Stock Market Today: With Eyes Only for Stimulus, Investors Keep Buying

Wall Street kept its sights squarely on the high likelihood of a stimulus bill Thursday, ignoring discouraging jobs and small business data.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks continued their broad but modest gains Thursday as the promise of COVID stimulus aid helped overshadow troubling economic signals.

Senate Majority Leader Mitch McConnell said it was "highly likely" that both stimulus and funding negotiations would continue through the weekend – a nearly $1 trillion deal appears imminent. And it's none too soon: Jobless claims climbed to 885,000 last week, up from 862,000 previously and the highest such figure since early September.

Barclays' Michael Gapen and Chun Yao also highlighted deterioration in small business data provided by local-commerce platform Womply: "We view the decline in the number of small businesses open and drop in net revenue in November as consistent with other high-frequency data that suggest momentum in U.S. economic activity is slowing into year-end."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average gained 0.5% to a record 30,303, led by Johnson & Johnson (JNJ, +2.6%) and Nike (NKE, +1.6%); the latter reports quarterly earnings Friday morning.

Other action in the stock market today:

- The S&P 500 climbed 0.6% to a new high of 3,722.

- The Nasdaq Composite also closed at record highs, finishing up 0.8% to 12,764.

- The small-cap Russell 2000 jumped 1.3% to a fresh high of 1,978.

- Gold futures closed at $1,890.40 per ounce, a 1.7% improvement.

- U.S. crude oil futures improved by 0.9% to $48.33 per barrel.

The Case for Value

Value stocks might have hiccupped a bit of late, but they're still enjoying a solid quarter. The Russell 1000 Value Index has outperformed the Russell 1000 Growth Index by roughly five percentage points since Oct. 1.

While value has served up several head fakes over the past decade-plus, "We believe it's the very beginning of a change in the environment," says Eli Salzmann, portfolio manager of Neuberger Berman Large Cap Value Fund (NPRTX). "With both monetary and fiscal stimulus being pumped into the system and a post-pandemic environment on the horizon, we think the economic clock is resetting back to early cycle, and that tends to favor value over growth."

If so, that's great news for broader value stocks and value funds alike. But Salzmann adds that "we also believe that inflation and interest rates will be higher in the medium term versus where they are today, and that has tended to benefit value sectors such as Financials, Industrials and Materials."

Industrial stocks had a particularly forgettable spring, and, even after a vigorous comeback in recent months, it greatly trails the broader market with 9% returns in 2020. But not to worry – a number of strategists agree with Salzmann that the sector will have its day in 2021. These five industrial stocks might fly under the radar of many investors, but their outlooks are bright as the new year nears.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

A Scary Emerging AI Threat

A Scary Emerging AI ThreatThe Kiplinger Letter An emerging public health issue caused by artificial intelligence poses a new national security threat. Expect AI-induced psychosis to gain far more attention.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

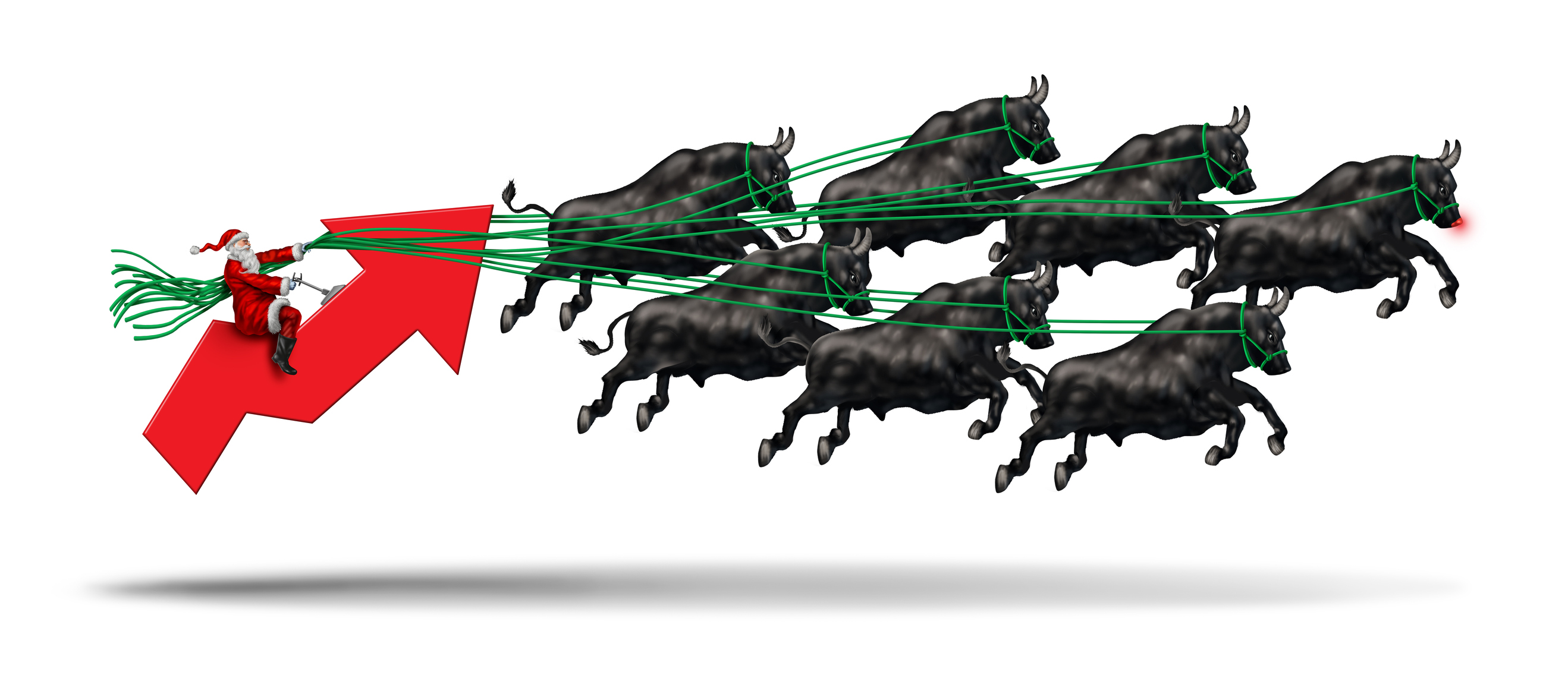

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.