Stock Market Today: Stocks Fall on Anniversary of Bear Market Bottom

Rising short-term COVID concerns, including lockdowns in Europe and a trial-vaccine stumble, pulled down stocks across the board Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks marked the one-year anniversary of the COVID bear market's lowest point much the same way they acted on March 23, 2020 – they sold off.

Fortunately, today's declines were milder, and they came amid what's still a vastly more optimistic outlook for stocks, the economy and the public health.

Tuesday's selling, however, was sparked by short-term setbacks on the COVID front: renewed and extended coronavirus lockdowns in Europe, rising domestic caseloads in the U.S., and another setback for AstraZeneca's (AZN, -3.5%) experimental vaccine, after U.S. health officials said promising trial results might have relied on "outdated information." Oil prices were hit particularly hard: U.S. crude futures declined 6.2% to $57.76 per barrel, triggering a 1.5% decline in the energy sector (XLE).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

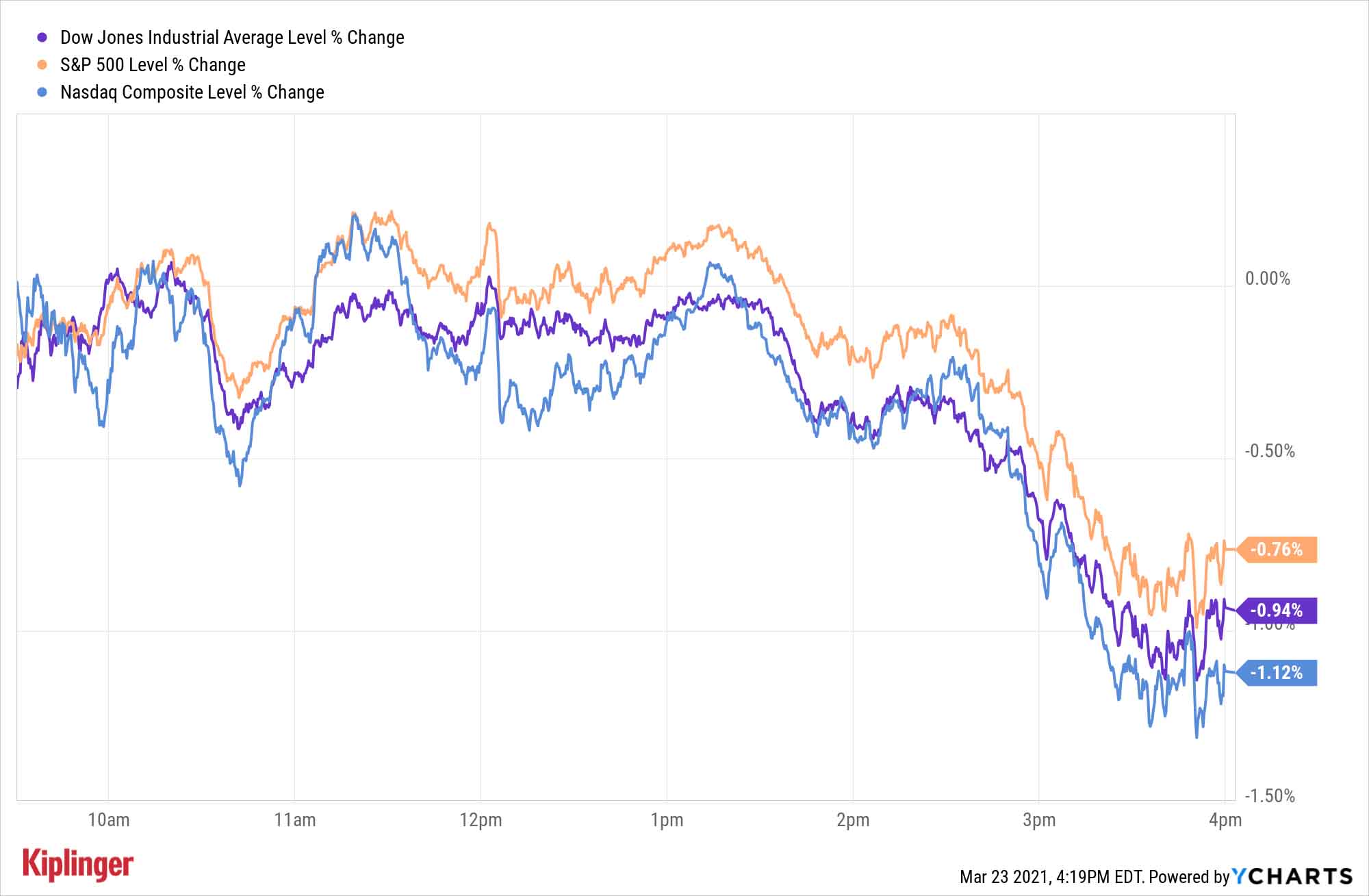

But the weakness was widespread. The Dow Jones Industrial Average sagged 0.9% to 32,423, the S&P 500 lost 0.8% to 3,910, and the Nasdaq Composite retreated by 1.1% to 13,227. The small-cap Russell 2000 was a little truer to last year's escalated selling, plunging 3.6% to 2,185.

Other action in the stock market today:

- Gold futures closed 0.8% lower to $1,725.10 per ounce.

- Bitcoin prices declined another 1.5% to $55,011. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Bull Market: Year Two

The good news, then? Today is also the one-year anniversary of the current bull market, and historically, they do well in their second year.

"Since World War II, there have been six other bear-market declines of at least 30%, and in every single case the S&P 500 was up firmly the first year of a new bull market – with an average return of more than 40%," says Ryan Detrick, chief market strategist for LPL Financial. "The good news is the gains continued in year two, as stocks were also up the second year of a new bull market every single time – up a solid 16.9% on average. Only once (after the 1987 crash) did stocks gain more during year two than year one."

The S&P 500 is up much more than that average, with 75% gains through Tuesday's close. But if you look at the best stocks of the past year – with dozens returning between 300% and 1,000% – you'll see the story of where America has been, and where it's likely going.

Many stocks supporting work-from-home and e-commerce trends are still up massively from their March lows despite cooling off of late … but also, many "recovery" stocks have made the list thanks to red-hot recent runs as investors try to get ahead of the American reopening.

Read on as we take a quick look back at the past year in the markets, including a list of the new bull market's most fruitful stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.