The 2021 Outlook for Bitcoin Prices, Adoption and Risks

We look at the year ahead for Bitcoin and other digital coins, including where experts see prices going, why more people are investing and how to get started.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

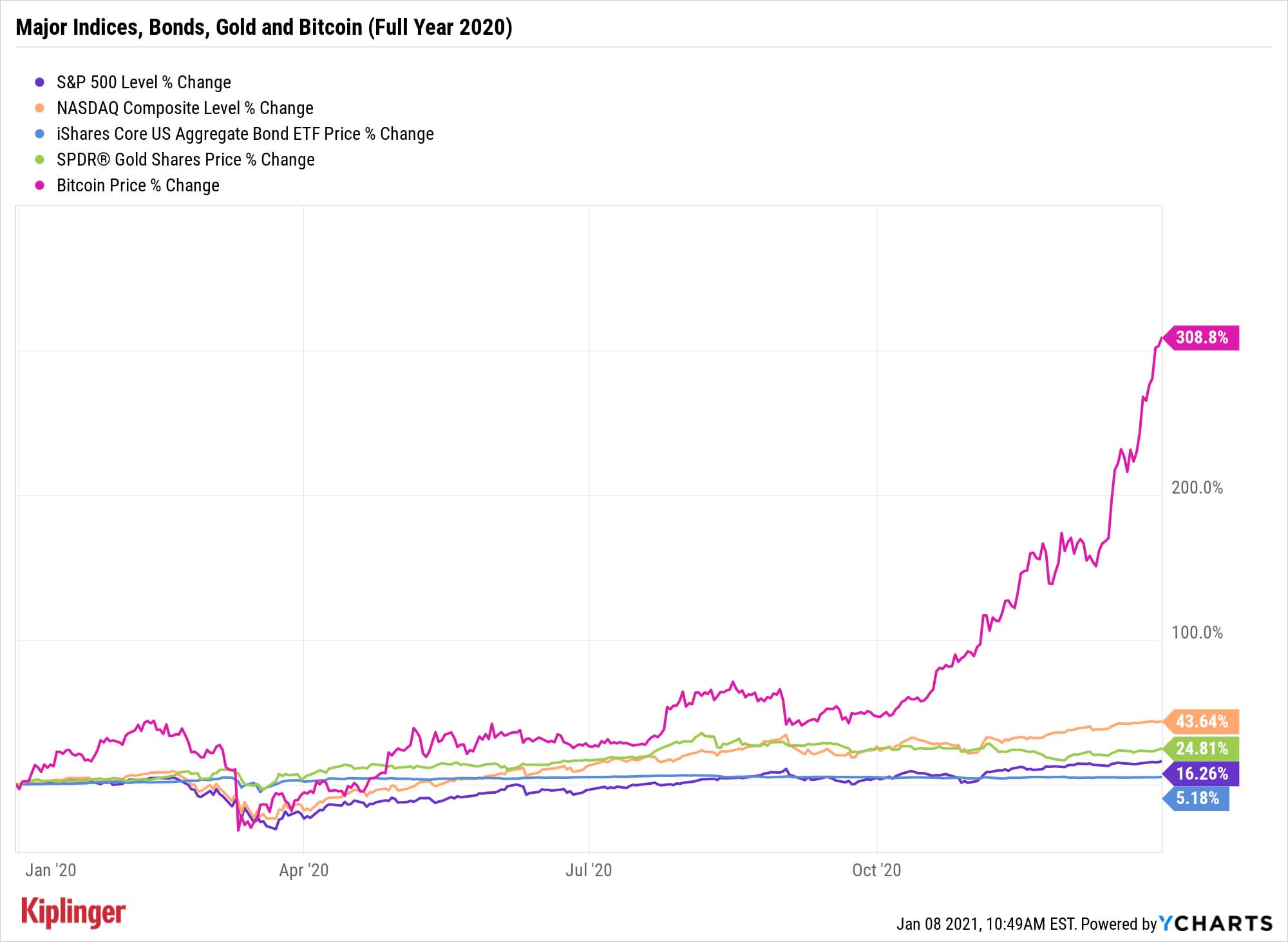

Proponents of digital currencies are exuberant about the potential for 2021 after a monster year that saw highflying Bitcoin prices grab control of the spotlight.

That's nothing new – but the much wider feeling across Wall Street that "this time it's different" is.

Bitcoin prices recovered from a multiyear slump in 2020. It breached its 2017 record near $20,000 in November, and it has gone parabolic ever since, sitting well above $40,000 as of this publication.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What might actually make this time different, however, isn't that Bitcoin prices hit new highs in 2020 and finished the year with a head of steam. It's that the cryptocurrency succeeded in its first trial by fire.

The resilience of that digital coin and others – and the reasons behind it – have many excited not just about the prospects for this young asset class in 2021, but also for the overall adoption of this burgeoning financial technology.

What Is Bitcoin?

First, a quick refresher for the uninitiated:

Bitcoin is one of many digital currencies. Unlike traditional "fiat" currencies created and operated by a government and central bank, Bitcoin is "mined," or created by people who solve mathematical problems with computing power. Transactions are kept on the blockchain, an encrypted and decentralized ledger that protects the integrity of Bitcoin while also ensuring the privacy of the user.

And in contrast to fiat currencies, which can be printed on demand, Bitcoin is limited to a total of 21 million possible coins once it is fully mined. (Fortunately, it can be divided fractionally down to 1/100,000,000th of a Bitcoin, known as a "Satoshi.") It was designed to be a true store of value that couldn't be manipulated.

Indeed, Bitcoin was invented in 2008 and launched in 2009, just as world governments were printing money to respond to the global financial crisis. A slew of other digital assets followed.

"One of the things that fascinates me with how Bitcoin has come into existence is that it came in upside-down," says Greg King, CEO of Osprey Funds, which operates the Osprey Bitcoin Trust. "It came in through individual acceptance, a grassroots type of thing."

Bitcoin More Than Survives 2020

Bitcoin prices crashed after sharp rallies in 2013 and 2017, but these declines weren't precipitated by any major event spanning multiple asset classes. The digital coin was merely cut by the other edge of speculation's blade; worries about hacking risks, for instance, hampered cryptocurrencies in 2018.

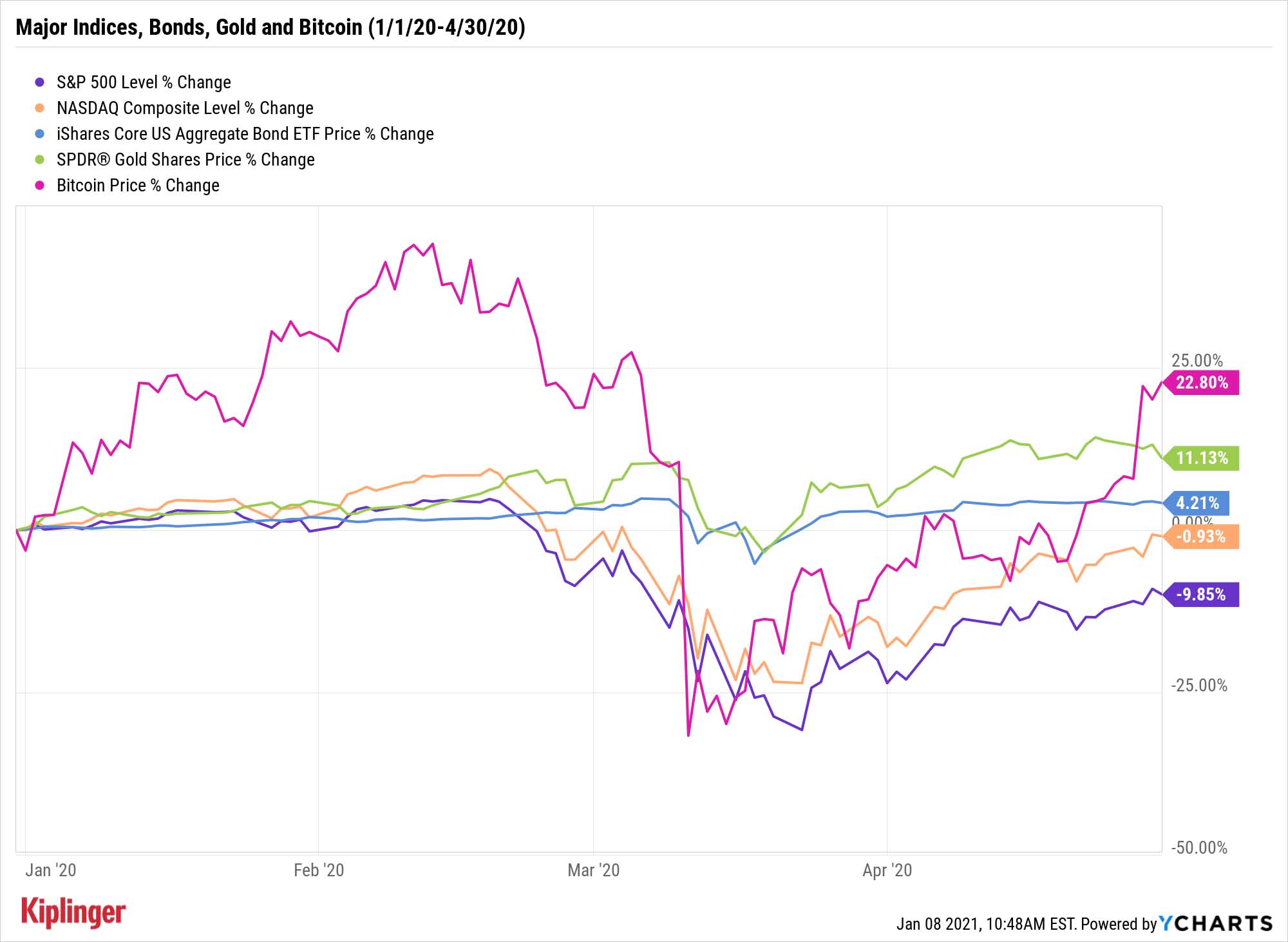

So the bear market of 2020, brief as it was, marked the first time Bitcoin and other digital currencies faced a truly global crisis that threatened numerous types of investments.

Cryptocurrencies were hardly immune from the bear turn. Investors first started selling off equities in February as they moved to cash, and even safety plays such as gold eventually took a dip in March. But Bitcoin eventually fell, too, crashing hard in mid-March.

Those lows were short-lived, however. Digital currencies bounced hardest off the bottom, and Bitcoin turned positive by April.

It then took flight through the end of 2020.

"What we needed to see was Bitcoin survive a global macro meltdown," says Tyrone Ross, CEO of Onramp Invest, a digital platform allowing financial advisors to provide clients with access to cryptocurrencies. "If you look at when it was invented until March, it had never experienced a recessionary environment."

"It correlated with the market and came down with everything else. There was a flight to dollars. (But) if you look at how it behaved since then, folks see that there's something here. The actual activity on the blockchain was impressive."

How Bitcoin Interest is Growing

A push to liquidity, such as the one seen in March, is rare, and it usually occurs at the climax of a market selloff. The fact that it also happened in Bitcoin around the same time hints that more institutional interest was in play than in previous crashes.

And growing institutional interest is one of several trends that King expects to be a major driver in Bitcoin prices over the years to come.

Coinbase, a digital currency exchange that's expected to go public this year, said on Nov. 21 that its institutional asset base from $6 billion in April 2020 to $20 billion as of mid-November. And Canaccord Genuity recently pointed out a laundry list of recent institutional and other noteworthy cryptocurrency events. Here are just a few highlights from the last quarter of 2020:

- Oct. 27: JPMorgan Chase (JPM) sends its "JPM Coin" digital currency live and forms an Onyx division to focus on the blockchain.

- Nov. 9: Billionaire investor Stanley Druckenmiller says he owns Bitcoin.

- Nov. 14: Galaxy Digital announced the acquisition of two companies as it builds out a platform for institutional access to digital assets.

- Nov. 18: Mexican billionaire Ricardo Salinas Pliego says 10% of his liquid assets are invested in Bitcoin.

- Dec. 9: Billionaire and hedge fund manager Ray Dalio says Bitcoin has a place in investors' portfolios.

- Dec. 12: Insurance firm MassMutual purchases $100 million in Bitcoin.

That's just a sliver of the announcements from Q4, which also included moves from a number of nations advancing digital currency or blockchain initiatives, including the U.S., Canada, Japan, England, South Korea, China and Russia.

King adds that individual interest is being driven higher as platforms such as Square (SQ) and PayPal (PYPL) are making digital currencies such as Bitcoin more accessible to people. And in October, Coinbase launched a cryptocurrency debit card under the Visa (V) banner.

Then there's inflation.

Cryptocurrencies such as Bitcoin are drawing comparisons to gold, as they're a relatively fixed asset at a time when fiat money printing is growing out of control.

Billionaire Paul Tudor Jones, a relative newcomer to the space, told CNBC that the cryptocurrency market is "still in the first inning" and that he sees Bitcoin as a better inflation play than Treasury Inflation-Protected Securities (TIPS) and gold.

BCA Research strategists see a similar advantage, saying that "in addition to benefitting from ample global liquidity and the cyclical US dollar bear market, Bitcoin will be an attractive hedge against rising inflation in the second half of the decade."

Time will tell whether that's the case. Inflation fears after the financial crisis led to a spike in gold prices in 2011, but when higher rates of inflation failed to materialize, investors exited the gold trade quickly. Nevertheless, the metal, like its digital counterpart, did make new highs in 2020 around $2,070 per ounce; unlike Bitcoin prices, gold has pulled back considerably, now sitting around $1,850.

King says there's another interesting twist to the cryptocurrency narrative this time around.

"One thing I've found interesting versus 2016 and 2017 is nobody's asking about Bitcoin and nefarious activities," he says. "I haven't gotten a single question on that. Obviously, all types of currencies are used for illegal activities. That question seems to have disappeared. To me, that's an indicator of growing acceptance and understanding."

It's possible cryptocurrency is following the playbook laid out in 1914 by union leader Nicholas Klein: "First they ignore you. Then they ridicule you. And then they attack you and want to burn you. And then they build monuments to you."

2021: Another Massive Year for Bitcoin Prices?

Bitcoin is attracting a growing number of analysts, and as a result, Bitcoin price targets are becoming more commonplace.

Some have been downright bombastic. Former Adaptive Capital partner Willy Woo calls $200,000 a "conservative" estimate for year-end 2021. In mid-November, Citigroup told its institutional clients that it sees the potential for Bitcoin prices to rise as high as $318,000 by the end of this year.

Others are more restrained. For instance, BTIG's Julian Emanuel says Bitcoin could reach $50,000 – the same price target Bloomberg pointed to in its Crypto Outlook 2021.

Ross, without making a specific prediction, sees the cryptocurrency space further growing in value to the global financial system:

"I think in 2021 we'll see a lot of news that will move the price higher," he says. "We'll get closer to an ETF, announcements from broker-dealers that they're getting involved. Some more FOMO (fear of missing out) from retail investors, and what you'll also see is that at some point you'll see a massive RIA announce that they have a meaningful amount of their business in BTC."

"One of the things we do believe is that there's a secular trend into Bitcoin," adds King, who's also reticent to throw out a price target. "We're in an S-curve type of growth with an emerging technology. If you look at the previous patterns of prices versus adoption, it tends to consolidate and then have a multiple move higher. This is starting to look pretty decisively higher."

This combination of increased investment interest in Bitcoin as an investment, as well as increased adaptation of Bitcoin, cryptocurrency and blockchain technologies by companies, points to a perfect storm for prices.

But Ross adds a word of caution.

"You always have risk," he says. "Systemic risk, market risk … There are some global macro events that can affect markets, and as Bitcoin becomes more financialized, it won't become that noncorrelated asset anymore."

The Regulatory Wild Card

One of the biggest risks to any bullish calls, sky-high or not, is the potential for regulatory agencies to suddenly erect a brick wall.

While fewer people might be asking about using Bitcoin to buy illicit substances anymore, regulators are again taking a close look at digital currencies, this time with a focus on how these coins act as securities.

The most noteworthy of late: In late December, the Securities and Exchange Commission SEC filed a lawsuit against the "altcoin" Ripple. (Altcoins are any digital coin that's an alternative to Bitcoin.) The issue at question is whether its digital currency is really a digital currency, or if it's an unregistered securities offering. The news was enough to cut Ripple prices by more than half in just a few days, and several cryptocurrency exchanges stopped trading in the altcoin until the issue is resolved.

Even then, some Bitcoin bulls see a silver lining. Ripple has a different mechanism relative to Bitcoin's decentralized model, so some believe a crackdown on altcoins points to Bitcoin as the first (and maybe only) stop for people interested in cryptocurrencies.

How to Invest in Bitcoin

While Bitcoin prices might be sitting above $40,000 right now, you can still enter it (and most other cryptocurrencies) for literally just a few bucks by purchasing fractions of coins. But no investor should spend a cent without brushing up on what is still a very nascent technology and asset class.

"The best investment that any investment that any individual can make is learning as much as they can," Ross says. "That truly is the best way."

To that end, sites such as Coinbase and Binance Academy offer rudimentary basics to get people up to speed.

If you feel like you're ready to begin investing directly in the cryptocurrencies themselves, you can do so on a number of sites, including Coinbase and Robinhood, and even PayPal and Square's Cash App.

Just consider starting small.

Most analyst outfits at this point have at least acknowledged the upside possibilities for Bitcoin and other digital currencies. However, they don't all view cryptocurrencies as investment-worthy for most retail investors just given the still-speculative nature of the space and uncertain regulatory outlook.

Not to mention, for all their highs, digital currencies have shaken a lot of people out at their lows.

"If you feel left out of the gains, don't," the Wells Fargo Investment Institute wrote in December. "Bitcoin has indeed outperformed gold and the S&P 500 Index over the last three years, but look at the volatile journey Bitcoin investors had to endure to get there. Up until only two months ago, three-year total returns were pretty much the same among the three assets, but volatility differed.

"Cryptocurrency investing today is a bit like living in the early days of the 1850s gold rush, which involved more speculating than investing," adds the WFII, which still admits "fads don't typically last 12 years."

Those who only invest through 401(k)s, IRAs and other accounts through traditional brokerages can't directly invest in digital currencies through those vehicles yet. But you still have a few options, such as investing in companies that have tied their futures to cryptocurrencies and/or blockchain technology.

"For most traditional investors, look at companies that are on the fringe of this technology, like Square," Ross says.

The SEC has not yet approved an exchange-traded fund (ETF) that tracks Bitcoin prices by actually holding the cryptocurrency in the same way that, say, the SPDR Gold Shares (GLD) holds gold. (However, many hope 2021 is the year we finally see a Bitcoin ETF.)

However, investors do have access to a few ETF-esque funds. For instance, the Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE), which trade "over the counter," track the price of their respective cryptocurrencies. But they are different than ETFs in a few noteworthy ways, which we outline here, that investors should know about before purchasing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

A prolific financial writer, Andrew Packer has helmed newsletters on small-cap value investing, early-stage investments, special situations, short-selling, covered call writing, commodity investing, and insider trading, among others. He’s most proud of his 100% win rate on all trades in 2016.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Is Crypto Investing Coming to a Credit Union Near You?

Is Crypto Investing Coming to a Credit Union Near You?Credit unions are getting in on crypto investing through partnerships with third-party platforms, but the risks to investors still apply.

-

The GENIUS, CLARITY, and Anti-CBDC Acts: What Bitcoin Investors Need to Know

The GENIUS, CLARITY, and Anti-CBDC Acts: What Bitcoin Investors Need to KnowMovement on the crypto front at the federal level has the potential to usher in substantial change. Here's what it means for your portfolio.

-

Cryptocurrency May be Coming to Your 401(k) with Rules Change

Cryptocurrency May be Coming to Your 401(k) with Rules ChangeCrypto may be coming to a 401(k) near you. Financial experts weigh in on whether retirement savers should take the plunge.

-

Is It Too Late to Invest in Bitcoin?

Is It Too Late to Invest in Bitcoin?Bitcoin has been volatile in recent months, but several analysts believe the cryptocurrency will resume its winning ways. Should investors get in now?

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?