Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The U.S. stock market meandered through the past year, ending this May less than 3% ahead of the same date in 2022. The Japanese market, however, returned more than 15%. Even the war-troubled European market returned nearly 5%.

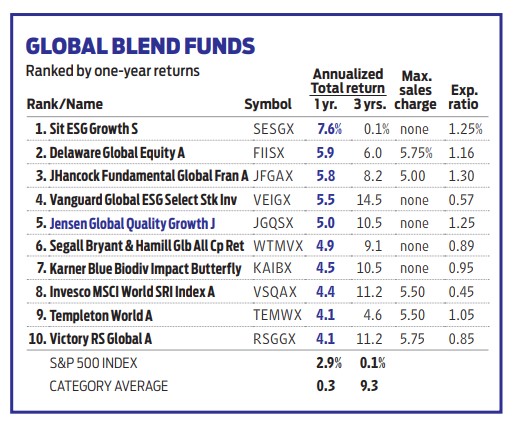

Global blend funds invest the world over, in both bargain-price stocks and faster-growing fare. The category has lagged the U.S. market recently, but some top-performing funds have maneuvered smartly through geopolitical challenges such as COVID and trade tensions.

The Jensen Global Quality Growth Fund (JGQSX) notched a 5% return in the year ending May 31, putting it in the top 10% of its category, according to research firm Morningstar. As the fund's name suggests, the managers are focused on two main factors: strong growth prospects and healthy finances, demonstrated by competitive advantages and good cash flows, says Allen Bond, a co-manager of the fund and head of research for Jensen.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Managers look for proven gems

The managers start by screening for companies that have achieved a return on equity (a measure of profitability) of at least 15% for the past 10 years, which generally limits them to large, well-established companies.

"We are not trying to find hidden gems that have yet to prove themselves as viable businesses," Bond says. Then, they zero in on companies with strong growth in free cash flow (cash left over after operating expenses and spending on assets such as buildings and equipment). Because of the focus on quality and growth, the average price-earnings ratio for fund holdings was about 23 recently, compared with a P/E of 19 for the S&P 500 Index. The concentrated portfolio held only 35 stocks at last report.

The fund's top holding is Dow stock Microsoft (MSFT), which gets about half of its revenue outside the U.S. Bond is bullish on the company's growing cloud-computing services. He also likes AstraZeneca (AZN), the European pharmaceutical giant, with some cancer and diabetes drugs in the pipeline that could boost sales.

The fund aims to make international stocks about 40% of its portfolio. Among its domestically focused holdings is blue chip stock UnitedHealth Group (UNH), which should benefit from higher demand for healthcare as the nation ages, says Bond.

The fund charges expenses of 1.25% annually, slightly above average for its category.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kim Clark is a veteran financial journalist who has worked at Fortune, U.S News & World Report and Money magazines. She was part of a team that won a Gerald Loeb award for coverage of elder finances, and she won the Education Writers Association's top magazine investigative prize for exposing insurance agents who used false claims about college financial aid to sell policies. As a Kiplinger Fellow at Ohio State University, she studied delivery of digital news and information. Most recently, she worked as a deputy director of the Education Writers Association, leading the training of higher education journalists around the country. She is also a prize-winning gardener, and in her spare time, picks up litter.

-

Before You Go to Costco, Try This Grocery Strategy First

Before You Go to Costco, Try This Grocery Strategy FirstA simple shift in how you plan meals could help you spend and waste less.

-

10 Things to Know About Decluttering

10 Things to Know About DeclutteringYou’ve spent a lifetime amassing your stuff. Here’s how to get rid of it.

-

QUIZ: Are You Ready To Retire At 62?

QUIZ: Are You Ready To Retire At 62?Quiz Are you in a good position to retire at 62? Find out with this quick quiz.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.