Stock Market Today: Dow, S&P 500 Surge Late, Set New Highs

Investors ignored weak February spending data and lifted the Dow and S&P 500 from decent gains to record territory with a Friday afternoon push.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

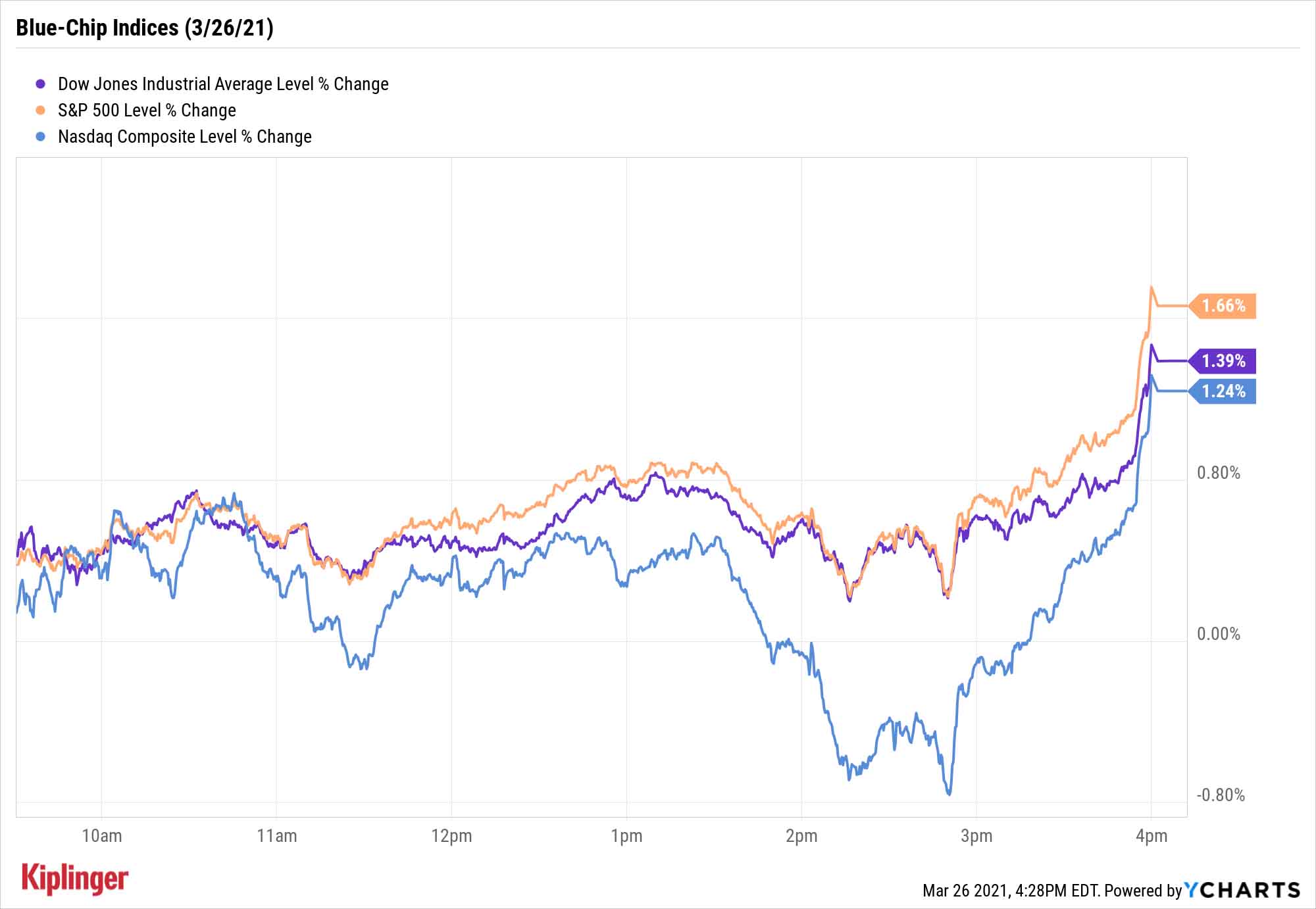

Wall Street looked like it was going to close the week in tame fashion, but buyers rushed in during the final hour to send all the major indices to strong gains.

The Commerce Department reported Friday that personal income declined by 7.1% in February, slightly better than the 7.3% drop economists were expecting in a month with storm disruptions, fewer working days and no stimulus checks.

However, consumer spending declined 1% last month, undershooting estimates of a 0.7% decline – but that should snap back in March thanks to outgoing stimulus checks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average (+1.4% to 33,072) and the S&P 500 (+1.7% to 3,974) were both en route to modest gains, and then a final-hour rally propelled them to new all-time highs. The industrial average was led by Cisco Systems (CSCO, +4.1%), Nike (NKE, +3.4%) and Intel (INTC, +4.6%).

The latter joined in a broad semiconductor rally that included Qualcomm (QCOM, +4.5%), Broadcom (AVGO, +4.4%) and Texas Instruments (TXN, +5.4%) to help the Nasdaq Composite (+1.2% to 13,138) flip from red to green in the late afternoon.

Other action in the stock market today:

- The small-cap Russell 2000 rocketed 1.3% higher to 2,211.

- Tesla (TSLA) declined 3.4% despite CEO Elon Musk's best efforts to prop it up – Musk tweeted there's "a >0% chance Tesla could be the biggest company," then followed it up with another tweet saying "Probably within a few months" that he quickly deleted.

- Comcast (CMCSA, -2.0%) dropped after DAZN Group, known as "the Netflix of sport," outbid Comcast's Sky division for a major Italian soccer contract.

- U.S. crude oil futures sprang back again, jumping 4.8% to settle at $61.35 per barrel.

- Gold futures edged 0.4% higher to $1,732.30 per ounce.

- Bitcoin prices joined the rally as well, climbing 3.2% to $53,832. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

One Bright Outlook for the Next Few Months

More encouragingly, the first-quarter earnings season will soon be upon us, and corporate America is expecting it to be a doozy. John Butters, senior earnings analyst at FactSet, notes that 60 S&P 500 companies have issued positive earnings per share (EPS) guidance for the first quarter.

"If 60 is the final number of S&P 500 companies issuing positive EPS guidance for the quarter, it will mark the highest number of S&P 500 companies issuing positive EPS guidance for a quarter since FactSet began tracking this metric in 2006," he says. "The current record is 57, which occurred in the previous quarter (Q4 2020)."

It could be an especially good quarter for tech stocks, as the sector leads the way with 29 companies issuing positive guidance.

Analysts are bullish on the sector, too, rating 61% of the S&P 500's tech stocks as Buys – but they feel equally as strong about energy, which has surged over the past few months, and healthcare.

While not as flashy as tech and not as recently en vogue as energy, healthcare is a favorite among buy-and-hold investors given the sector's ability to provide performance in bull and bear markets. Particularly attractive on this front are the sector's Big Pharma names, which provide not just stability, but typically well-above-average yields.

Read on as we explore seven large pharmaceutical stocks that are mostly just churning along with little fanfare, but that income investors can always appreciate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.