Stock Market Today: Small Caps Roar Despite Lousy Unemployment Data

A spike in weekly initial jobless claims reversed recent progress and weighed on blue chips, but the Russell 2000 set fresh records once again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Hopes among investors for yet another round of federal stimulus were at least momentarily offset by a significant employment setback Thursday. But, while the major blue-chip indices yielded ground, small-cap stocks continued their red-hot 2021.

Initial jobless claims for the week ended Jan. 9 came in worse than expected, to 965,000, from 784,000 in the prior week.

"The increase in the pace of job separation initially peaked in the week ending December 12, when initial claims registered 892k, and then gradually subsided thereafter through the week ending Jan. 2," say Barclays analysts. "This week's increase reverses that improvement and leaves initial claims at their highest level since late August."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, Brad McMillan, chief investment officer for Commonwealth Financial Network, says "the economic impact (of rising jobless claims) will be limited by the recently passed stimulus bill, which will provide support for those laid off and help preserve confidence and purchasing power."

A third stimulus bill could lend even more support. President-Elect Joe Biden is expected to unveil a COVID relief and vaccination plan tonight, and the package, which multiple reports tag at roughly $2 trillion, is expected to include additional direct payments to Americans.

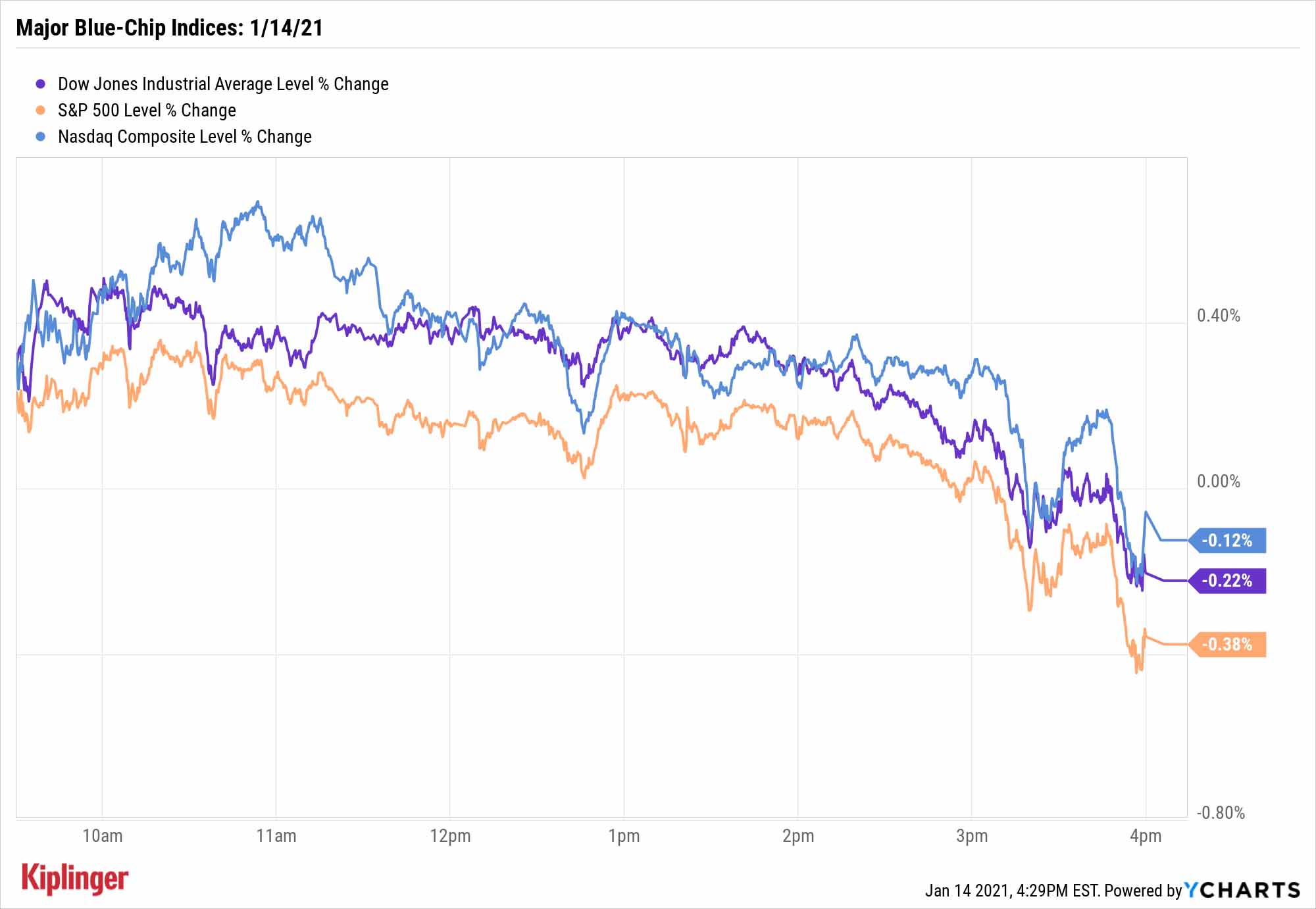

The Dow Jones Industrial Average lost 0.2% to 30,991; Intel (INTC, +4.0%) was tops among its 30 components as Wall Street continued to cheer the ouster of its CEO, while Visa (V, -3.6%) led the way lower.

Other action in the stock market today:

- The S&P 500 declined by 0.4% to 3,795.

- The Nasdaq Composite slipped 0.1% to 13,112.

- Gold futures declined 0.2% to $1,851.40 per ounce.

- U.S. crude oil futures had another great day, improving by 1.3% to settle at $53.37 per barrel.

- Bitcoin prices, at $35,916 on Wednesday, improved to $39,633. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Small-Cap Stocks Keep Soaring

Blue chips' meek performance stood in stark contrast to the Russell 2000, as the small-cap index didn't just top its previous high yet again -- it cleanly punched through it. The Russell's 2.1% advance Thursday, to 2,155, gives it a wild 9%-plus return just half a month into the new year.

"Investors have gravitated to small caps and value stocks, particularly as earnings growth, relative depressed valuations (after 13 years of underperforming against growth) and the prospect of stronger GDP growth, a weaker dollar and perhaps rising rates, or at least a yield curve steepening, have caught investors' attention," says James Gowen, chief investment officer, small-cap equities, at Spouting Rock Asset Management.

He points to heightened activity in initial public offerings (IPOs), as well as soaring returns for a number of clean energy stocks.

Gowen also notes that small caps aren't as well-covered by the analyst community as their larger brethren, but fortunately the pros do dedicate some bandwidth to scouring these explosive opportunities.

Here, we've outlined 11 of the most promising stocks in the entire Russell 2000, as determined by the analyst set. In many cases, these stocks have already developed a following because of their outsized 2020 gains, but they're largely expected to keep generating abundant returns as 2021 unfolds.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.