce.

- The CBOE Volatility Index (VIX) was up again Tuesday, climbing 3.8% to 17.02.

- Bitcoin prices briefly topped $41,200 today before settling for a 0.6% gain to $39,946.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Where You Can Still Find Value

After a sluggish start to 2021, growth has started pulling its weight in its tug-of-war with value, but the environment still seems to favor the latter.

"While the rate of growth will slow from the sharp rebound in 2021, the outlook for 2022 hardly portends the economic-growth scarcity that drove growth stocks to massively outperform at the end of the last cycle," says Carl Ludwigson, director of manager research for investment firm Bel Air Investment Advisors. "Furthermore, the expected tapering of asset purchases by the Fed should allow 10-year interest rates to drift higher even as the overnight rate remains pegged near zero, which favors value over growth stocks, as the latter depends more on future cash flows."

But now that value has been driven up for roughly half a year … what value is left?

You can always rely on value ETFs to do the choosing for you, as their methodologies can rotate out of some stocks as their prices go from low to lofty.

If you're picking on your own, we can at least point you in the right direction. These 15 Dividend Aristocrats, for instance, are looking much more fairly priced than their payout-growing brethren.

Of course, if you'd like to expand your search past the 65-member collection of Dividend Aristocrats, you can find a wider variety of stocks whose valuations haven't yet been elevated into the nosebleed seats. These 16 value stocks offer a little bit of everything: excellent fundamentals, income production and, of course, a decent price. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.