Stock Market Today: Mutant COVID Strain Puts a Scare Into Wall Street

Stocks recovered much of their losses Monday after early selling, sparked by a more contagious strain of COVID in the U.K. and an agreement on a much-criticized stimulus bill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market provided a show of resilience Monday, finishing well off the lows of a trading day that, early on, looked like a stinker.

The biggest premarket scare came from across the pond, as dozens of countries shut down flights from the U.K. as that nation battles a mutant strain of COVID-19 that could be as much as 70% more infectious than most known strains.

Also weighing on the market is a potential "sell the news" event, with Congress poised to vote on a $900 billion stimulus bill – one that includes $600 checks (as opposed to the previous $1,200) for a smaller number of Americans than the original round of distributions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"There did not appear to be many upside market catalysts in this bill, as we're still clearly in a precarious phase with the virus," says Brian Price, head of investment management for Commonwealth Financial Network, who also noted that "stretched valuations and sentiment indicators" contributed to the weakness.

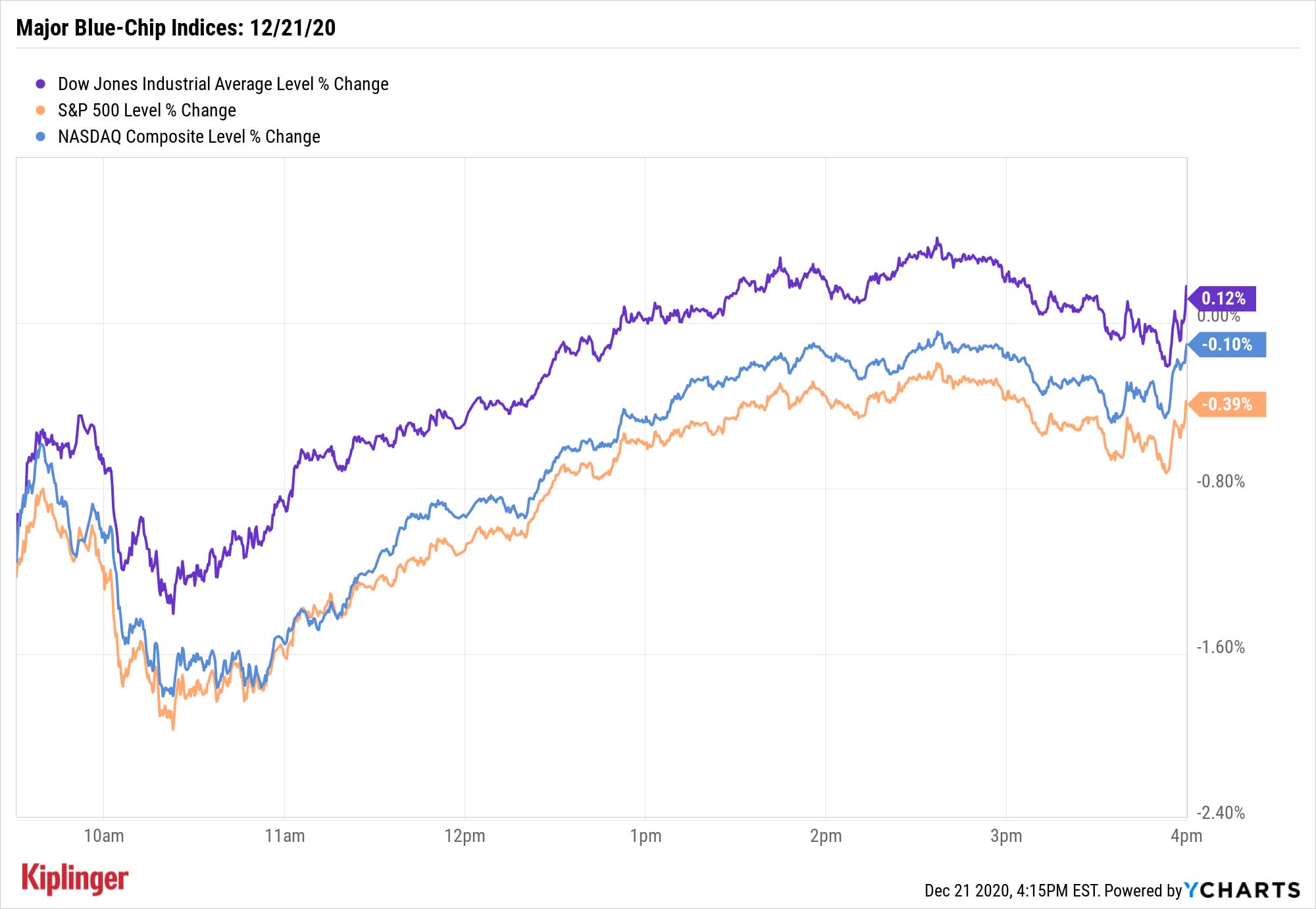

Nonetheless, the Dow Jones Industrial Average, which had dropped as much as 423 points (1.4%) at its nadir, snapped back to a 37-point (0.1%) gain to 30,216 thanks to gains in Goldman Sachs (GS, +6.1%) and Nike (NKE, +4.9%), among others.

The S&P 500 (-0.4% to 3,694) and Nasdaq Composite (-0.1% to 12,742) also finished well off the lows.

Other action in the stock market today:

- The small-cap Russell 2000 gained marginally to 1,970.

- Gold futures declined 0.3% to settle at $1,882.80 per ounce.

- U.S. crude oil futures dropped a sharp 2.9% to $47.74 per barrel.

A Short-Term Speed Bump for Value?

The passage of a stimulus measure will take one source of uncertainty off the table. In the short term, however, that might prove disruptive.

"New negative news about the virus could be enough to knock markets down and put the brakes on the overcrowded short dollar and growth-to-value rotations," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

But Wall Street largely sees value rolling in 2021: BofA Global Research, for instance, calls value stocks "the new growth stocks." (Indeed, BofA issued a rare double upgrade in the value-priced energy sector, which bodes well for these nine stocks.)

We've been discussing this rotation into value for several weeks now, but there's oodles of value still on the table ... and just as many ways to capture that value.

The "safe" bet is to diversify through value funds such as these seven stalwarts, preventing calamity in any one stock from weighing too much on your returns. But if you're comfortable with single-stock bets, you'll want to consider these 15 value stocks. In addition to sporting cheap valuations compared to both their industrymates and their own historical metrics, they also provide above-average to downright generous dividend income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.